Answered step by step

Verified Expert Solution

Question

1 Approved Answer

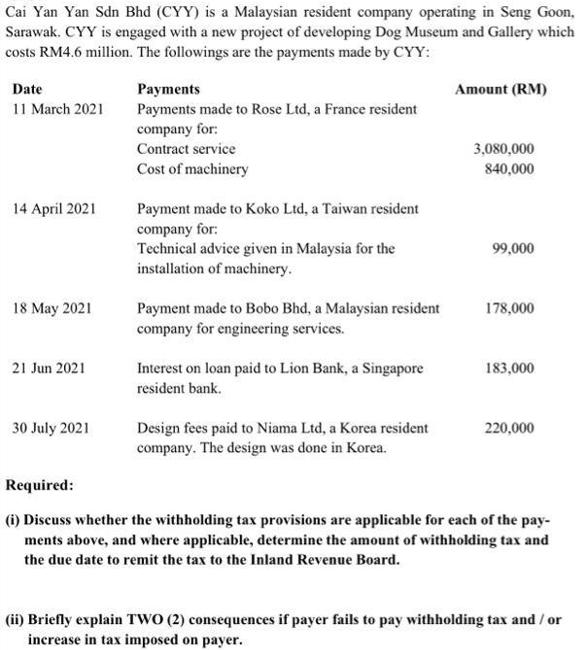

Cai Yan Yan Sdn Bhd (CYY) is a Malaysian resident company operating in Seng Goon, Sarawak. CYY is engaged with a new project of

Cai Yan Yan Sdn Bhd (CYY) is a Malaysian resident company operating in Seng Goon, Sarawak. CYY is engaged with a new project of developing Dog Museum and Gallery which costs RM4.6 million. The followings are the payments made by CYY: Date 11 March 2021 14 April 2021 18 May 2021 21 Jun 2021 30 July 2021 Payments Payments made to Rose Ltd, a France resident company for: Contract service Cost of machinery Payment made to Koko Ltd, a Taiwan resident company for: Technical advice given in Malaysia for the installation of machinery. Payment made to Bobo Bhd, a Malaysian resident company for engineering services. Interest on loan paid to Lion Bank, a Singapore resident bank. Design fees paid to Niama Ltd, a Korea resident company. The design was done in Korea. Amount (RM) 3,080,000 840,000 99,000 178,000 183,000 220,000 Required: (i) Discuss whether the withholding tax provisions are applicable for each of the pay- ments above, and where applicable, determine the amount of withholding tax and the due date to remit the tax to the Inland Revenue Board. (ii) Briefly explain TWO (2) consequences if payer fails to pay withholding tax and / or increase in tax imposed on payer.

Step by Step Solution

★★★★★

3.58 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

i Withholding tax provisions are applicable to certain types of payments made by a Malaysian resident company to nonresident companies or individuals ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started