Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bridgeport Inc. has an industrial sewing machine that it has used for the past 5 years. The company is considering replacing the machine with

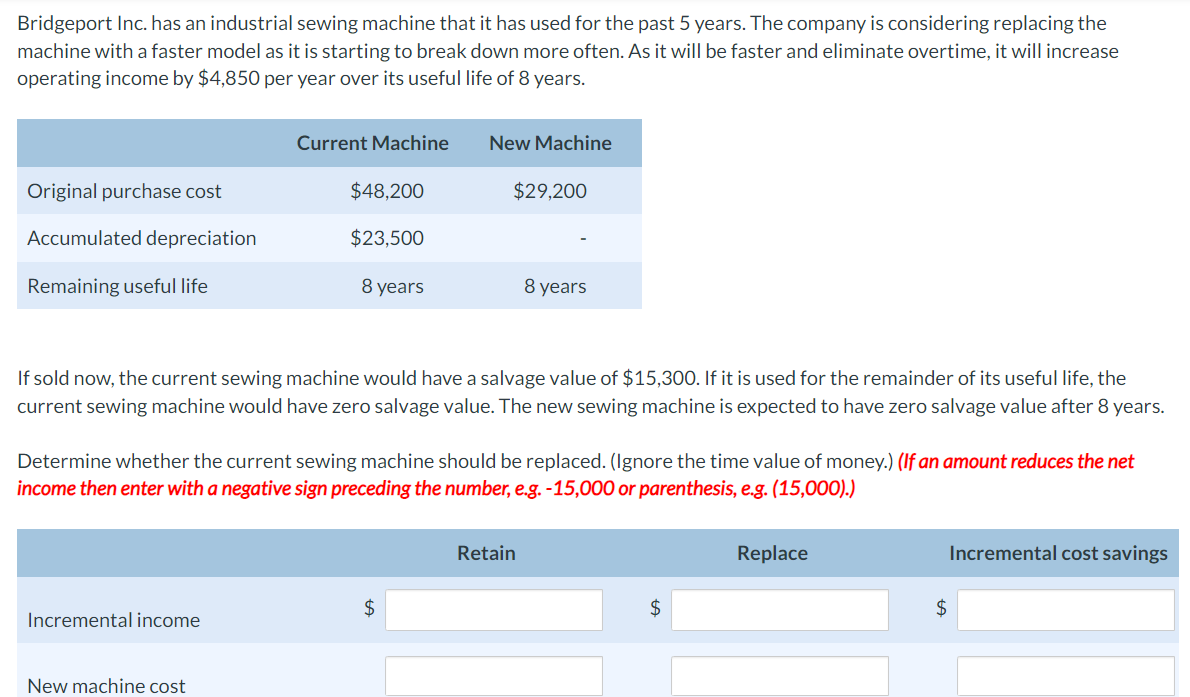

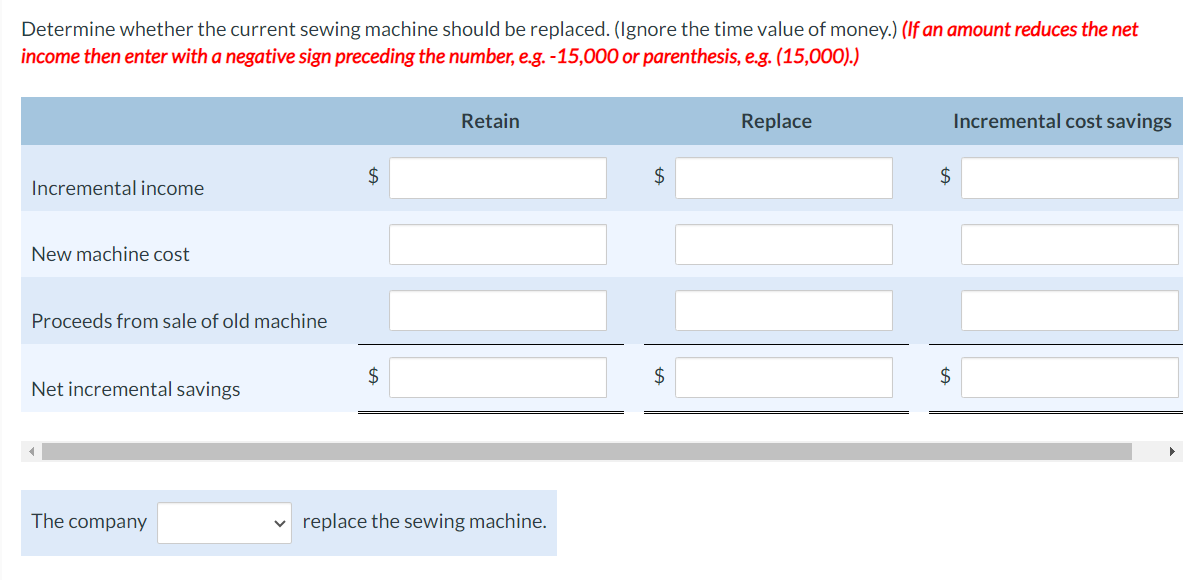

Bridgeport Inc. has an industrial sewing machine that it has used for the past 5 years. The company is considering replacing the machine with a faster model as it is starting to break down more often. As it will be faster and eliminate overtime, it will increase operating income by $4,850 per year over its useful life of 8 years. Current Machine New Machine Original purchase cost $48,200 $29,200 Accumulated depreciation $23,500 Remaining useful life 8 years 8 years If sold now, the current sewing machine would have a salvage value of $15,300. If it is used for the remainder of its useful life, the current sewing machine would have zero salvage value. The new sewing machine is expected to have zero salvage value after 8 years. Determine whether the current sewing machine should be replaced. (Ignore the time value of money.) (If an amount reduces the net income then enter with a negative sign preceding the number, e.g. -15,000 or parenthesis, e.g. (15,000).) Retain Replace Incremental cost savings $ $ $ Incremental income New machine cost Determine whether the current sewing machine should be replaced. (Ignore the time value of money.) (If an amount reduces the net income then enter with a negative sign preceding the number, e.g. -15,000 or parenthesis, e.g. (15,000).) Retain Replace Incremental cost savings $ $ $ Incremental income New machine cost Proceeds from sale of old machine Net incremental savings $ $ $ The company replace the sewing machine.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started