Answered step by step

Verified Expert Solution

Question

1 Approved Answer

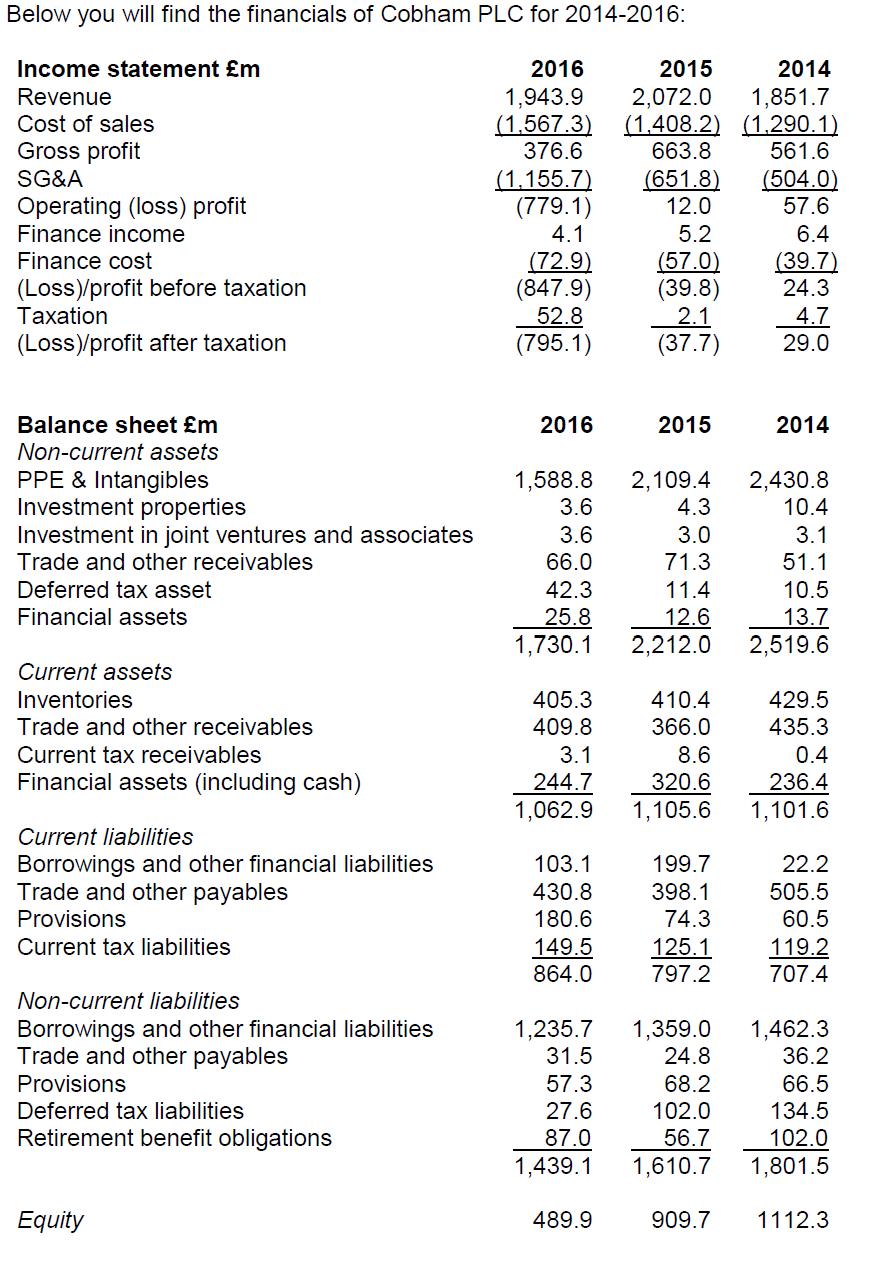

Calculate the following ratios for 2016 and 2015 with showing detailed calculations. a. ROE b. Gross profit margin c. Total asset turnover d. Inventory turnover

Calculate the following ratios for 2016 and 2015 with showing detailed calculations.

a. ROE

b. Gross profit margin

c. Total asset turnover

d. Inventory turnover

e. Current ratio

f. Debt-to-equity

g. Interest coverage ratio

a. ROE

b. Gross profit margin

c. Total asset turnover

d. Inventory turnover

e. Current ratio

f. Debt-to-equity

g. Interest coverage ratio

Below you will find the financials of Cobham PLC for 2014-2016: Income statement m Revenue Cost of sales Gross profit SG&A Operating (loss) profit Finance income Finance cost (Loss)/profit before taxation Taxation (Loss)/profit after taxation Balance sheet m Non-current assets PPE & Intangibles Investment properties Investment in joint ventures and associates Trade and other receivables Deferred tax asset Financial assets Current assets Inventories Trade and other receivables Current tax receivables Financial assets (including cash) Current liabilities Borrowings and other financial liabilities Trade and other payables Provisions Current tax liabilities Non-current liabilities Borrowings and other financial liabilities Trade and other payables Provisions Deferred tax liabilities Retirement benefit obligations Equity 2016 2015 2014 1,943.9 2,072.0 1,851.7 (1,567.3) (1.408.2) (1,290.1) 376.6 663.8 561.6 (651.8) 12.0 5.2 (57.0) (39.8) 2.1 (37.7) (1.155.7) (779.1) 4.1 (72.9) (847.9) 52.8 (795.1) 2016 1,588.8 3.6 3.6 66.0 42.3 25.8 1,730.1 405.3 409.8 3.1 244.7 1,062.9 103.1 430.8 180.6 149.5 864.0 1,235.7 31.5 57.3 27.6 87.0 1,439.1 489.9 2015 2,109.4 4.3 3.0 71.3 11.4 12.6 2,212.0 410.4 366.0 8.6 320.6 1,105.6 199.7 398.1 74.3 125.1 797.2 1,359.0 24.8 68.2 102.0 56.7 1,610.7 909.7 (504.0) 57.6 6.4 (39.7) 24.3 4.7 29.0 2014 2,430.8 10.4 3.1 51.1 10.5 13.7 2,519.6 429.5 435.3 0.4 236.4 1,101.6 22.2 505.5 60.5 119.2 707.4 1,462.3 36.2 66.5 134.5 102.0 1,801.5 1112.3

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started