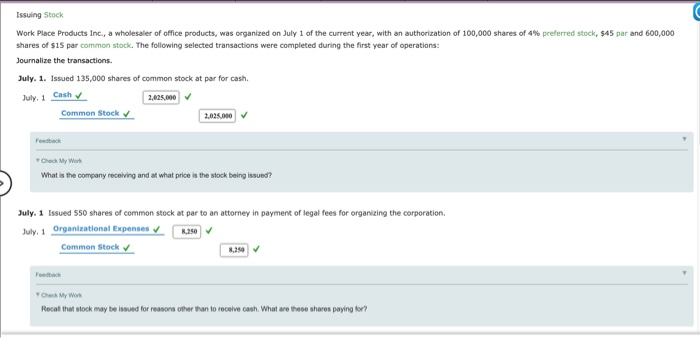

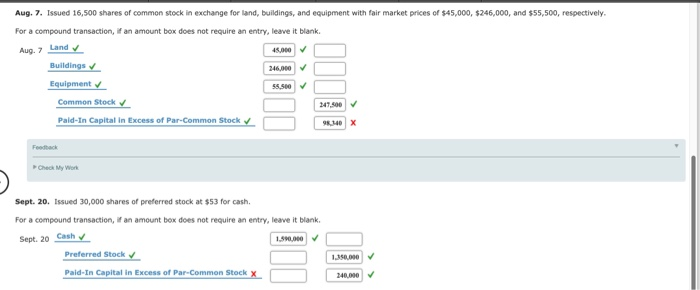

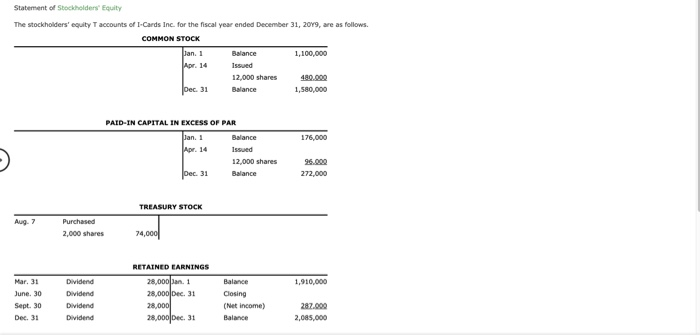

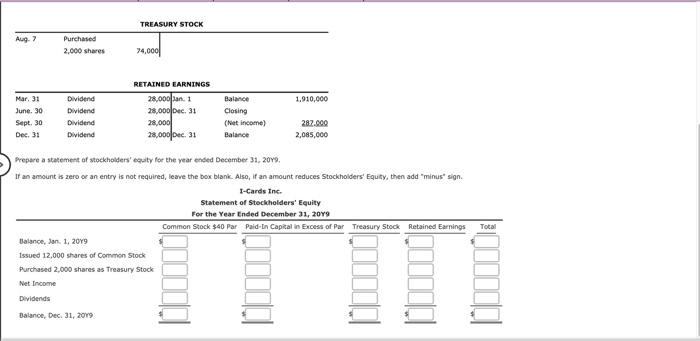

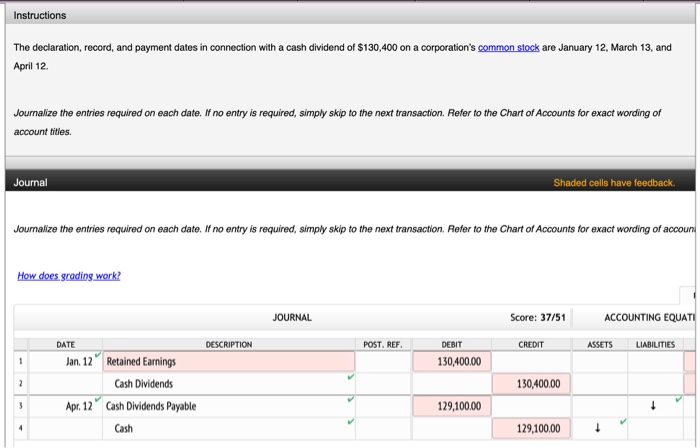

C Issuing Stock Work Place Products Inc., a wholesaler of office products, was organized on July 1 of the current year, with an authorization of 100,000 shares of 4% preferred stock, $45 par and 600,000 shares of $15 par common stock. The following selected transactions were completed during the first year of operations: Journalize the transactions. July. 1. Issued 135,000 shares of common stock at par for cash. 2,025,000 Common Stock July 1 Cash Check My Work What is the company receiving and at what price is the stock being issued? July, 1 Issued 550 shares of common stock at par to an attorney in payment of legal fees for organizing the corporation. July 1 Organizational Expenses Common Stock 8.250 Check My Work Recall that stock may be issued for reasons other than to receive cash. What are these shares paying for? Aug. 7. Issued 16,500 shares of common stock in exchange for land, buildings, and equipment with fair market prices of $45,000, $245,000, and $55,500, respectively. For a compound transaction, if an amount box does not require an entry, leave it blank. Aug. 7 Land 246,000 55,500 Buildings Equipment Common Stock Pald-In Capital in Excess of Par-Common Stock 9.340 X Foodteck Check My Wort Sept. 20. Issued 30,000 shares of preferred stock at $53 for cash. For a compound transaction, if an amount box does not require an entry, leave it blank. Sept. 20 Cash 1.590,000 1.350.000 Preferred Stock Pald-In Capital in Excess of Par-Common Stock X 240.000 Statement of Stockholders' Equity The stockholders' equity Taccounts of L-Cards Inc. for the fiscal year ended December 31, 2019, are as follows. COMMON STOCK Jan. 1 Balance 1,100,000 Apr. 14 Issued 12,000 shares Dec 31 Balance 1,580,000 176,000 PAID-IN CAPITAL IN EXCESS OF PAR Jan. 1 Balance Apr. 14 Issued 12,000 shares Dec. 31 Balance 272,000 TREASURY STOCK Aug. 7 Purchased 2,000 shares 74,000 1,910,000 Mar. 31 June 30 Sept. 30 Dec. 31 Dividend Dividend Dividend Dividend RETAINED EARNINGS 28,000an. 1 28,000Dec 31 28,000 28,000Dec. 31 Balance Closing (Net income) Balance 287.000 2,085,000 TREASURY STOCK Aug. Purchased 2,000 shares 74,000 1,910,000 Mar. 31 June 30 Sept. 30 Dec. 31 Dividend Dividend Dividend Dividend RETAINED EARNINGS 28,000 an 1 28,000Dec. 31 28,000 28,000Dec. 31 Balance Closing (Net income) Balance 282.000 2,085,000 Prepare a statement of stockholders' equity for the year ended December 31, 2049. If an amount is zero or an entry is not required, leave the box blank. Also, if an amount reduces Stockholders' Equity, then add "minus" sign. 1-Cards Inc. Statement of Stockholders' Equity For the Year Ended December 31, 2049 Common Stock $40 Par Paid-In Capital in Excess of Par Treasury Stock Retained Earnings Balance, Jan 1, 2019 Issued 12,000 shares of Common Stock Purchased 2,000 shares as Treasury Stock Net Income Dividends Total Balance, Dec 31, 2019 Instructions The declaration, record, and payment dates in connection with a cash dividend of $130,400 on a corporation's common stock are January 12, March 13, and April 12 Journalize the entries required on each date. If no entry is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of account titles Journal Shaded cells have feedback Journalize the entries required on each date. If no entry is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of accoun How does grading work? JOURNAL Score: 37/51 ACCOUNTING EQUATI DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES 1 130,400.00 2 130,400.00 Jan 12 Retained Earnings Cash Dividends Apr. 12 Cash Dividends Payable Cash 3 129,100.00 4 129,100.00