Question

i) The PBIT and depreciation expense for Marys Company Ltd for the year ended December 31, 2020 were $220,000 and $35,000 respectively. The company had

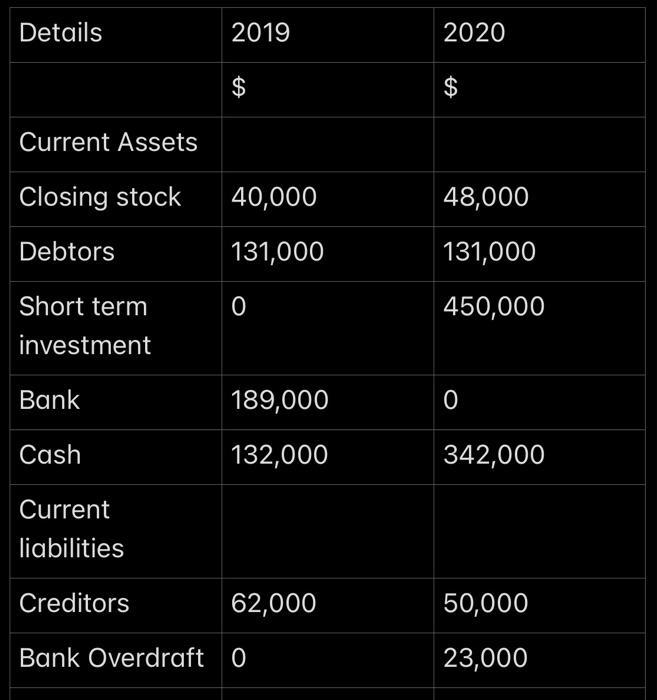

i) The PBIT and depreciation expense for Mary’s Company Ltd for the year ended December 31, 2020 were $220,000 and $35,000 respectively. The company had also reported the following information in their statement of financial position

extract as at December 31, 2019 and 2020:

If Harry's Company net cash flow from investing activities is $210,000 and its net cash flow from financing activities is $103,000, how much is their net increase or decrease in cash and cash equivalents?

ii)

The management team at Jane's Company Ltd has provided you with the following information related to

transactions which took place during 2020:

• Issued $50,000 of ordinary shares and received $80,000 cash

• Repaid long term borrowings of $22,000 • Declared and paid cash dividend of $7,000

• Sold a long term investment instrument for $6,000

• Purchased some long term investment instruments for

$10,000

How much is the net cash flow from financing activities?

Details 2019 Short term investment $ Current Assets Closing stock 40,000 Debtors 131,000 0 Bank Cash Current liabilities Creditors Bank Overdraft 0 189,000 132,000 62,000 2020 48,000 131,000 450,000 0 342,000 50,000 23,000

Step by Step Solution

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

If Harry s Company net cash flow from investing activities is 210 000 and its net cash flow from fin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635dee09d8fe5_180063.pdf

180 KBs PDF File

635dee09d8fe5_180063.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started