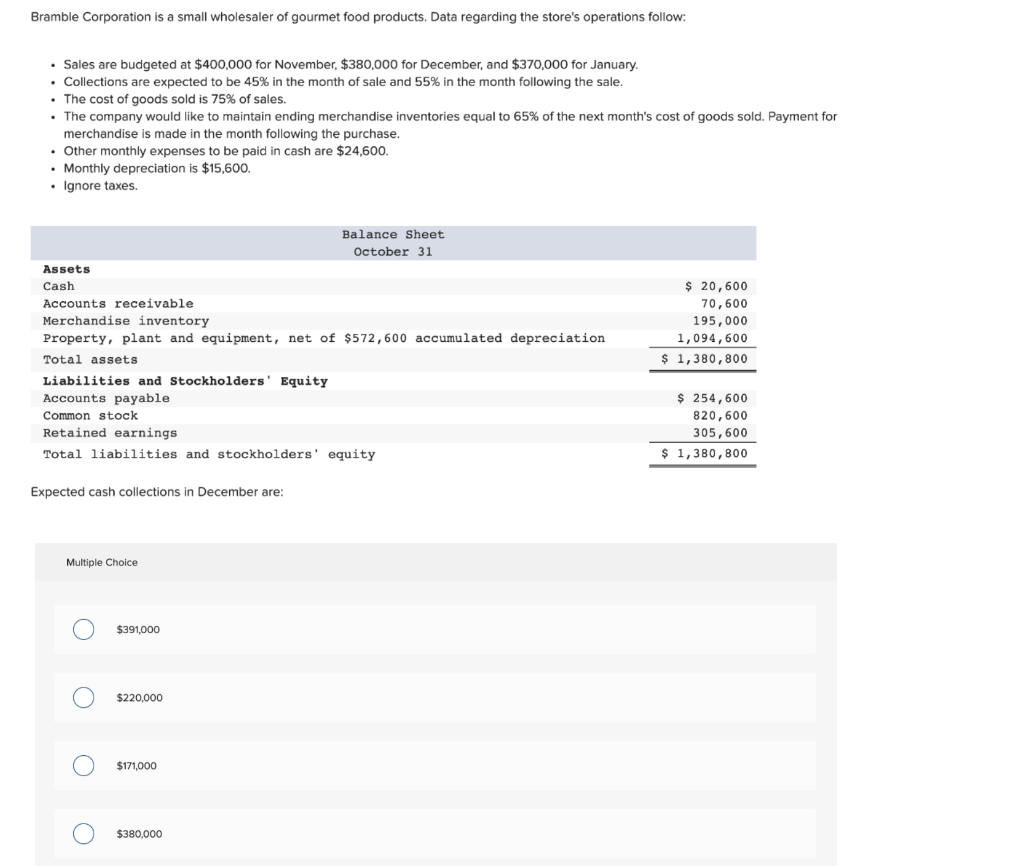

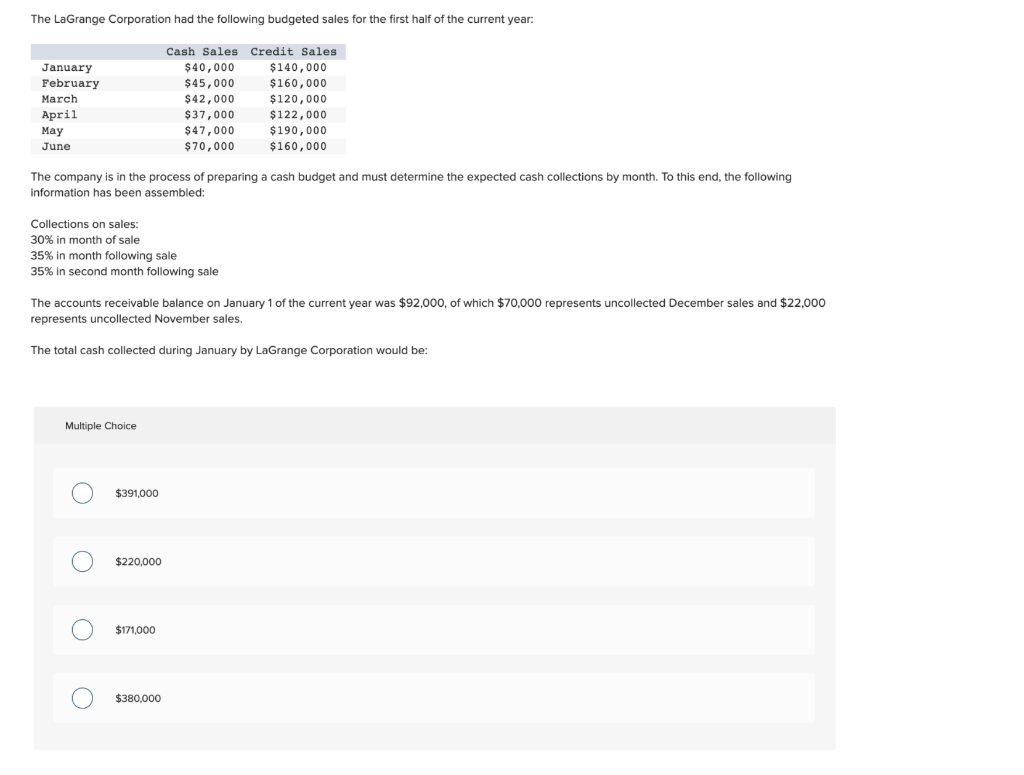

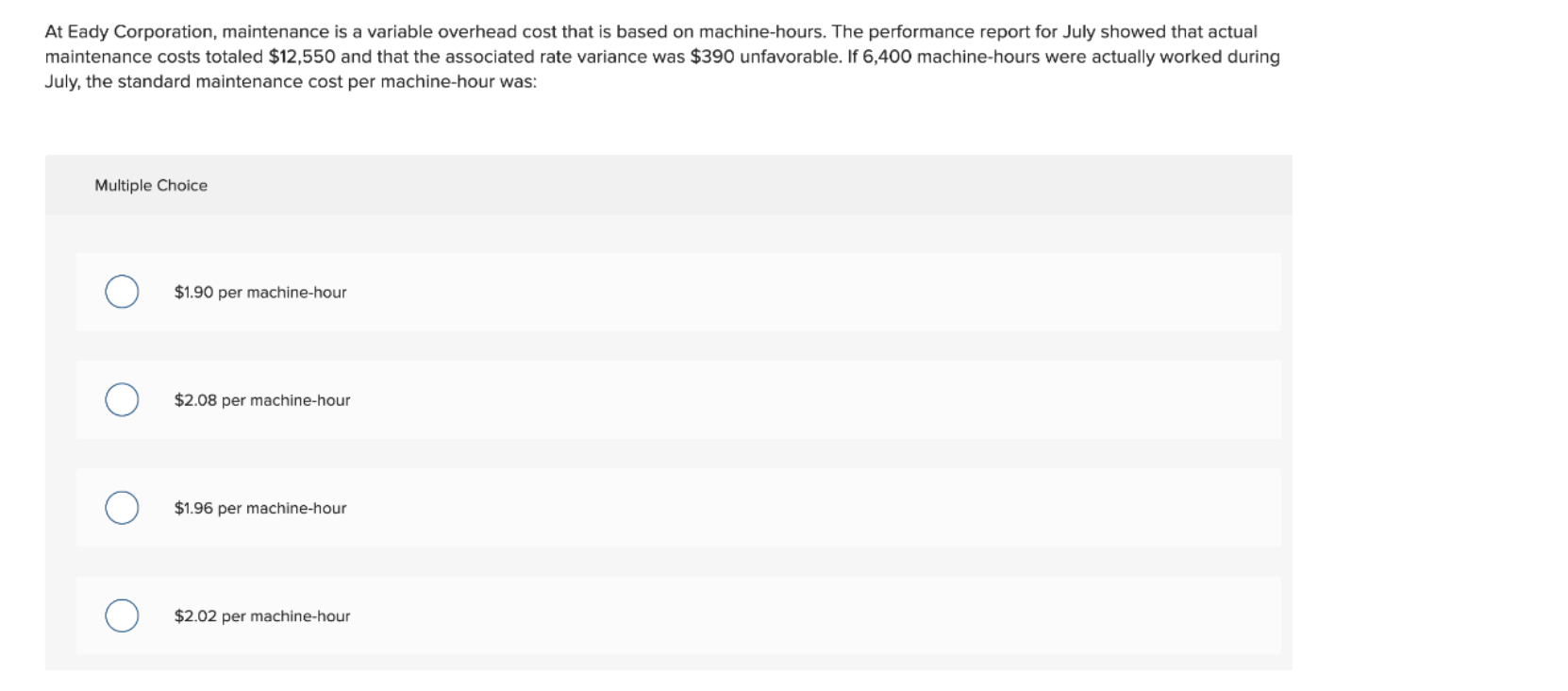

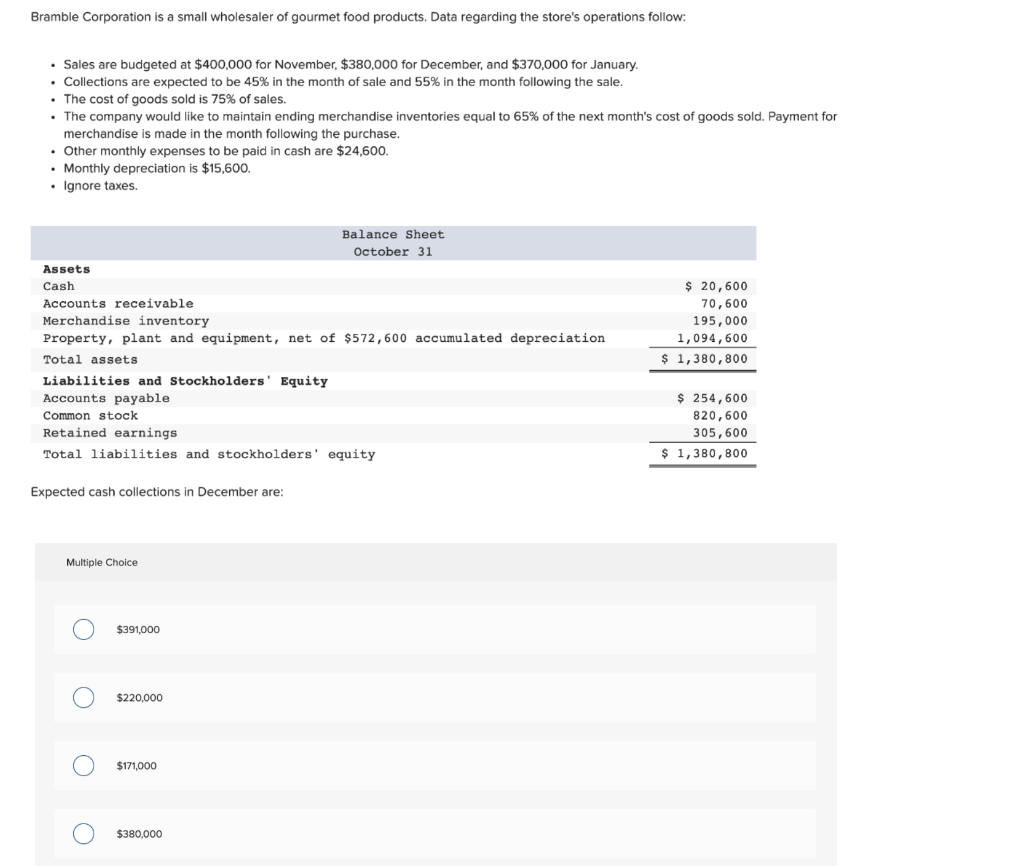

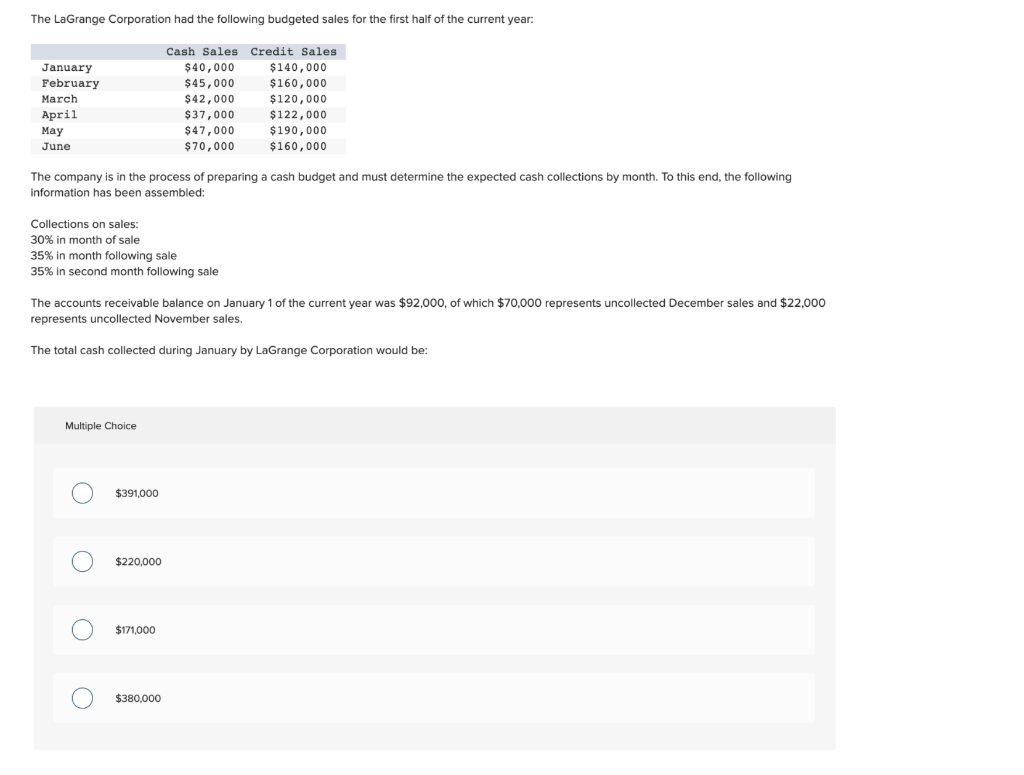

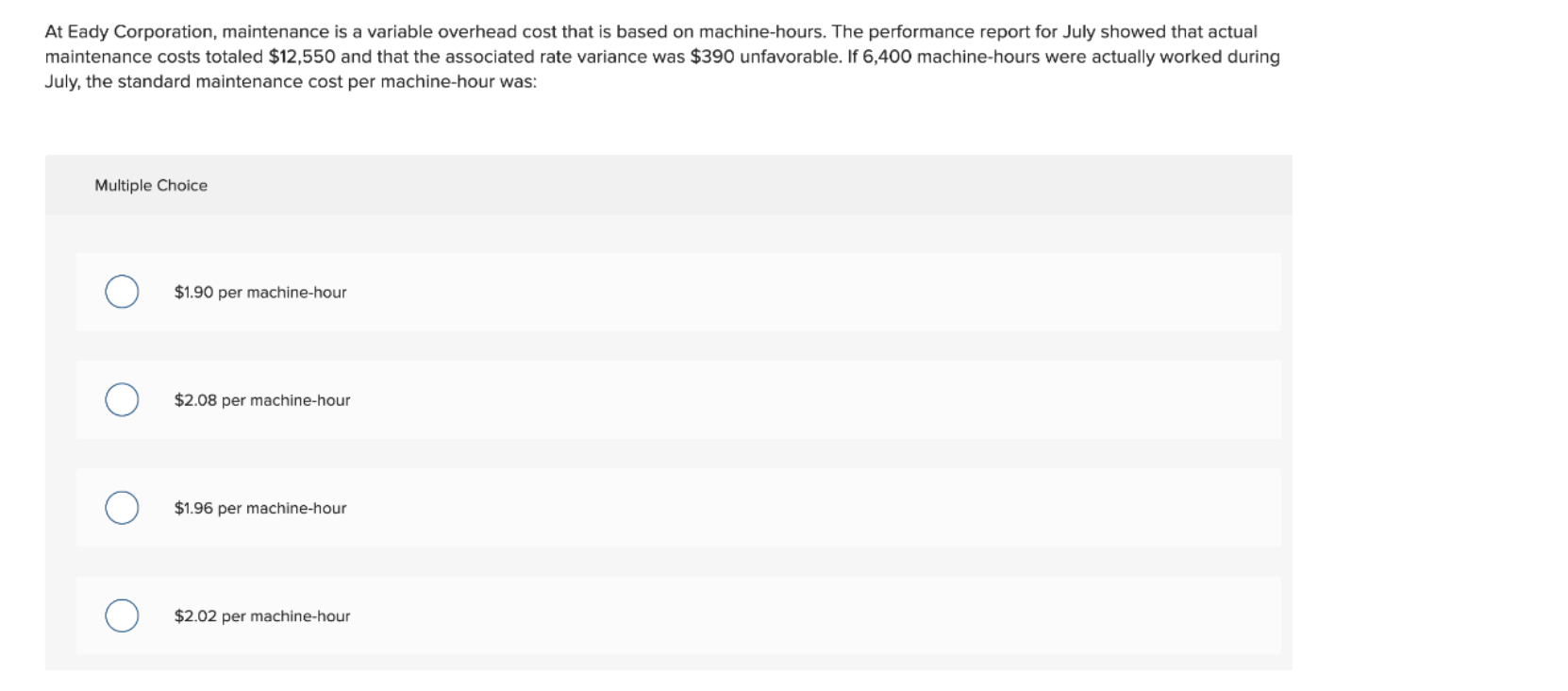

Bramble Corporation is a small wholesaler of gourmet food products. Data regarding the store's operations follow: Sales are budgeted at $400,000 for November, $380,000 for December, and $370,000 for January Collections are expected to be 45% in the month of sale and 55% in the month following the sale. The cost of goods sold is 75% of sales. The company would like to maintain ending merchandise inventories equal to 65% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase. Other monthly expenses to be paid in cash are $24,600. Monthly depreciation is $15,600. Ignore taxes. Balance Sheet October 31 Assets Cash Accounts receivable Merchandise inventory Property, plant and equipment, net of $572,600 accumulated depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings Total liabilities and stockholders' equity $ 20,600 70,600 195,000 1,094,600 $ 1,380,800 $ 254,600 820,600 305,600 $ 1,380,800 Expected cash collections in December are: Multiple Choice $391,000 O $220,000 $171,000 $380,000 The LaGrange Corporation had the following budgeted sales for the first half of the current year: January February March April May June Cash Sales Credit Sales $40,000 $140,000 $45,000 $160,000 $42,000 $120,000 $ 37,000 $ 47,000 $190,000 $160,000 $122,000 $70,000 The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled: Collections on sales: 30% in month of sale 35% in month following sale 35% in second month following sale The accounts receivable balance on January 1 of the current year was $92,000, of which $70,000 represents uncollected December sales and $22,000 represents uncollected November sales. The total cash collected during January by LaGrange Corporation would be: Multiple Choice $391,000 o o $220,000 $171,000 $380,000 At Eady Corporation, maintenance is a variable overhead cost that is based on machine-hours. The performance report for July showed that actual maintenance costs totaled $12,550 and that the associated rate variance was $390 unfavorable. If 6,400 machine-hours were actually worked during July, the standard maintenance cost per machine-hour was: Multiple Choice $1.90 per machine-hour $2.08 per machine-hour o $1.96 per machine-hour $2.02 per machine-hour