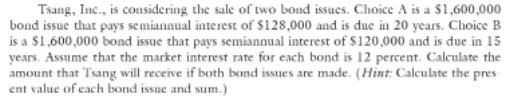

Tsang, Inc., is considering the sale of two bond issues. Choice A is a $1,600,000 bond issue that pays semiannual interest of $128,000 and

Tsang, Inc., is considering the sale of two bond issues. Choice A is a $1,600,000 bond issue that pays semiannual interest of $128,000 and is due in 20 years. Choice B is a $1,600,000 bond issue that pays semiannual interest of $120,000 and is due in 15 years. Assume that the market interest rate for each bond is 12 percent. Calculate the amount that Tsang will receive if both bond issues are made. (Hint: Calculate the pres ent value of each bond issue and sum.)

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Determine the present ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started