Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Burton and Associates, LLCs income statement for the year ended December 31, 2021, included $2,875,069 of sales, all of which were credit sales. Its comparative

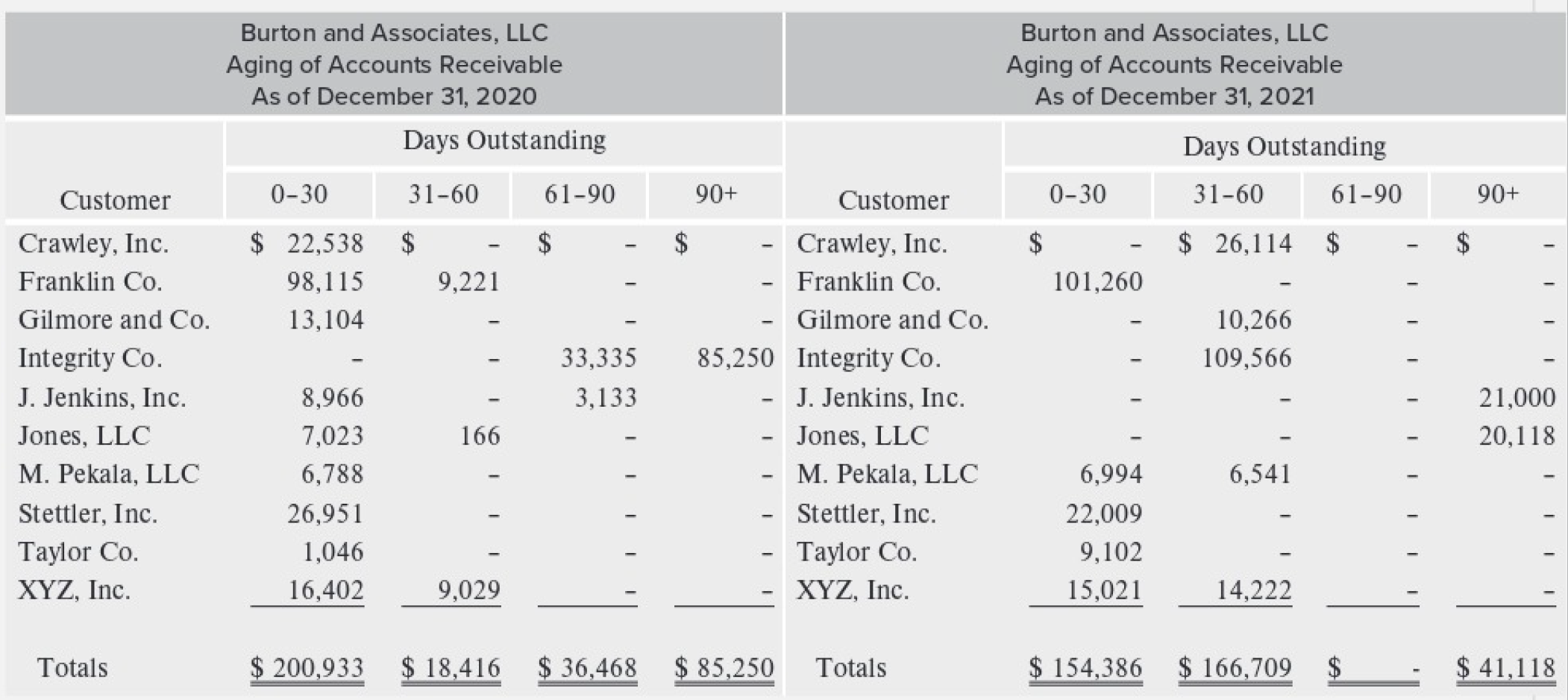

Burton and Associates, LLCs income statement for the year ended December 31, 2021, included $2,875,069 of sales, all of which were credit sales. Its comparative balance sheets for December 31, 2020, and December 31, 2021, included $341,067 and $362,213 of accounts receivable, respectively, the aging of which is included below:

Burton and Associates, LLCs comparative balance sheets include no reserve for bad debts at December 31, 2020, or December 31, 2021. Assuming the companys payment terms are 30 days, do the following:

- Calculate accounts receivable turnover for 2021.

- Calculate the average collection period for 2021.

- Comment on the status of the companys accounts receivable at December 31, 2021. Do collections seem to be improving? Explain your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started