Answered step by step

Verified Expert Solution

Question

1 Approved Answer

National Wild Resorts Ltd (hereafter NWR) is a leading resorts company that manages lodges, campgrounds and resorts throughout Namibia. The company has developed a corporate

National Wild Resorts Ltd (hereafter “NWR”) is a leading resorts company that manages lodges, campgrounds and resorts throughout Namibia. The company has developed a corporate website to keep abreast of technological advancements and accommodate the trend of doing business online. NWR noted that most of its reservations are done online. The website enables it to advertise its lodges, and to make potential customers aware of any special promotions. As

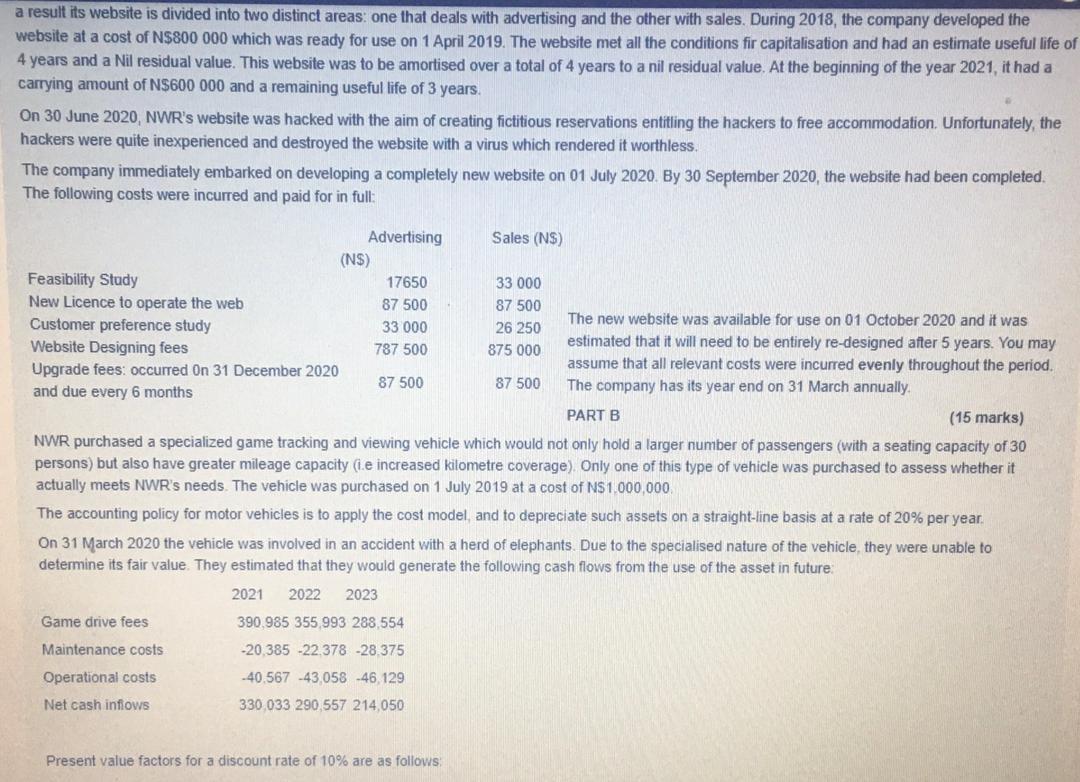

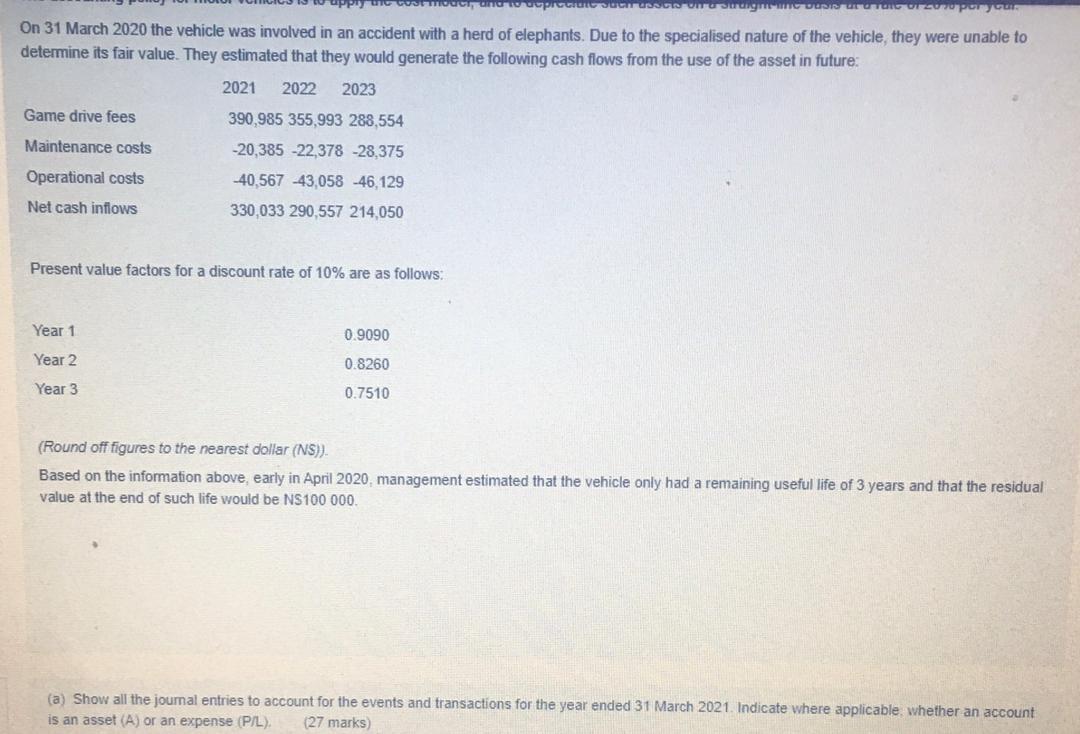

a result its website is divided into two distinct areas: one that deals with advertising and the other with sales. During 2018, the company developed the website at a cost of N$800 000 which was ready for use on 1 April 2019. The website met all the conditions fir capitalisation and had an estimate useful life of 4 years and a Nil residual value. This website was to be amortised over a total of 4 years to a nil residual value. At the beginning of the year 2021, it had a carrying amount of N$600 000 and a remaining useful life of 3 years. On 30 June 2020, NWR's website was hacked with the aim of creating fictitious reservations entitling the hackers to free accommodation. Unfortunately, the hackers were quite inexperienced and destroyed the website with a virus which rendered it worthless. The company immediately embarked on developing a completely new website on 01 July 2020. By 30 September 2020, the website had been completed. The following costs were incurred and paid for in full: Feasibility Study New Licence to operate the web Customer preference study Website Designing fees Upgrade fees: occurred On 31 December 2020 and due every 6 months Advertising (NS) Game drive fees Maintenance costs Operational costs Net cash inflows 17650 87 500 33 000 787 500 87 500 The new website was available for use on 01 October 2020 and it was estimated that it will need to be entirely re-designed after 5 years. You may assume that all relevant costs were incurred evenly throughout the period. The company has its year end on 31 March annually. PART B (15 marks) NWR purchased a specialized game tracking and viewing vehicle which would not only hold a larger number of passengers (with a seating capacity of 30 persons) but also have greater mileage capacity (i.e increased kilometre coverage). Only one of this type of vehicle was purchased to assess whether it actually meets NWR's needs. The vehicle was purchased on 1 July 2019 at a cost of N$1,000,000. The accounting policy for motor vehicles is to apply the cost model, and to depreciate such assets on a straight-line basis at a rate of 20% per year. On 31 March 2020 the vehicle was involved in an accident with a herd of elephants. Due to the specialised nature of the vehicle, they were unable to determine its fair value. They estimated that they would generate the following cash flows from the use of the asset in future: 2021 2022 2023 390,985 355,993 288,554 -20,385 -22,378 -28.375 -40.567 -43,058 -46,129) 330,033 290,557 214,050 Sales (NS) Present value factors for a discount rate of 10% are as follows: 33 000 87 500 26 250 875 000 87 500

Step by Step Solution

★★★★★

3.29 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started