Answered step by step

Verified Expert Solution

Question

1 Approved Answer

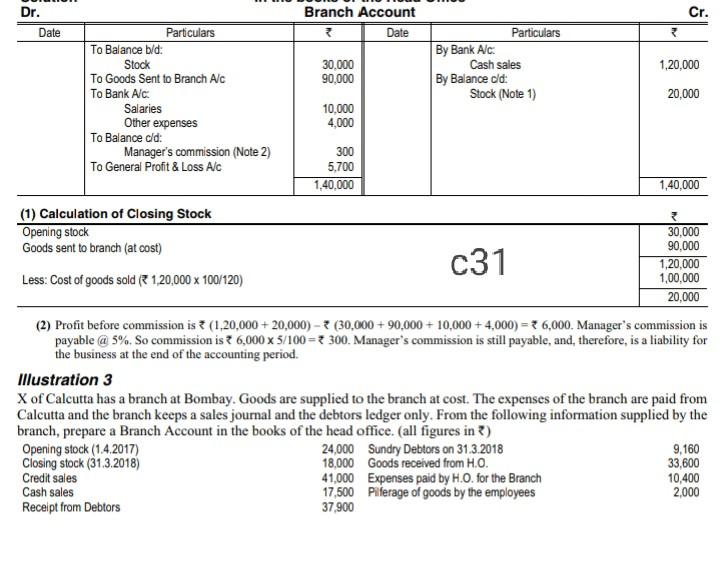

Branch Account Cr. Dr. Date Date 30,000 90,000 Particulars By Bank Alc: Cash sales By Balance old Stock (Note 1) 1,20,000 Particulars To Balance b/d:

Branch Account Cr. Dr. Date Date 30,000 90,000 Particulars By Bank Alc: Cash sales By Balance old Stock (Note 1) 1,20,000 Particulars To Balance b/d: Stock To Goods Sent to Branch Alc To Bank Alc Salaries Other expenses To Balance ald: Manager's commission (Note 2) To General Profit & Loss Alc 20,000 10.000 4,000 300 5,700 1,40.000 1,40,000 (1) Calculation of Closing Stock Opening stock Goods sent to branch (at cost) Less: Cost of goods sold R 120,000 x 100/120) c31 30,000 90.000 1,20,000 1,00,000 20,000 (2) Profit before commission is * (1.20,000 + 20,000) (30,000 + 90,000 + 10,000+ 4,000) = 6,000. Manager's commission is payable @ 5%. So commission is ? 6,000 x 5/100 = 300. Manager's commission is still payable, and therefore, is a liability for the business at the end of the accounting period. Illustration 3 X of Calcutta has a branch at Bombay. Goods are supplied to the branch at cost. The expenses of the branch are paid from Calcutta and the branch keeps a sales journal and the debtors ledger only. From the following information supplied by the branch, prepare a Branch Account in the books of the head office. (all figures in ) Opening stock (1.4.2017) 24,000 Sundry Debtors on 31.3.2018 9,160 Closing stock (31.3.2018) 18,000 Goods received from H.O. 33,600 Credit sales 41,000 Expenses paid by H.O. for the Branch 10,400 Cash sales 17,500 Piferage of goods by the employees 2,000 Receipt from Debtors 37,900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started