Question

Brighton Services repairs locomotive engines. It employs 100 full-time workers at $20 per hour. Despite operating at capacity, last year's performance was a great disappointment

Brighton Services repairs locomotive engines. It employs 100 full-time workers at $20 per hour. Despite operating at capacity, last year's performance was a great disappointment to the managers. In total, 10 jobs were accepted and completed, incurring the following total costs.

| Direct materials | $ | 1,048,400 | |

| Direct labor | 4,400,000 | ||

| Manufacturing overhead | 1,100,000 | ||

Of the $1,100,000 manufacturing overhead, 30 percent was variable overhead and 70 percent was fixed.

This year, Brighton Services expects to operate at the same activity level as last year, and overhead costs and the wage rate are not expected to change. For the first quarter of this year, Brighton Services completed two jobs and was beginning the third (Job 103). The costs incurred follow.

Job Direct Materials Direct Labor 101 $138,500 $503,000 102 106,000 313,700 103 95,300 195,400 Total manufacturing overhead 272,500 Total marketing and administrative costs 123,000

You are a consultant associated with Lodi Consultants, which Brighton Services has asked for help. Lodi's senior partner has examined Brighton Services's accounts and has decided to divide actual factory overhead by job into fixed and variable portions as follows.

| Actual Manufacturing Overhead | |||||

| Variable | Fixed | ||||

| 101 | $ | 31,200 | $ | 105,300 | |

| 102 | 28,800 | 89,500 | |||

| 103 | 5,900 | 11,800 | |||

| $ | 65,900 | $ | 206,600 | ||

In the first quarter of this year, 30 percent of marketing and administrative cost was variable and 70 percent was fixed. You are told that Jobs 101 and 102 were sold for $870,000 and $576,000, respectively. All over- or underapplied overhead for the quarter is written off to Cost of Goods Sold.

Required:

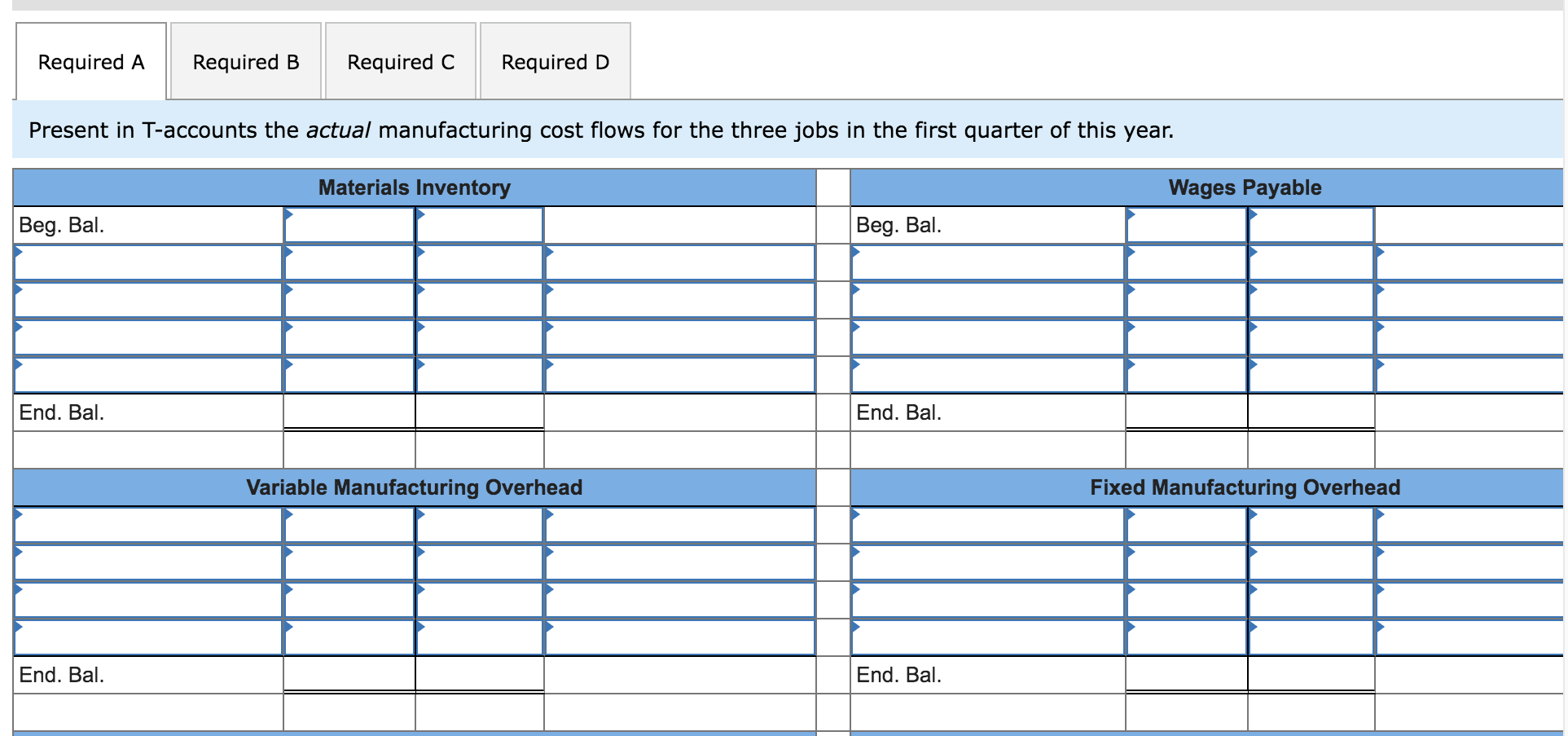

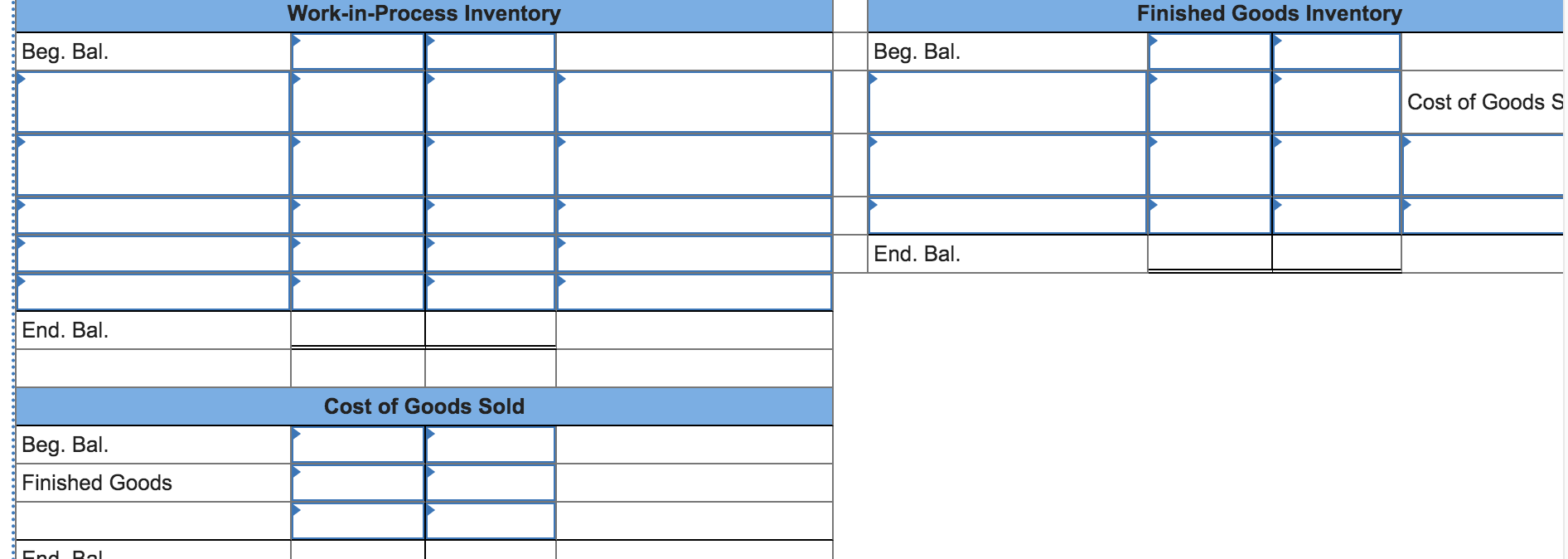

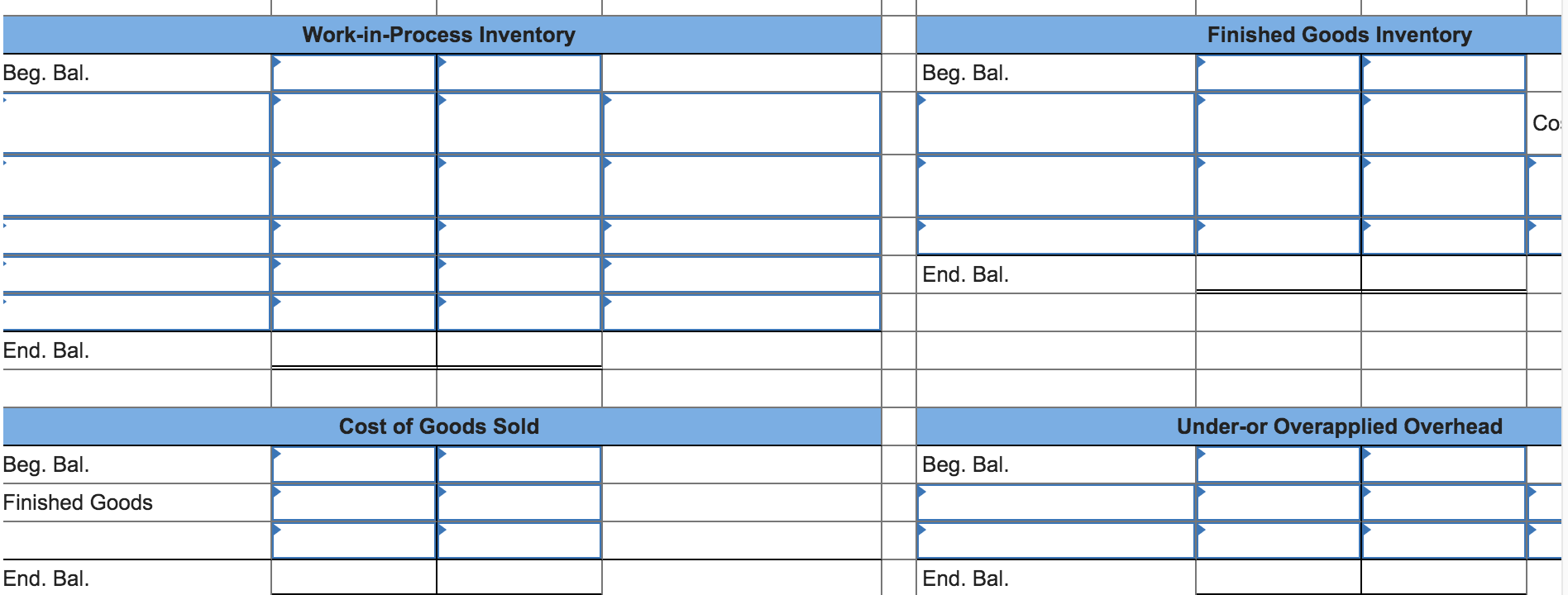

a. Present in T-accounts the actual manufacturing cost flows for the three jobs in the first quarter of this year.

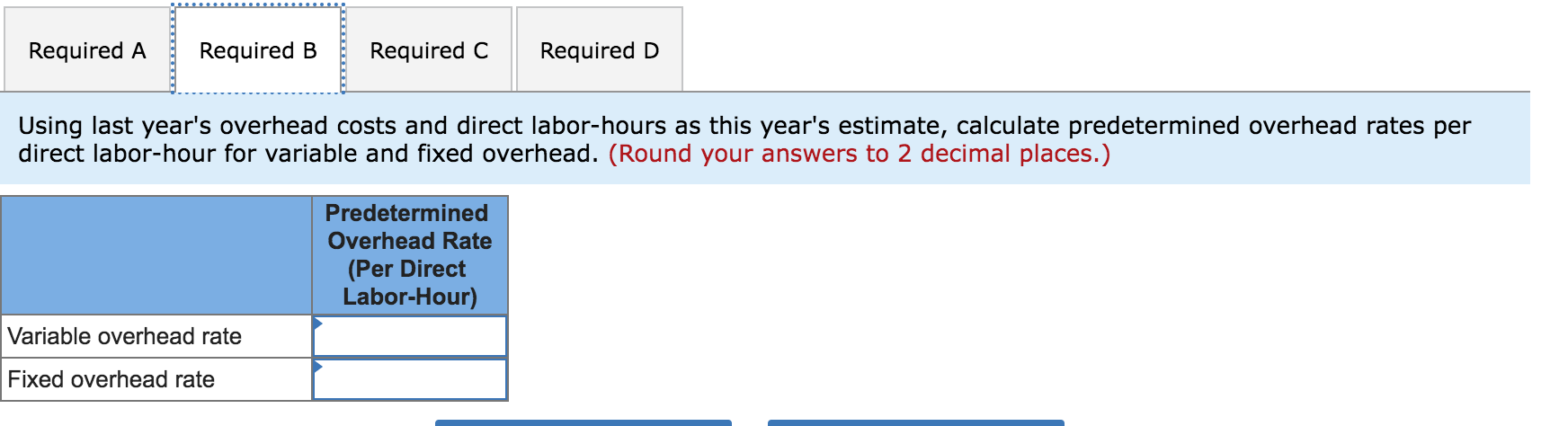

b. Using last year's overhead costs and direct labor-hours as this year's estimate, calculate predetermined overhead rates per direct labor-hour for variable and fixed overhead.

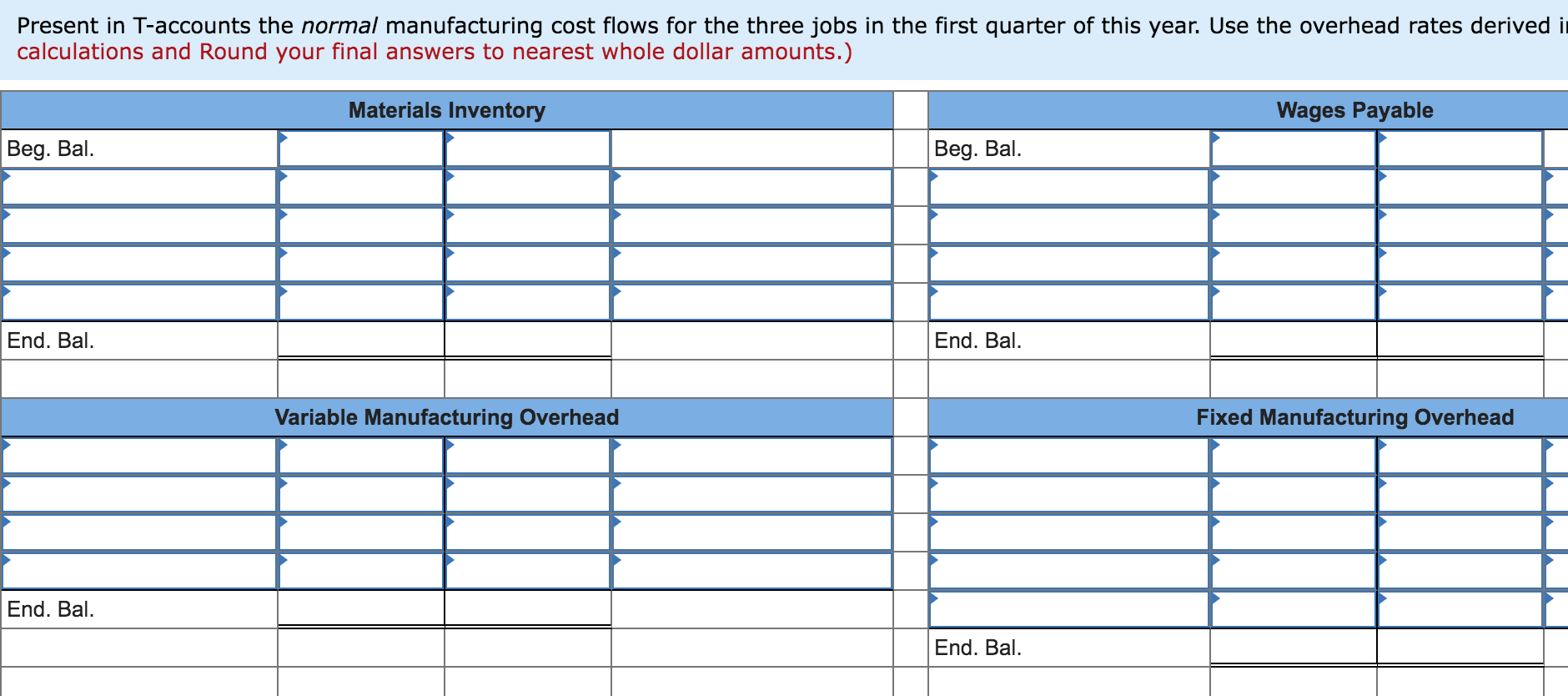

c. Present in T-accounts the normal manufacturing cost flows for the three jobs in the first quarter of this year. Use the overhead rates derived in requirement (b).

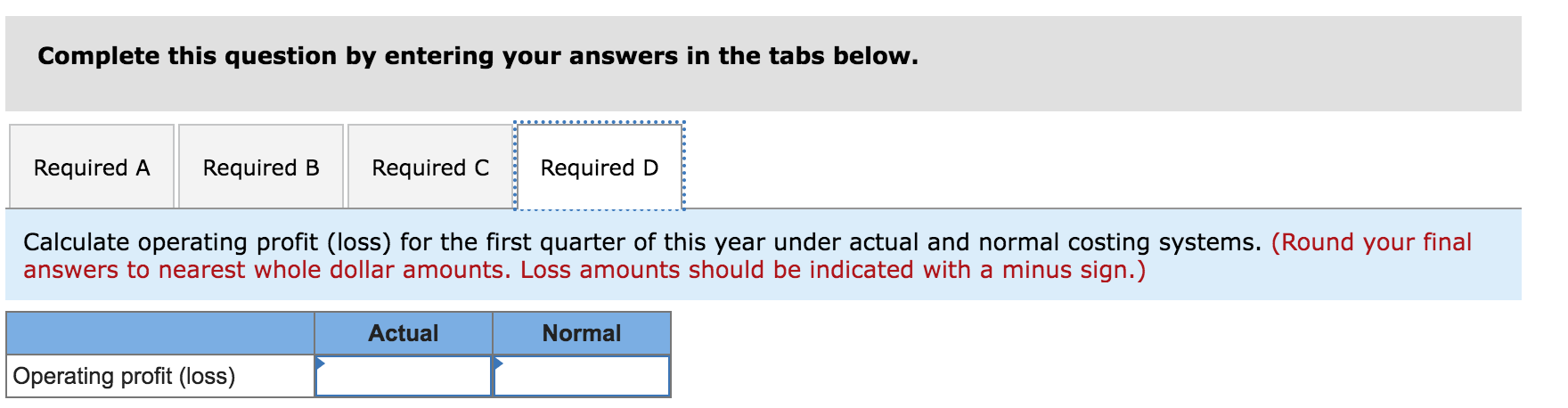

d. Calculate operating profit (loss) for the first quarter of this year under actual and normal costing systems.

Required A Required B Required C Required D Present in T-accounts the actual manufacturing cost flows for the three jobs in the first quarter of this year. Materials Inventory Wages Payable Beg. Bal. Beg. Bal. End. Bal. End. Bal. Variable Manufacturing Overhead Fixed Manufacturing Overhead End. Bal. End. Bal. Work-in-Process Inventory Finished Goods Inventory Beg. Bal. Beg. Bal. Cost of Goods S End. Bal. End. Bal. Cost of Goods Sold Beg. Bal. Finished Goods Ind Ral Required A Required B Required C Required D Using last year's overhead costs and direct labor-hours as this year's estimate, calculate predetermined overhead rates per direct labor-hour for variable and fixed overhead. (Round your answers to 2 decimal places.) Predetermined Overhead Rate (Per Direct Labor-Hour) Variable overhead rate Fixed overhead rate Present in T-accounts the normal manufacturing cost flows for the three jobs in the first quarter of this year. Use the overhead rates derived i calculations and Round your final answers to nearest whole dollar amounts.) Materials Inventory Wages Payable Beg. Bal. Beg. Bal. End. Bal. End. Bal. Variable Manufacturing Overhead Fixed Manufacturing Overhead End. Bal. End. Bal. Work-in-Process Inventory Finished Goods Inventory Beg. Bal. Beg. Bal. Co End. Bal. End. Bal. Cost of Goods Sold Under-or Overapplied Overhead Beg. Bal. Beg. Bal. Finished Goods End. Bal. End. Bal. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Calculate operating profit (loss) for the first quarter of this year under actual and normal costing systems. (Round your final answers to nearest whole dollar amounts. Loss amounts should be indicated with a minus sign.) Actual Normal Operating profit (loss)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started