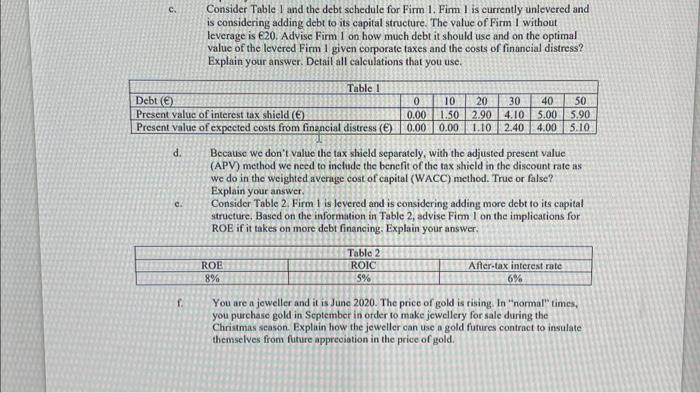

c. Consider Table 1 and the debt schedule for Firm 1. Firm 1 is currently unlevered and is considering adding debt to its capital structure. The value of Firm I without leverage is E20. Advise Firm 1 on how much debt it should use and on the optimal value of the levered Firm 1 given corporate taxes and the costs of financial distress? Explain your answer. Detail all calculations that you use. d. Because we don't value the tax sheld separately, with the adjusted present value (APV) method we need to include the benefit of the tax shield in the discount rate as we do in the weighted average cost of capital (WACC) method. True or false? Explain your answer. e. Consider Table 2. Firm 1 is levered and is considering adding more debt to its capital strueture, Based on the information in Table 2, advise Firm 1 on the implications for ROE if it takes on more debt financing. Explain your answer. f. You are a jeweller and it is June 2020. The price of gold is rising. In "normal" times, you purchase gold in September in order to make jewellery for sale during the Christmas scason. Explain how the jeweller can use a gold futures contract to insulate themselves from future appresiation in the price of gold. c. Consider Table 1 and the debt schedule for Firm 1. Firm 1 is currently unlevered and is considering adding debt to its capital structure. The value of Firm I without leverage is E20. Advise Firm 1 on how much debt it should use and on the optimal value of the levered Firm 1 given corporate taxes and the costs of financial distress? Explain your answer. Detail all calculations that you use. d. Because we don't value the tax sheld separately, with the adjusted present value (APV) method we need to include the benefit of the tax shield in the discount rate as we do in the weighted average cost of capital (WACC) method. True or false? Explain your answer. e. Consider Table 2. Firm 1 is levered and is considering adding more debt to its capital strueture, Based on the information in Table 2, advise Firm 1 on the implications for ROE if it takes on more debt financing. Explain your answer. f. You are a jeweller and it is June 2020. The price of gold is rising. In "normal" times, you purchase gold in September in order to make jewellery for sale during the Christmas scason. Explain how the jeweller can use a gold futures contract to insulate themselves from future appresiation in the price of gold