Answered step by step

Verified Expert Solution

Question

1 Approved Answer

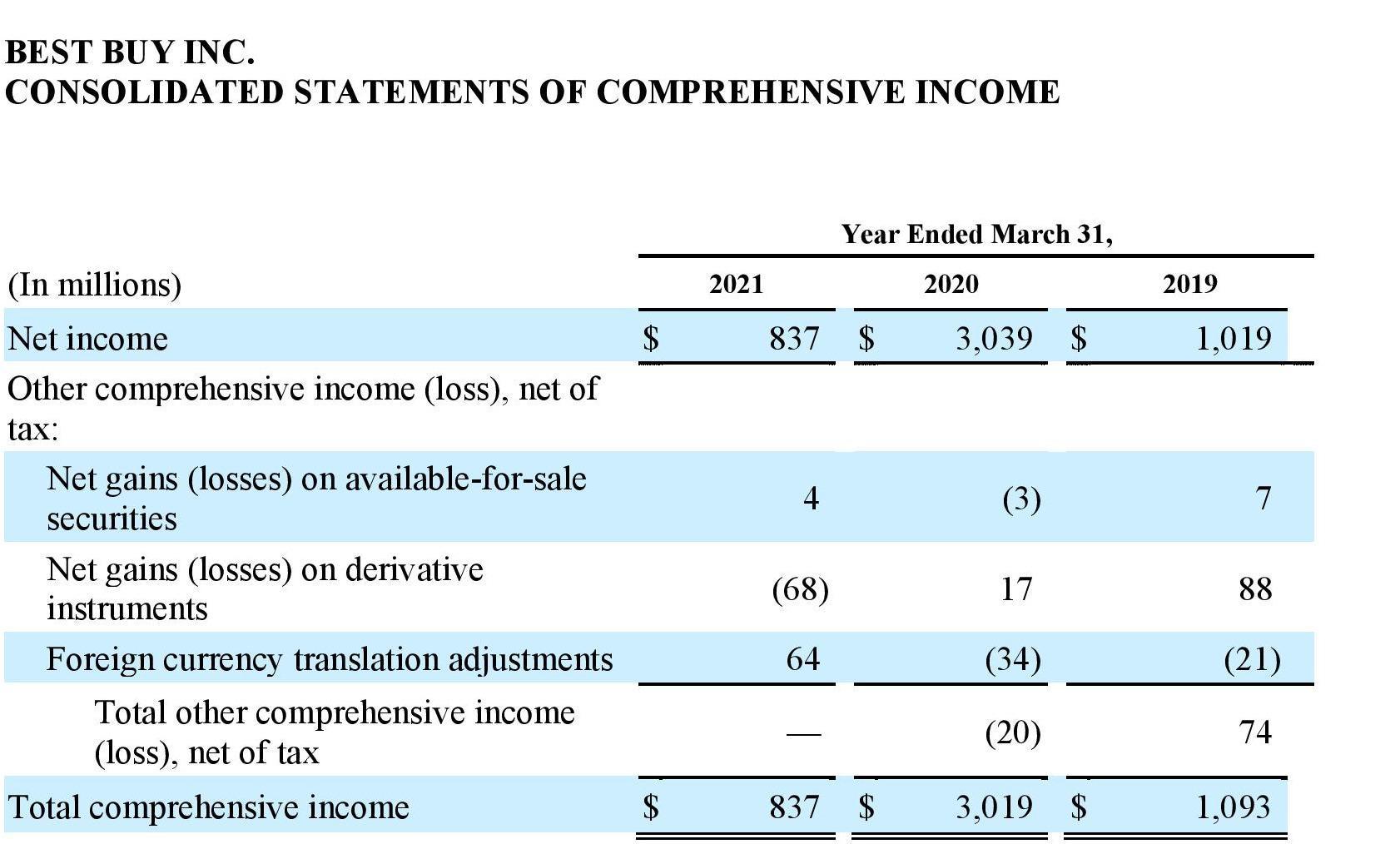

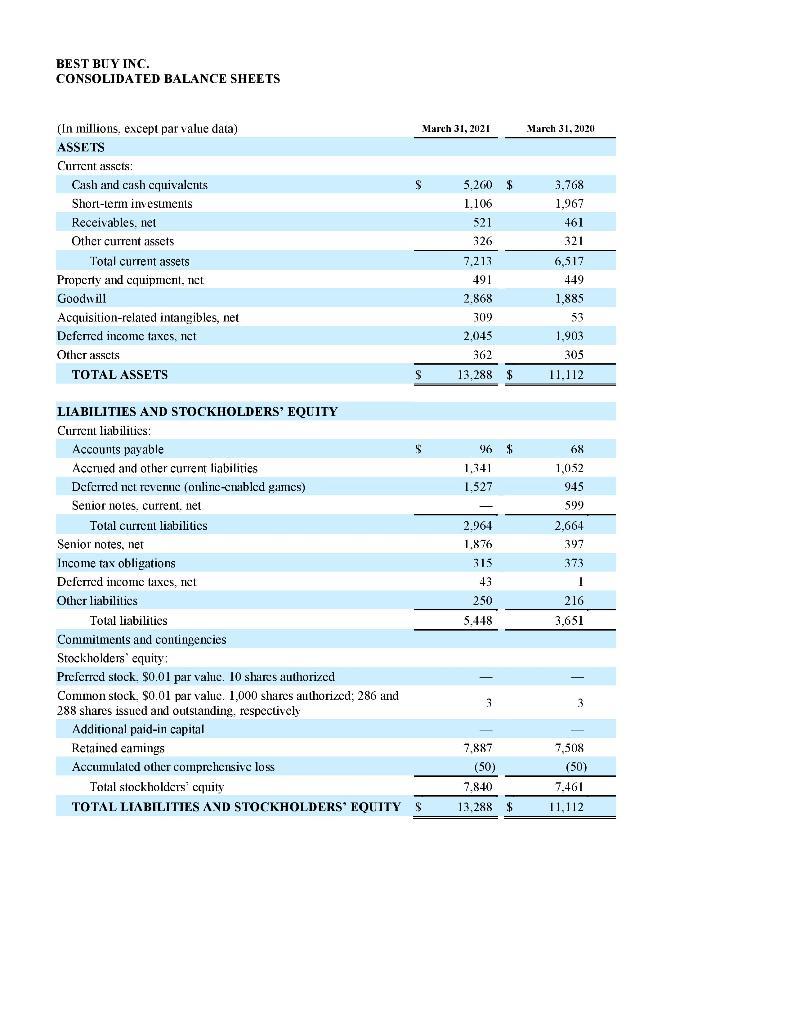

Calculate the following financial ratios based upon the companys financial information provided: Calculate the following ratios for 2020: Quick Ratio, Current Ratio, RNOA, RNOE, NOPAT,

Calculate the following financial ratios based upon the company’s financial information provided:

- Calculate the following ratios for 2020: Quick Ratio, Current Ratio, RNOA, RNOE, NOPAT, WACC, CAPM and Debt to EBITDA. (Show all calculations.)

- For CAPM, please use 3.651 billion in total debt for 2019, and 5.448 billion in total debt in 2020, with a fiscal 2020 interest expense of $63 million, and a statutory tax rate of 37% with an estimated market beta of 0.70 and an expected risk-free rate of 2.5% and the expected market premium of 4%.

BEST BUY INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Net income Other comprehensive income (loss), net of tax: Net gains (losses) on available-for-sale securities Net gains (losses) on derivative instruments Foreign currency translation adjustments Total other comprehensive income (loss), net of tax Total comprehensive income $ 2021 837 $ 4 (68) 64 Year Ended March 31, 2020 837 3,039 $ (3) 17 (34) (20) 3,019 2019 1,019 7 88 (21) 74 1,093

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Quick Ratio The Quick Ratio also known as the Acid Test is a measure of a companys ability to meet its shortterm obligations with its most liquid assets It is calculated by dividing a companys liquid ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started