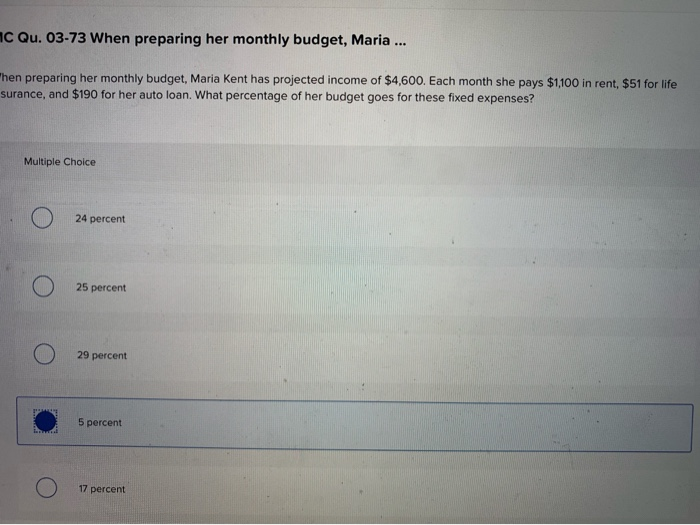

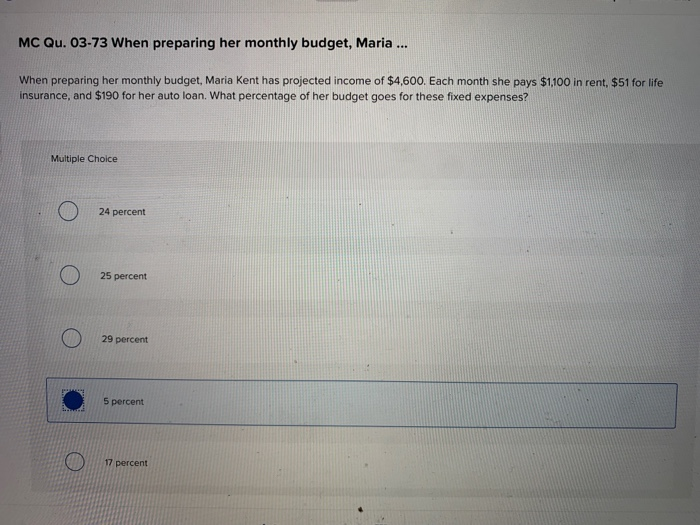

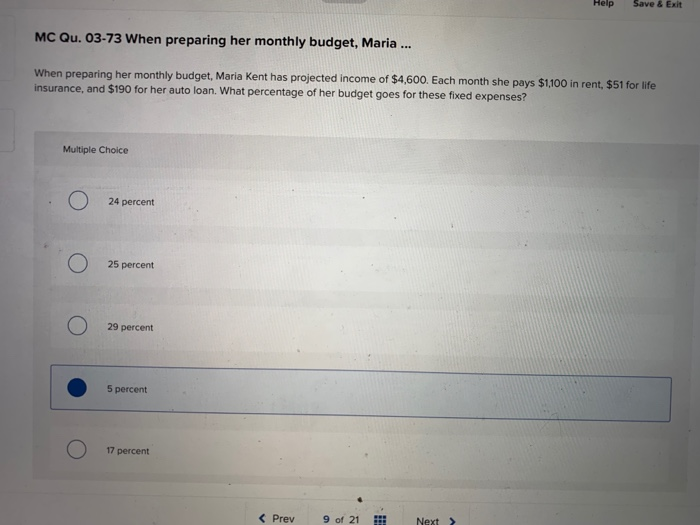

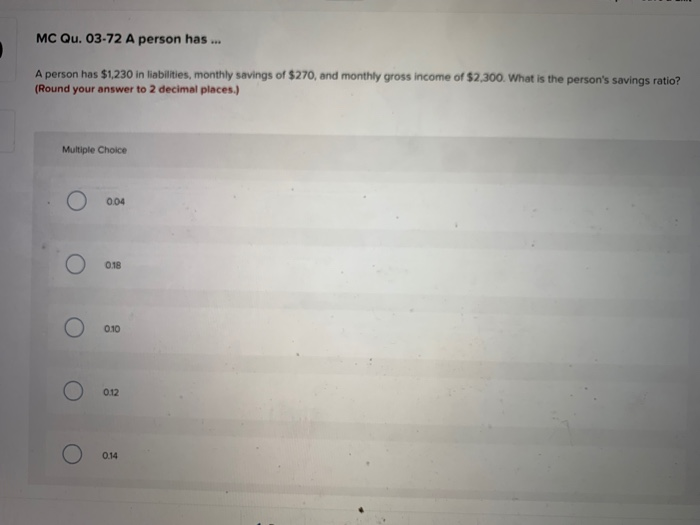

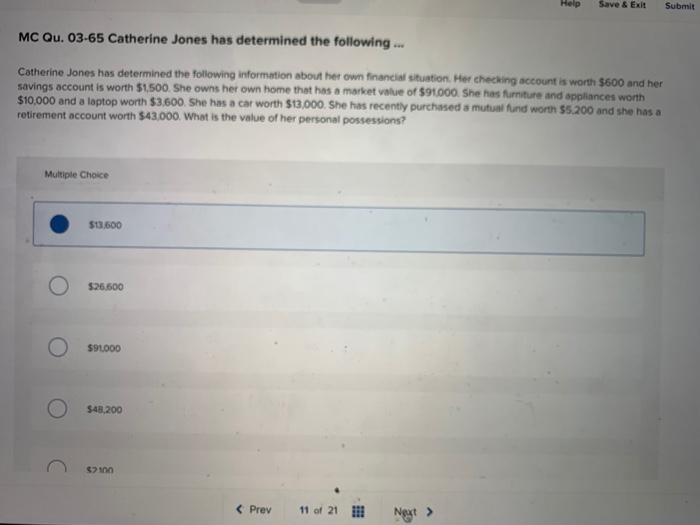

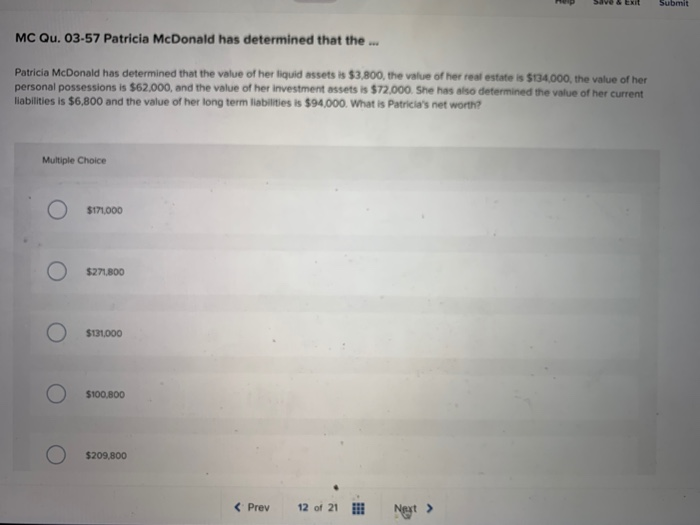

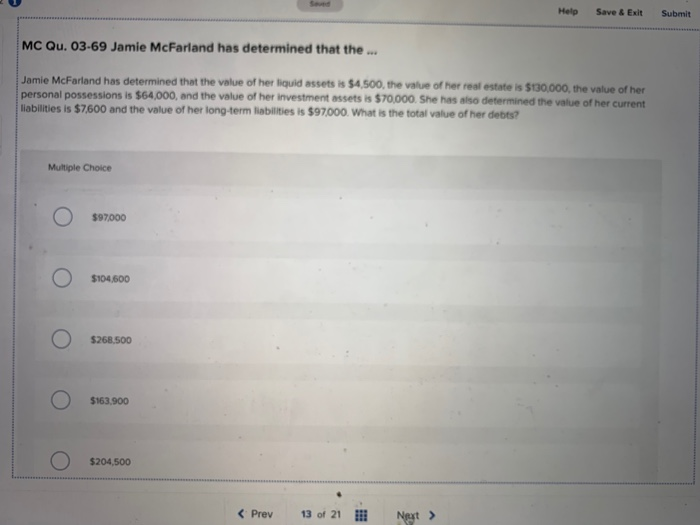

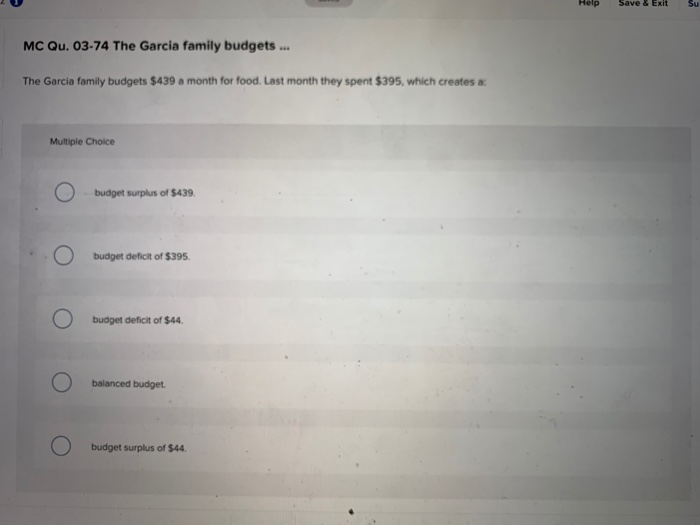

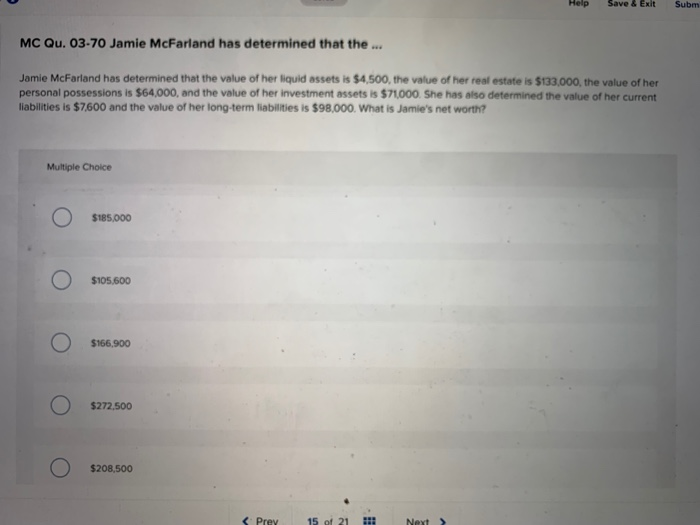

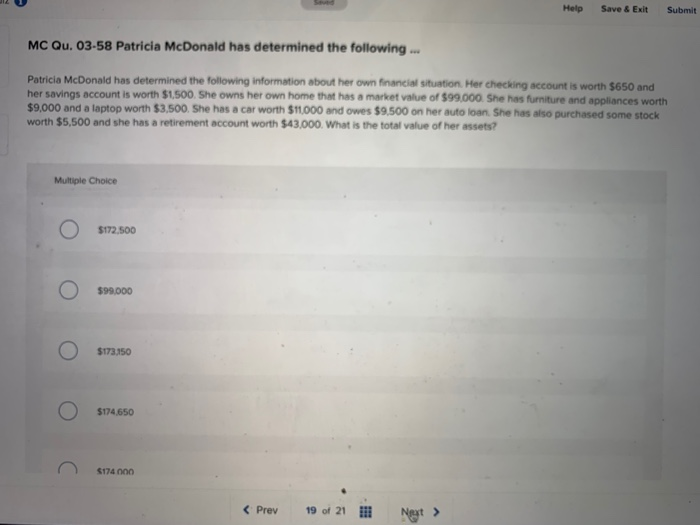

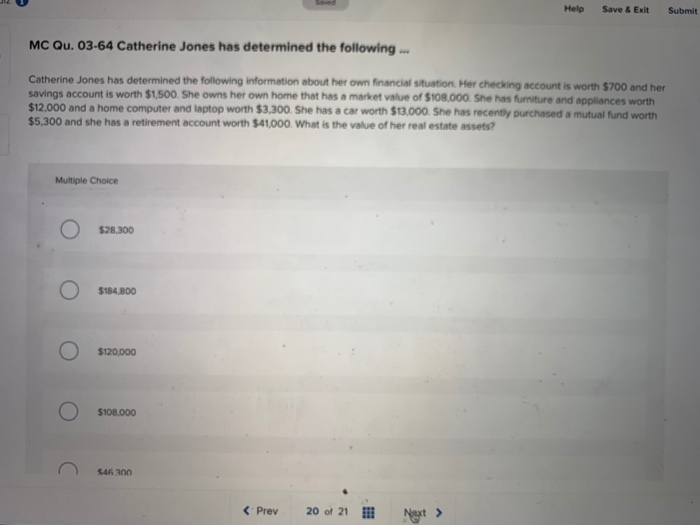

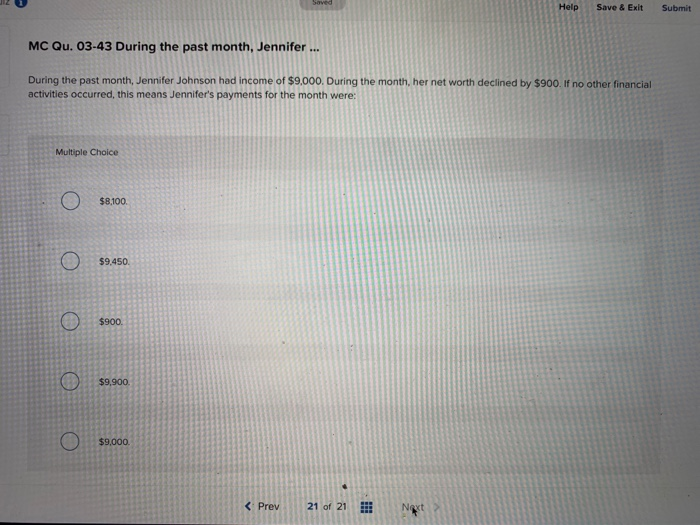

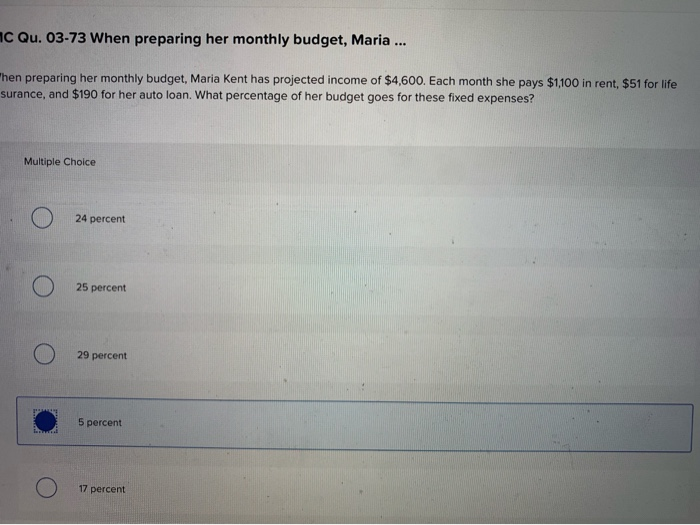

C Qu. 03-73 When preparing her monthly budget, Maria ... then preparing her monthly budget, Maria Kent has projected income of $4,600. Each month she pays $1,100 in rent, $51 for life surance, and $190 for her auto loan. What percentage of her budget goes for these fixed expenses? Multiple Choice 24 percent 25 percent ooooo O 29 percent 5 percent 17 percent MC Qu. 03-73 When preparing her monthly budget, Maria ... When preparing her monthly budget, Maria Kent has projected income of $4,600. Each month she pays $1,100 in rent, $51 for life insurance, and $190 for her auto loan. What percentage of her budget goes for these fixed expenses? Multiple Choice 0 24 percent 25 percent O 29 percent 5 percent O 17 percent MC Qu. 03-73 When preparing her monthly budget, Maria ... When preparing her monthly budget, Maria Kent has projected income of $4,600. Each month she pays $1,100 in rent, $51 for life insurance, and $190 for her auto loan. What percentage of her budget goes for these fixed expenses? Multiple Choice O 24 percent 25 percent 29 percent 5 percent 5 percent O 17 percent MC Qu. 03-72 A person has ... A person has $1.230 in liabilities, monthly savings of $270, and monthly gross income of $2,300. What is the person's savings ratio? (Round your answer to 2 decimal places.) MC Qu. 03-65 Catherine Jones has determined the following Catherine Jones has determined the following information about her own financial situation. Her checking account is worth $600 and her savings account is worth $1,500. She owns her own home that has a market value of $91000. She has furniture and appliances worth $10,000 and a laptop worth $3,600. She has a car worth $13,000. She has recently purchased a mutual fund worth 55.200 and she has a retirement account worth $43,000. What is the value of her personal possessions? Multiple Choice $13.600 oooc MC Qu. 03-57 Patricia McDonald has determined that the ... Patricia McDonald has determined that the value of her liquid assets is $3,800, the value of her real estate is 5034.000the value of her personal possessions is 562,000, and the value of her investment assets is $72.000. She has also determined the value of her current liabilities is $6,800 and the value of her long term liabilities is $94.000. What is Patricia's net worth Multiple Choice O $17.000 O $271.000 O $131000 O O $100,800 O $209,800 Help Save & Exit Submit MC Qu. 03-69 Jamie McFarland has determined that the ... the value of her liquid assets is $4,500, the value of her real estate is $130.000, the value of her personal possessions is 564,000, and the value of her investment assets is $70,000. She has also determined the value of her current liabilities is 57,600 and the value of her long-term liabilities is $97,000. What is the total value of her det? Multiple Choice O $97000 $104,600 $268.500 o ooo $163.900 O $204,500 Help Save & Exit Su MC Qu. 03-74 The Garcia family budgets ... The Garcia family budgets $439 a month for food. Last month they spent $395, which creates a Multiple Choice O budget surplus of $439 budget deficit of $395 budget deficit of $44. balanced budget ) budget surplus of $44. Help Save & Exit Subm MC Qu. 03-70 Jamie McFarland has determined that the ... Jamie McFarland has determined that the value of her liquid assets is $4.500, the value of her real estate is 5033.000, the value of her personal possessions is $64,000, and the value of her investment assets is $71,000. She has also determined the value of her current liabilities is 57,600 and the value of her long-term liabilities is $98.000. What is Jamie's net worth? Multiple Choice $166,900 $208,500 Help Save & Exit Submit MC Qu. 03-64 Catherine Jones has determined the following Catherine Jones has determined the following information about her own financial situation. Her checking account is worth $700 and her savings account is worth $1,500. She owns her own home that has a market value of $108.000. She has furniture and appliances worth $12,000 and a home computer and laptop worth $3,300. She has a car worth $13,000. She has recently purchased a mutual fund worth $5,300 and she has a retirement account worth $41,000. What is the value of her real estate assets Multiple Choice $184,800 ooooc $100,000 $46200 Help Save & Exit Submit MC Qu. 03-43 During the past month, Jennifer ... During the past month, Jennifer Johnson had income of $9,000. During the month, her net worth declined by $900. If no other financial activities occurred, this means Jennifer's payments for the month were: Multiple Choice 0 0 0 0 0