Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Botanical Company sells one product, herbal soap, by the case. On October 1, 20X7, part of the trial balance showed the following: (Click the

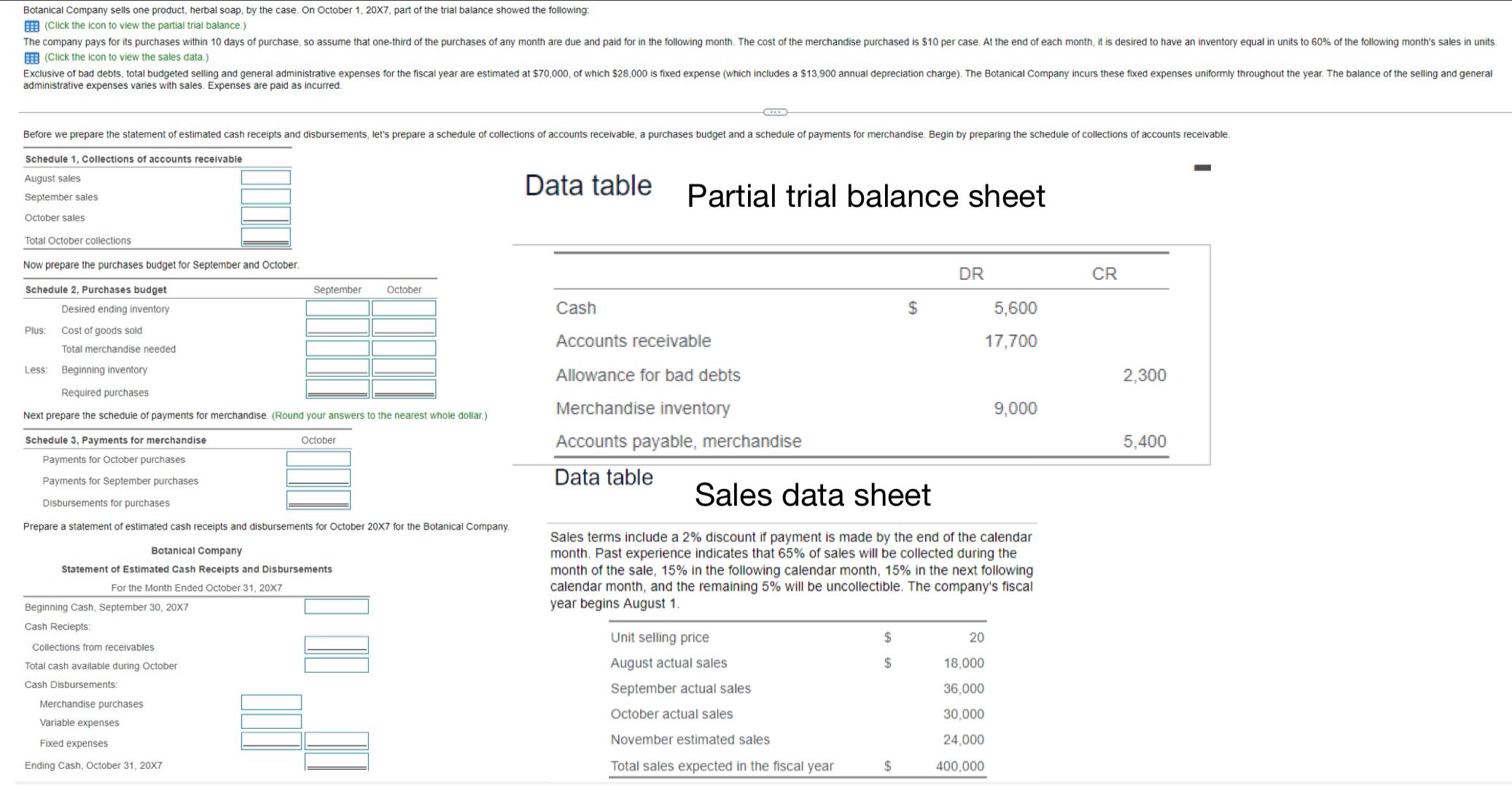

Botanical Company sells one product, herbal soap, by the case. On October 1, 20X7, part of the trial balance showed the following: (Click the icon to view the partial trial balance.) The company pays for its purchases within 10 days of purchase, so assume that one-third of the purchases of any month are due and paid for in the following month. The cost of the merchandise purchased is $10 per case. At the end of each month, it is desired to have an inventory equal in units to 60% of the following month's sales in units. (Click the icon to view the sales data.) Exclusive of bad debts, total budgeted selling and general administrative expenses for the fiscal year are estimated at $70,000, of which $28,000 is fixed expense (which includes a $13,900 annual depreciation charge). The Botanical Company incurs these fixed expenses uniformly throughout the year. The balance of the selling and general administrative expenses varies with sales. Expenses are paid as incurred. Before we prepare the statement of estimated cash receipts and disbursements, let's prepare a schedule of collections of accounts receivable, a purchases budget and a schedule of payments for merchandise. Begin by preparing the schedule of collections of accounts receivable. Schedule 1, Collections of accounts receivable August sales September sales October sales Total October collections: Now prepare the purchases budget for September and October. Schedule 2, Purchases budget Desired ending inventory Data table Partial trial balance sheet September October Cash Plus: Cost of goods sold Total merchandise needed Less: Beginning inventory Accounts receivable Allowance for bad debts Required purchases Merchandise inventory Next prepare the schedule of payments for merchandise. (Round your answers to the nearest whole dollar.) October Accounts payable, merchandise Data table DR CR $ 5,600 17,700 2,300 9,000 5,400 Schedule 3, Payments for merchandise Payments for October purchases Payments for September purchases Disbursements for purchases Prepare a statement of estimated cash receipts and disbursements for October 20X7 for the Botanical Company. Botanical Company Statement of Estimated Cash Receipts and Disbursements For the Month Ended October 31, 20X7 Beginning Cash, September 30, 20X7 Cash Reciepts: Collections from receivables Total cash available during October Cash Disbursements: Merchandise purchases Variable expenses Fixed expenses Ending Cash, October 31, 20X7 Sales data sheet Sales terms include a 2% discount if payment is made by the end of the calendar month. Past experience indicates that 65% of sales will be collected during the month of the sale, 15% in the following calendar month, 15% in the next following calendar month, and the remaining 5% will be uncollectible. The company's fiscal year begins August 1. Unit selling price $ 20 August actual sales $ 18,000 September actual sales 36,000 October actual sales 30,000 November estimated sales 24,000 Total sales expected in the fiscal year $ 400,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started