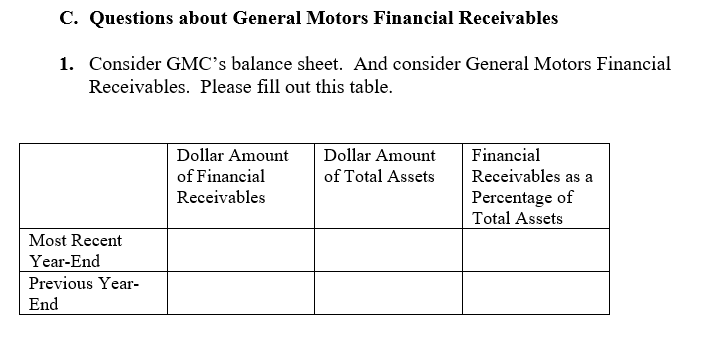

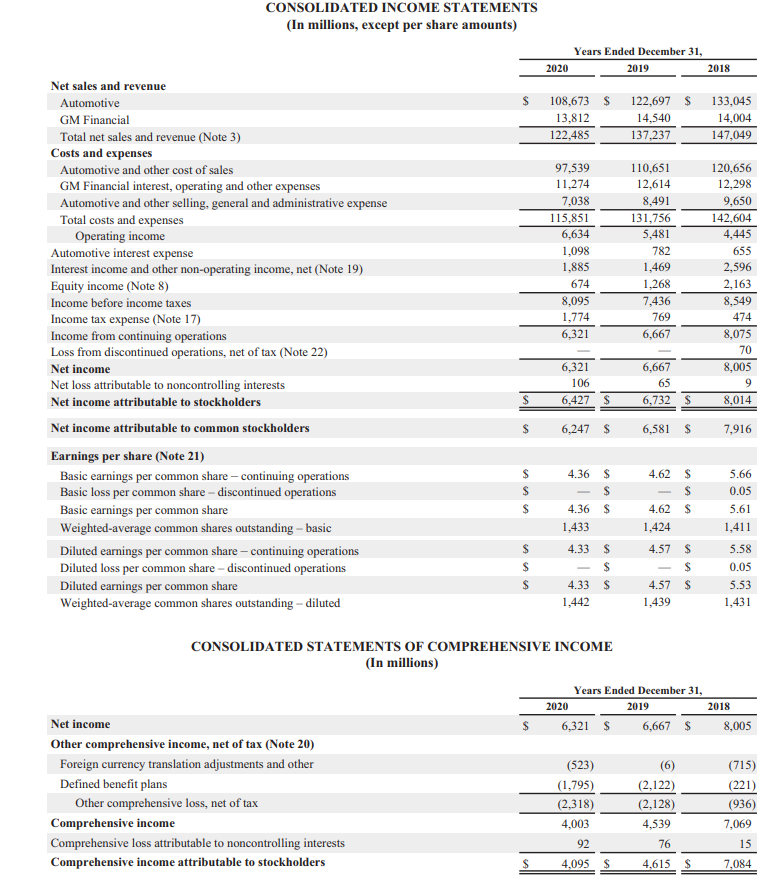

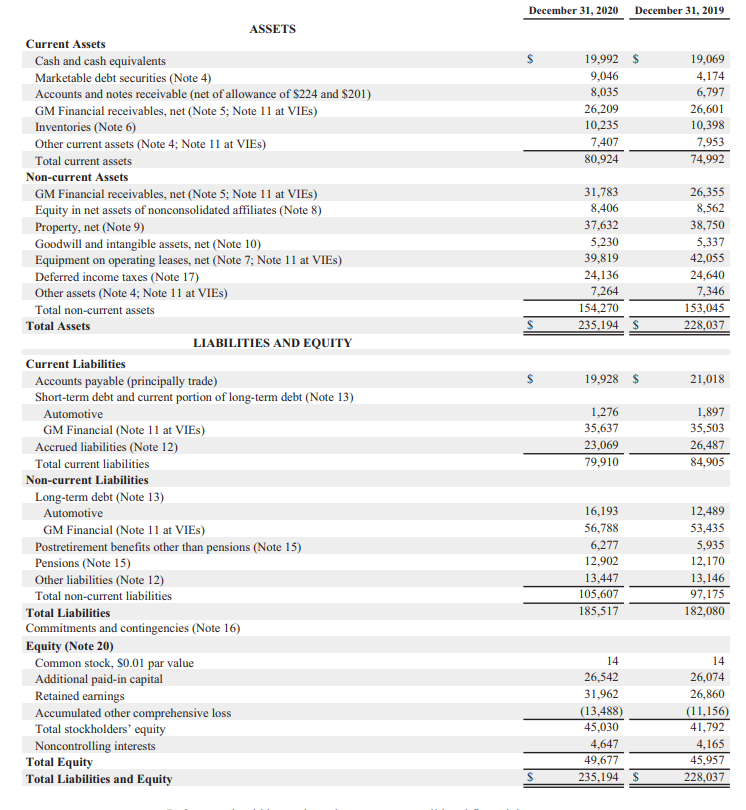

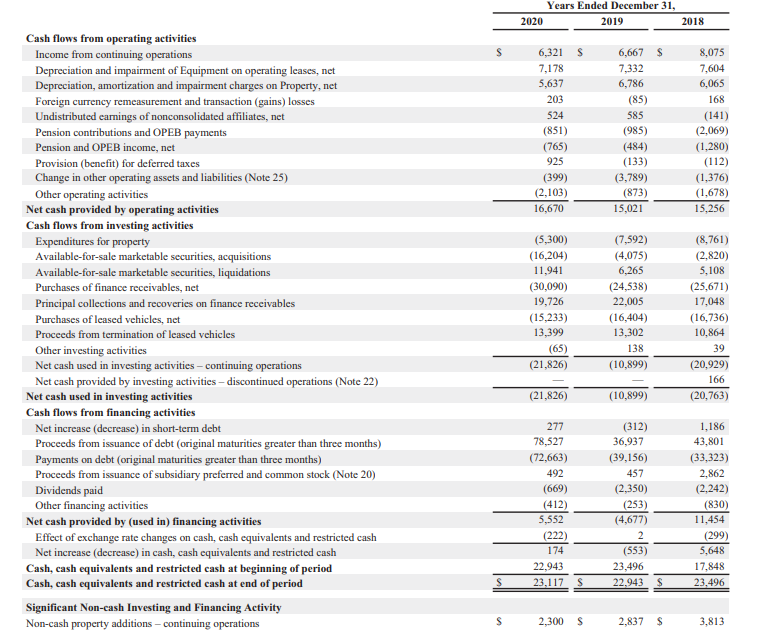

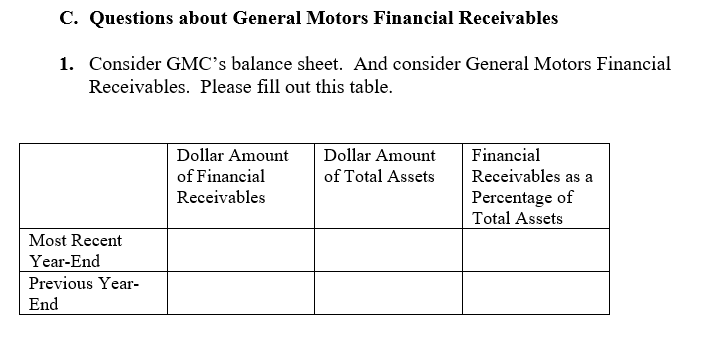

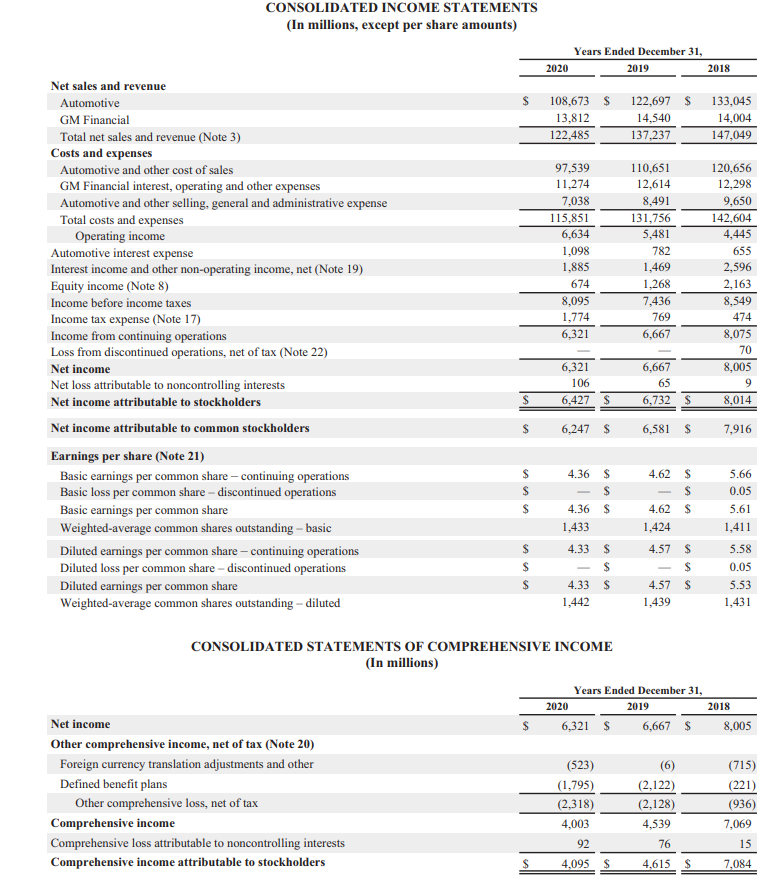

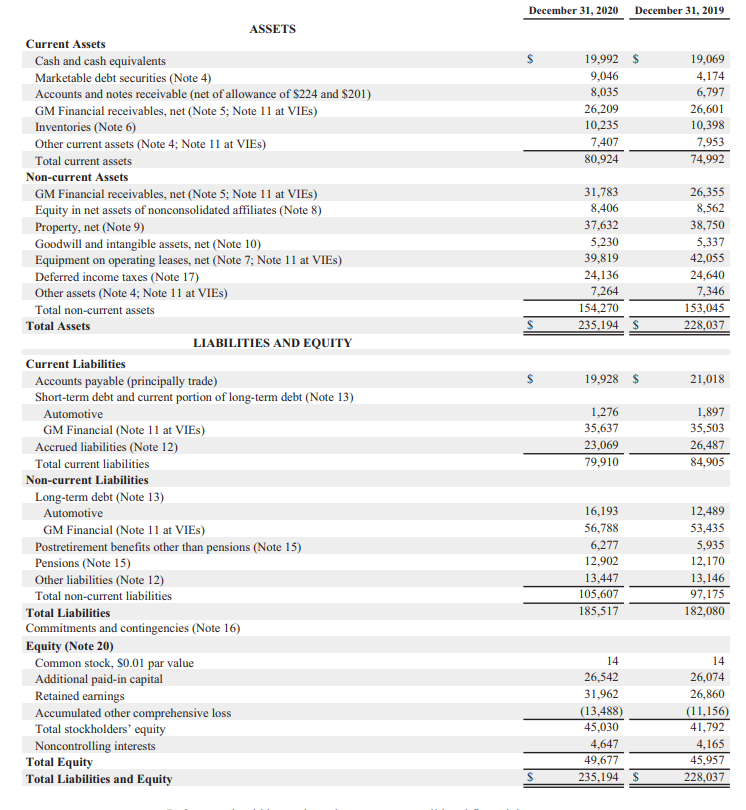

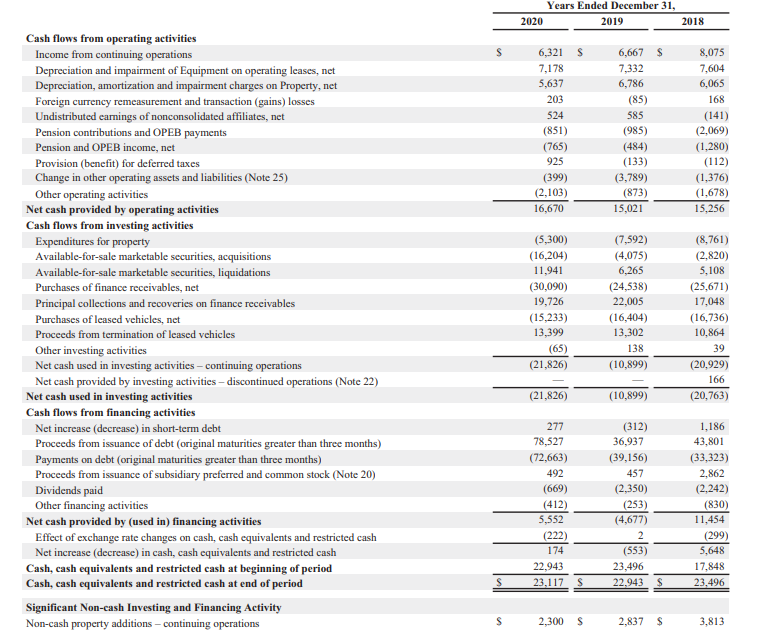

C. Questions about General Motors Financial Receivables 1. Consider GMC's balance sheet. And consider General Motors Financial Receivables. Please fill out this table. Dollar Amount of Financial Receivables Dollar Amount of Total Assets Financial Receivables as a Percentage of Total Assets Most Recent Year-End Previous Year- End 2018 CONSOLIDATED INCOME STATEMENTS (In millions, except per share amounts) Years Ended December 31, 2020 2019 Net sales and revenue Automotive $ 108,673 $ 122,697 $ 133,045 GM Financial 13,812 14,540 14,004 Total net sales and revenue (Note 3) 122,485 137,237 147,049 Costs and expenses Automotive and other cost of sales 97,539 110,651 120,656 GM Financial interest, operating and other expenses 11,274 12,614 12,298 Automotive and other selling, general and administrative expense 7,038 8,491 9,650 Total costs and expenses 115,851 131,756 142,604 Operating income 6,634 5,481 4,445 Automotive interest expense 1,098 782 655 Interest income and other non-operating income, net (Note 19) 1,885 1,469 2,596 Equity income (Note 8) 674 1,268 2,163 Income before income taxes 8,095 7,436 8,549 Income tax expense (Note 17) 1,774 769 474 Income from continuing operations 6,321 6,667 8,075 Loss from discontinued operations, net of tax (Note 22) 70 Net income 6,321 6,667 8,005 Net loss attributable to noncontrolling interests 106 65 9 Net income attributable to stockholders $ 6,427 $ 6,732 $ 8,014 Net income attributable to common stockholders 6,247 $ 6,581 $ 7,916 Earnings per share (Note 21) Basic earnings per common share - continuing operations 4.36 $ 4.62 S 5.66 Basic loss per common share - discontinued operations S S S 0.05 Basic earnings per common share S 4.36 $ 4.62 $ 5.61 Weighted average common shares outstanding - basic 1,433 1,424 1,411 Diluted earnings per common share - continuing operations 4.33 4.57 $ 5.58 Diluted loss per common share - discontinued operations $ 0.05 Diluted earnings per common share $ 4.33 4.57 $ 5.53 Weighted average common shares outstanding - diluted 1,442 1,439 1,431 $ S S S A $ S CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Years Ended December 31, 2020 2019 2018 Net income $ 6,321 $ 6,667 $ 8,005 Other comprehensive income, net of tax (Note 20) Foreign currency translation adjustments and other (523) (6) (715) Defined benefit plans (1,795) (2,122) (221) Other comprehensive loss, net of tax (2,318) (2,128) (936) Comprehensive income 4,003 4,539 7,069 Comprehensive loss attributable to noncontrolling interests 92 76 15 Comprehensive income attributable to stockholders 4,095 $ 4,615 $ 7,084 $ December 31, 2020 December 31, 2019 $ 19,992 $ 9,046 8,035 26,209 10,235 7,407 80,924 19,069 4,174 6,797 26,601 10,398 7,953 74,992 31,783 8,406 37,632 5,230 39,819 24,136 7.264 154,270 235,194 $ 26,355 8,562 38,750 5,337 42,055 24,640 7,346 153,045 228,037 S S 19,928 $ 21,018 ASSETS Current Assets Cash and cash equivalents Marketable debt securities (Note 4) Accounts and notes receivable (net of allowance of $224 and $201) GM Financial receivables, net (Note 5; Note 11 at VIES) Inventories (Note 6) Other current assets (Note 4; Note 11 at VIES) Total current assets Non-current Assets GM Financial receivables, net (Note 5; Note 11 at VIES) Equity in net assets of nonconsolidated affiliates (Note 8) Property, net (Note 9) Goodwill and intangible assets, net (Note 10) Equipment on operating leases, net (Note 7; Note 11 at VIES) Deferred income taxes (Note 17) Other assets (Note 4; Note 11 at VIES) Total non-current assets Total Assets LIABILITIES AND EQUITY Current Liabilities Accounts payable (principally trade) Short-term debt and current portion of long-term debt (Note 13) Automotive GM Financial (Note 11 at VIES) Accrued liabilities (Note 12) Total current liabilities Non-current Liabilities Long-term debt (Note 13) Automotive GM Financial (Note 11 at VIES) Postretirement benefits other than pensions (Note 15) Pensions (Note 15) Other liabilities (Note 12) Total non-current liabilities Total Liabilities Commitments and contingencies (Note 16) Equity (Note 20) Common stock, $0.01 par value Additional paid-in capital Retained eamings Accumulated other comprehensive loss Total stockholders equity Noncontrolling interests Total Equity Total Liabilities and Equity 1,276 35,637 23,069 79,910 1,897 35,503 26,487 84,905 16,193 56,788 6,277 12,902 13,447 105,607 185,517 12,489 53,435 5,935 12,170 13,146 97,175 182,080 14 26,542 31,962 (13,488) 45,030 4,647 49,677 235,194 14 26,074 26,860 (11,156) 41,792 4,165 45,957 228,037 S $ Years Ended December 31, 2020 2019 2018 S 6,667 S 6,321 $ 7,178 5,637 203 524 (851) (765) 925 (399) (2,103) 16,670 7,332 6,786 (85) 585 (985) (484) (133) (3,789) (873) 15,021 8,075 7,604 6,065 168 (141) (2,069) (1,280) (112) (1,376) (1,678) 15,256 Cash flows from operating activities Income from continuing operations Depreciation and impairment of Equipment on operating leases, net Depreciation, amortization and impairment charges on Property, net Foreign currency remeasurement and transaction (gains) losses Undistributed carnings of nonconsolidated affiliates, net Pension contributions and OPEB payments Pension and OPEB income, net Provision (benefit) for deferred taxes Change in other operating assets and liabilities (Note 25) Other operating activities Net cash provided by operating activities Cash flows from investing activities Expenditures for property Available-for-sale marketable securities, acquisitions Available-for-sale marketable securities, liquidations Purchases of finance receivables, net Principal collections and recoveries on finance receivables Purchases of leased vehicles, net Proceeds from termination of leased vehicles Other investing activities Net cash used in investing activities - continuing operations Net cash provided by investing activities - discontinued operations (Note 22) Net cash used in investing activities Cash flows from financing activities Net increase (decrease) in short-term debt Proceeds from issuance of debt (original maturities greater than three months) Payments on debt (original maturities greater than three months) Proceeds from issuance of subsidiary preferred and common stock (Note 20) Dividends paid Other financing activities Net cash provided by (used in) financing activities Effect of exchange rate changes on cash, cash equivalents and restricted cash Net increase (decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at beginning of period Cash, cash equivalents and restricted cash at end of period Significant Non-cash Investing and Financing Activity Non-cash property additions - continuing operations (5,300) (16,204) 11,941 (30,090) 19,726 (15,233) 13,399 (65) (21,826) (7.592) (4,075) 6,265 (24,538) 22,005 (16,404) 13,302 138 (10,899) (8,761) (2,820) 5,108 (25,671) 17,048 (16,736) 10,864 39 (20.929) 166 (20,763) (21,826) (10,899) 277 78,527 (72,663) 492 (669) (412) 5,552 (222) 174 22,943 23,117 S (312) 36,937 (39,156) 457 (2,350) (253) (4,677) 2 (553) 23,496 22.943 $ 1921 1,186 43,801 (33,323) 2.862 (2,242) (830) 11,454 (299) 5,648 17,848 23,496 S 2,300 $ 2,837 $ 3,813