Answered step by step

Verified Expert Solution

Question

1 Approved Answer

C. Prepare cash budgets for first quarter of 2017, by months and in total. D. If a company prepares budgeted statement of profit or loss

C. Prepare cash budgets for first quarter of 2017, by months and in total.

D. If a company prepares budgeted statement of profit or loss and statement of financial position, why is a cash budget still necessary? Briefly explain.

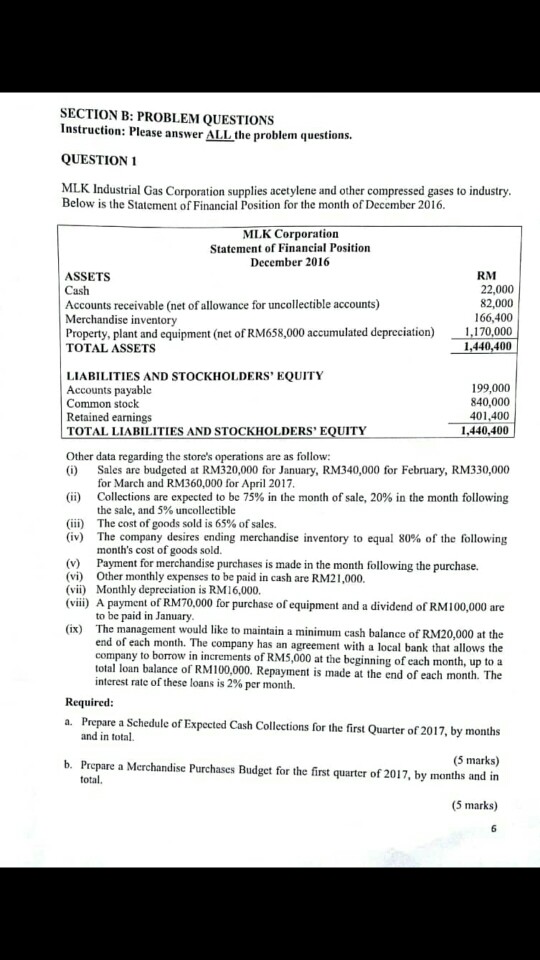

SECTION B: PROBLEM QUESTIONS Instruction: Please answer ALL the problem questions. QUESTION 1 MLK Industrial Gas Corporation supplies acetylene and other compressed gases to industry Below is the Statement of Financial Position for the month of December 2016. MLK Corporation Statement of Financial Position December 2016 ASSETS Cash Accounts receivable (net of allowance for uncollectible accounts) Merchandise inventory RM 22,000 82,000 166,400 Property, plant and equipment (net of RM658,000 accumulated depreciation)1,170,000 TOTAL ASSETS 1,440,400 LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable Common stock Retained earnings TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 199,000 840,000 401,400 1,440,400 Other data regarding the store's operations are as follow (i) Sales are budgeted at RM320,000 for January, RM340,000 for February, RM330,000 for March and RM360,000 for April 2017 Collections are expected to be 75% in the month of sale, 20% in the month following the sale, and 5% uncollectible The cost of goods sold is 65% of sales. The company desires ending merchandise inventory to equal 80% of the following month's cost of goods sold. (ii) (iii) (iv) (v) Payment for merchandise purchases is made in the month following the purchase. (vi) Other monthly expenses to be paid in cash are RM21,000. (vii) Monthly depreciation is RM16,000. (V???) A payment of RM70,000 for purchase of equipment and a dividend of RM 100,000 are to be paid in January (ix) The management would like to maintain a minimum cash balance of RM20,000 at the end of each month. The company has an agreement with a local bank that allows the company to borro total loan balance of RM100,000. Repayment is made at the end of each month interest rate of these loans is 2% per month. w in increments of RM5,000 at the beginning of each month, up to a Required: a. Prepare a Schedule of Expected Cash Collections for the first Quarter of 2017, by months and in total (5 marks) b. Prepare a Merchandise Purchases Budget for the first quarter of 2017, by months and in totalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started