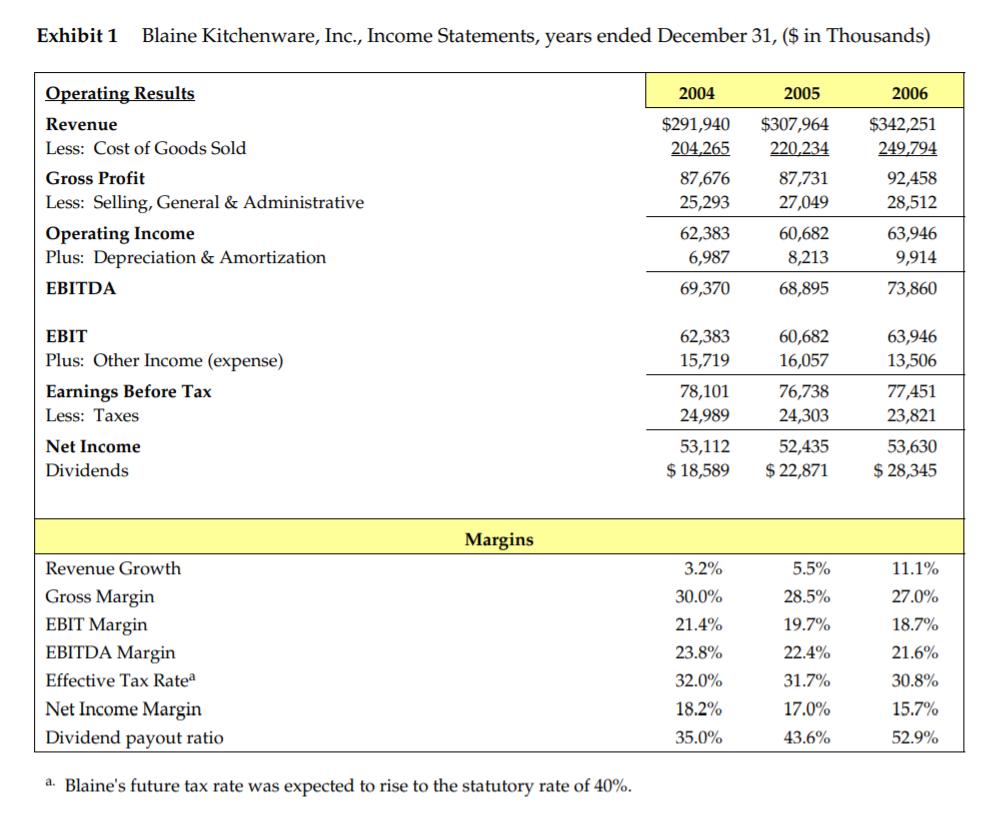

Exhibit 1 Blaine Kitchenware, Inc., Income Statements, years ended December 31, ($ in Thousands) Operating Results 2004 2005 2006 $291,940 $307,964 220,234 $342,251 249,794

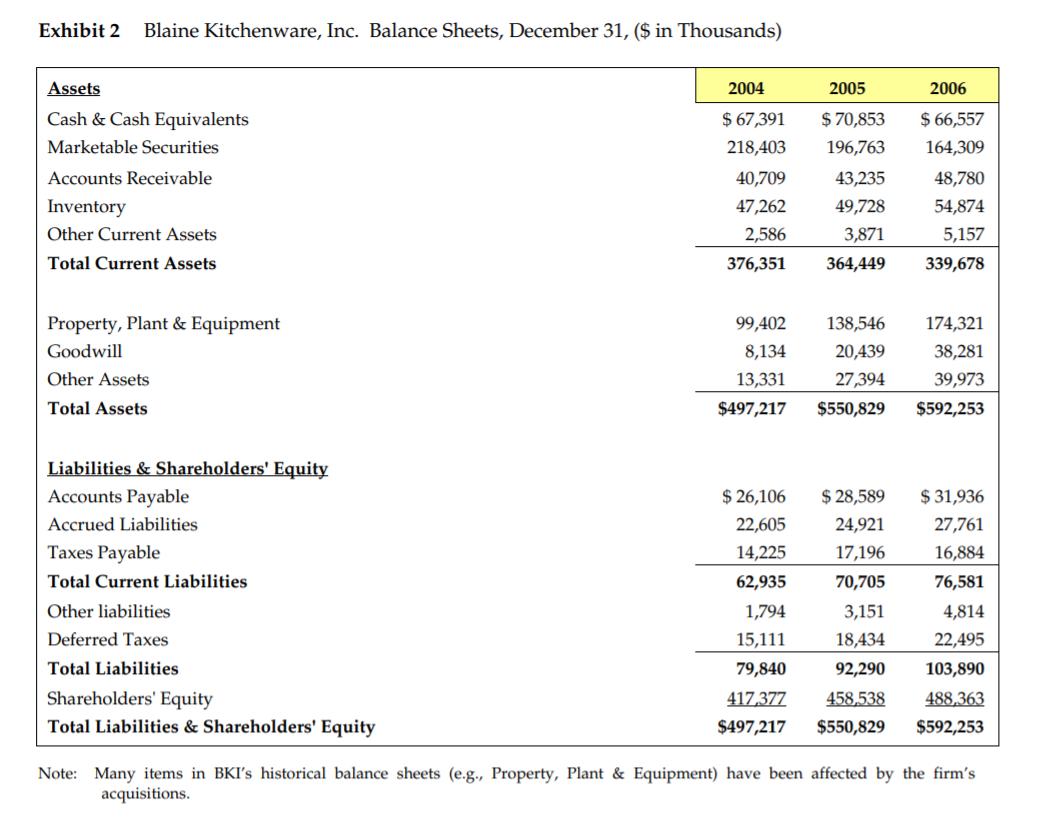

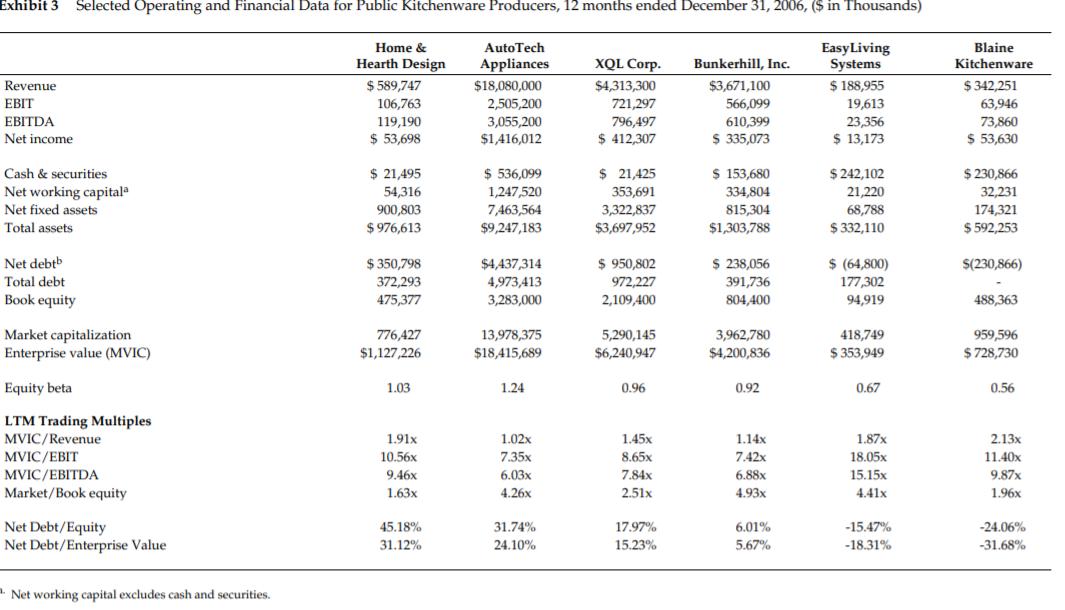

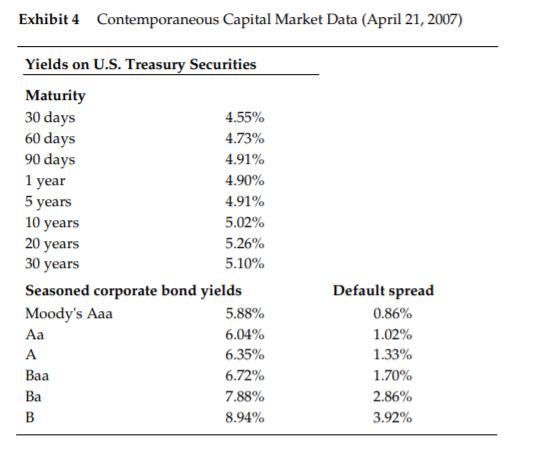

Exhibit 1 Blaine Kitchenware, Inc., Income Statements, years ended December 31, ($ in Thousands) Operating Results 2004 2005 2006 $291,940 $307,964 220,234 $342,251 249,794 Revenue Less: Cost of Goods Sold 204,265 87,676 25,293 Gross Profit 92,458 87,731 27,049 Less: Selling, General & Administrative 28,512 Operating Income Plus: Depreciation & Amortization 62,383 60,682 8,213 63,946 6,987 9,914 EBITDA 69,370 68,895 73,860 EBIT 60,682 16,057 62,383 63,946 Plus: Other Income (expense) 15,719 13,506 Earnings Before Tax 78,101 24,989 76,738 77,451 Less: Taxes 24,303 23,821 53,112 $ 18,589 Net Income 52,435 53,630 Dividends $ 22,871 $ 28,345 Margins Revenue Growth 3.2% 5.5% 11.1% Gross Margin 30.0% 28.5% 27.0% EBIT Margin 21.4% 19.7% 18.7% EBITDA Margin 23.8% 22.4% 21.6% Effective Tax Ratea 32.0% 31.7% 30.8% Net Income Margin 18.2% 17.0% 15.7% Dividend payout ratio 35.0% 43.6% 52.9% a. Blaine's future tax rate was expected to rise to the statutory rate of 40%. Exhibit 2 Blaine Kitchenware, Inc. Balance Sheets, December 31, ($ in Thousands) Assets 2004 2005 2006 Cash & Cash Equivalents $ 67,391 $ 70,853 $ 66,557 Marketable Securities 218,403 196,763 164,309 Accounts Receivable 40,709 43,235 48,780 Inventory 47,262 49,728 54,874 Other Current Assets 2,586 3,871 5,157 Total Current Assets 376,351 364,449 339,678 Property, Plant & Equipment 99,402 138,546 174,321 Goodwill 8,134 20,439 38,281 Other Assets 13,331 27,394 39,973 Total Assets $497,217 $550,829 $592,253 Liabilities & Shareholders' Equity Accounts Payable $ 26,106 $ 28,589 $ 31,936 Accrued Liabilities 22,605 24,921 27,761 Taxes Payable 14,225 17,196 16,884 Total Current Liabilities 62,935 70,705 76,581 Other liabilities 1,794 3,151 4,814 Deferred Taxes 15,111 18,434 22,495 Total Liabilities 79,840 92,290 103,890 Shareholders' Equity 417,377 458,538 488,363 Total Liabilities & Shareholders' Equity $497,217 $550,829 $592,253 Note: Many items in BKI's historical balance sheets (e.g., Property, Plant & Equipment) have been affected by the firm's acquisitions. Exhibit 3 Selected Operating and Financial Data for Public Kitchenware Producers, 12 months ended December 31, 2006, ($ in Thousands) Home & AutoTech Blaine EasyLiving Systems $ 188,955 Hearth Design Appliances XQL Corp. Bunkerhill, Inc. Kitchenware $ 589,747 $ 342,251 $4,313,300 721,297 796,497 $ 412,307 Revenue $18,080,000 $3,671,100 19,613 63,946 73,860 $ 53,630 EBIT 106,763 2,505,200 566,099 610,399 $ 335,073 EBITDA 119,190 3,055,200 23,356 Net income $ 53,698 $1,416,012 $ 13,173 Cash & securities $ 21,495 $ 536,099 $ 21,425 $ 153,680 $ 242,102 $ 230,866 Net working capitale Net fixed assets Total assets 54,316 900,803 $ 976,613 1,247,520 353,691 334,804 21,220 32,231 7,463,564 $9,247,183 3,322,837 $3,697,952 815,304 $1,303,788 68,788 $ 332,110 174,321 $ 592,253 $ 350,798 372,293 $ (64,800) $ 950,802 972,227 2,109,400 $ 238,056 391,736 804,400 Net debtb $4,437,314 S(230,866) 4,973,413 3,283,000 177,302 94,919 Total debt Book equity 475,377 488,363 Market capitalization Enterprise value (MVIC) 5,290,145 $6,240,947 776,427 13,978,375 3,962,780 959,596 $ 728,730 418,749 $1,127,226 $18,415,689 $4,200,836 $ 353,949 $4 Equity beta 1.03 1.24 0.96 0.92 0.67 0.56 LTM Trading Multiples MVIC/Revenue MVIC/EBIT MVIC/EBITDA Market/Book equity 1.91x 1.02x 1.45x 1.14x 1.87x 2.13x 10.56x 7.35x 8.65x 7.42x 18.05x 11.40x 9.46x 6.03x 7.84x 6.88x 15.15x 9.87x 1.63x 4.26x 2.51x 4.93x 4.41x 1.96x Net Debt/Equity Net Debt/Enterprise Value 45.18% 31.74% 17.97% 6.01% -15.47% -24.06% 31.12% 24.10% 15.23% 5.67% -18.31% -31.68% Net working capital excludes cash and securities. Exhibit 4 Contemporaneous Capital Market Data (April 21, 2007) Yields on U.S. Treasury Securities Maturity 30 days 60 days 90 days 1 year 5 years 10 years 20 years 30 years 4.55% 4.73% 4.91% 4.90% 4.91% 5.02% 5.26% 5.10% Seasoned corporate bond yields Default spread Moody's Aaa 5.88% 0.86% Aa 6.04% 1.02% 6.35% 1.33% Baa 6.72% 1.70% Ba 7.88% 2.86% B 8.94% 3.92% BLAINE KITCHENWARE 1. Evaluate the financial performance of Blaine Kitchen Ware over the period 2004.2005 and 2006 using financial ratios and commonsize analysis. 2. Calculate Blaine Kitchenware's Free cash flow, equity cash flow and capital cash flow for 2004,2005 and 2006. 3. Estimate Blaine Kitchenware's WACC in 2006, assuming an equity risk premium of 7.0% 4. Critically evaluate Blaine Kitchenware's current capital structure and dividend policy. 5. Analyze the impact of the proposed restructuring on Blaine's 2006 financial ratios, free cash flow, equity cash flow and wacc. (prepare the 2006 statements as if the restructuring was in place and analyze the impact. 6. Assuming a constant long term growth rate of 3%, estimate Blaine's share price in 2006 and after the proposed restructuring.

Step by Step Solution

3.39 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started