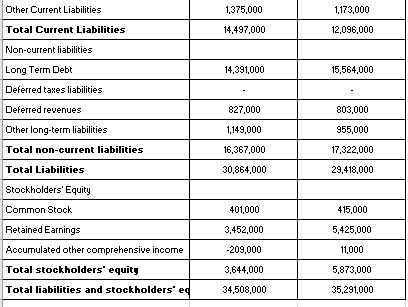

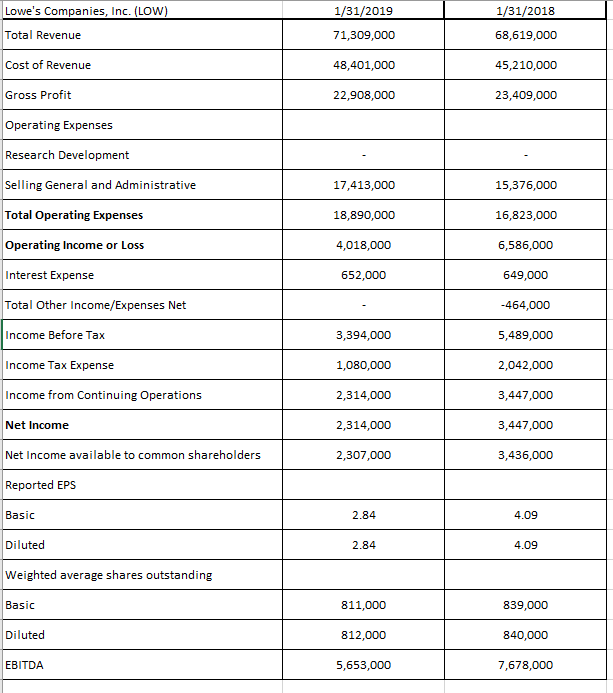

Calculate the following using the balance sheet and income statement: 1.) Gross Profit Percentage 2.) Operating Income Percentage 3.) Rate of Return on Net Sales 4.) Rate of Return on Total Assets 5.) Rate of Return on Common Stock 6.) Earnings Per Share of Common Stock 7.) Price/Earnings Ratio 8.) Dividend Yield 9.) Book Value Per Share of Common Stock 10.) Days' Sales in Receivables Ratio 11.) Accounts Receivable Turnover Ratio

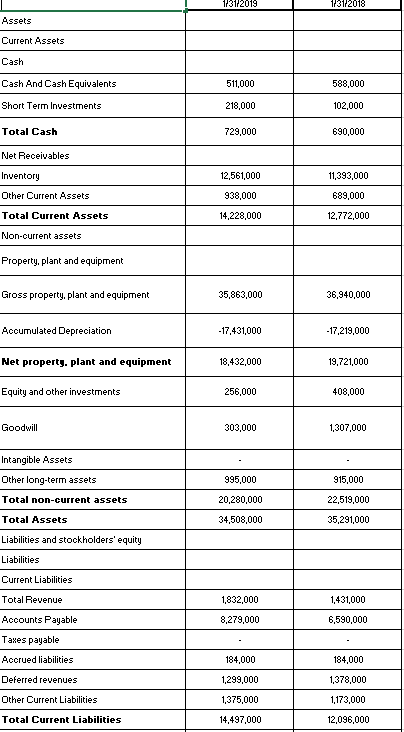

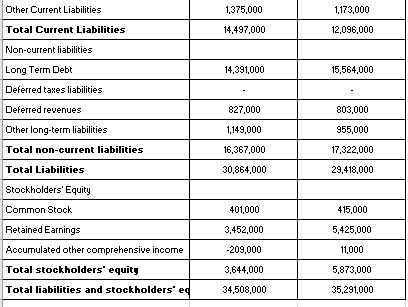

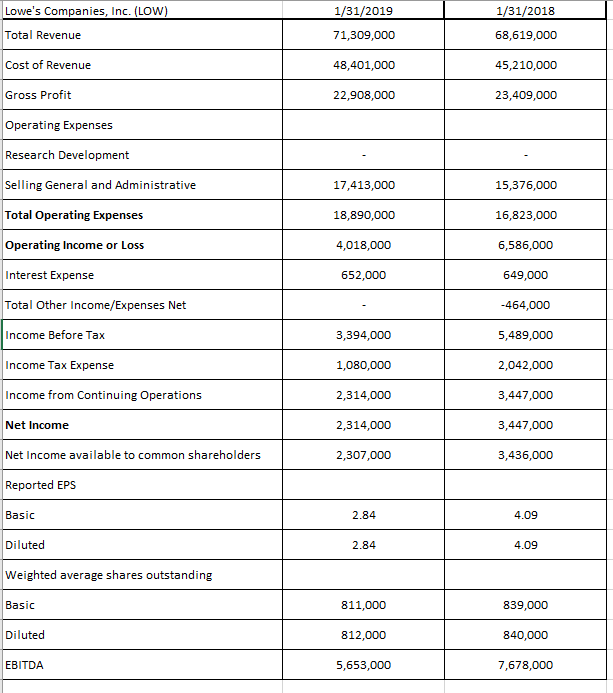

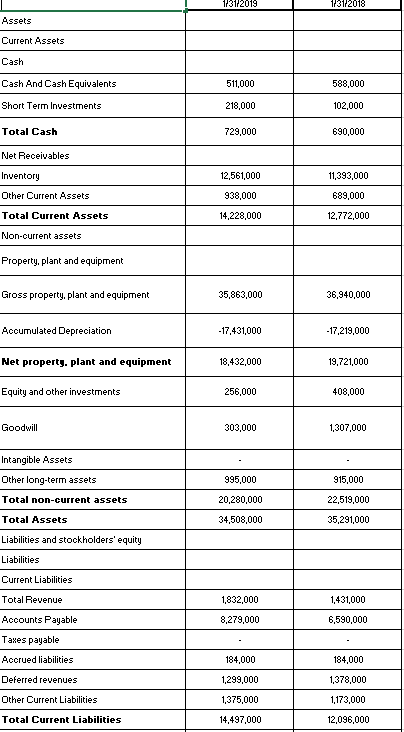

1131/2019 1/31/2018 Assets Current Assets Cash Cash And Cash Equivalents 588,000 511,000 Short Term Investments 218,000 102,000 Total Cash 729,000 690,000 Net Receivables Inventory 12,561,000 11,393,000 Other Current Assets 938,000 689,000 Total Current Assets 14,228,000 12,772,000 Non-current assets Property, plant and equipment Gross property, plant and equipment 35,863,000 36,940,000 Accumulated Depreciation -17,431,000 -17,219,000 Net property. plant and equipment 18,432,000 19,721,000 Equity and other investments 256,000 408,000 303,000 Goodwill 1,307,000 Intangible Assets Other long-term assets 995,000 915,000 Total non-current assets 20,280,000 22,519,000 34,508,000 Total Assets 35,291,000 Liabilities and stookholders' equity Liabilities Current Liabilities Total Revenue 1,832,000 1,431,000 Accounts Payable 6,590,000 8,279,000 es payable Accrued liabilities 184,000 184,000 Deferred revenues 1,299,000 1,378,000 Other Current Liabilities 1,375,000 1,173,000 14,497,000 Total Current Liabilities 12,096,000 Other Current Liabilities 1,375,000 1,173,000 Total Current Liabilities 14,497,000 12,096,000 Non-current liabilities Long Term Debt 14,391,000 15,564,000 Deferred taxes liabilities Deferred revenues 827,000 803,000 Other long-term liabilities 1,149,000 955,000 Total non-current liabilities 16,367,000 17,322,000 Total Liabilities 30,864,000 29,418,000 Stockholders' Equity Common Stock 401,000 415,000 Retained Earnings 3,452,000 5,425,000 Accumulated other comprehensive income -209,000 11,000 Total stockholders' equity 3,644,000 5,873,000 Total liabilities and stockholders' eq 34,508,000 35,291,000 Lowe's Companies, Inc. (LOW) 1/31/2019 1/31/2018 Total Revenue 71,309,000 68,619,000 Cost of Revenue 48,401,000 45,210,000 Gross Profit 22,908,000 23,409,000 Operating Expenses Research Development Selling General and Administrative 17,413,000 15,376,000 Total Operating Expenses 18,890,000 16,823,000 Operating Income or Loss 6,586,000 4,018,000 Interest Expense 652,000 649,000 Total Other Income/Expenses Net -464,000 5,489,000 Income Before Tax 3,394,000 Income Tax Expense 1,080,000 2,042,000 Income from Continuing Operations 2,314,000 3,447,000 Net Income 2,314,000 3,447,000 Net Income available to common shareholders 2,307,000 3,436,000 Reported EPS Basic 2.84 4.09 Diluted 2.84 4.09 Weighted average shares outstanding Basic 811,000 839,000 Diluted 812,000 840,000 EBITDA 5,653,000 7,678,000 1131/2019 1/31/2018 Assets Current Assets Cash Cash And Cash Equivalents 588,000 511,000 Short Term Investments 218,000 102,000 Total Cash 729,000 690,000 Net Receivables Inventory 12,561,000 11,393,000 Other Current Assets 938,000 689,000 Total Current Assets 14,228,000 12,772,000 Non-current assets Property, plant and equipment Gross property, plant and equipment 35,863,000 36,940,000 Accumulated Depreciation -17,431,000 -17,219,000 Net property. plant and equipment 18,432,000 19,721,000 Equity and other investments 256,000 408,000 303,000 Goodwill 1,307,000 Intangible Assets Other long-term assets 995,000 915,000 Total non-current assets 20,280,000 22,519,000 34,508,000 Total Assets 35,291,000 Liabilities and stookholders' equity Liabilities Current Liabilities Total Revenue 1,832,000 1,431,000 Accounts Payable 6,590,000 8,279,000 es payable Accrued liabilities 184,000 184,000 Deferred revenues 1,299,000 1,378,000 Other Current Liabilities 1,375,000 1,173,000 14,497,000 Total Current Liabilities 12,096,000 Other Current Liabilities 1,375,000 1,173,000 Total Current Liabilities 14,497,000 12,096,000 Non-current liabilities Long Term Debt 14,391,000 15,564,000 Deferred taxes liabilities Deferred revenues 827,000 803,000 Other long-term liabilities 1,149,000 955,000 Total non-current liabilities 16,367,000 17,322,000 Total Liabilities 30,864,000 29,418,000 Stockholders' Equity Common Stock 401,000 415,000 Retained Earnings 3,452,000 5,425,000 Accumulated other comprehensive income -209,000 11,000 Total stockholders' equity 3,644,000 5,873,000 Total liabilities and stockholders' eq 34,508,000 35,291,000 Lowe's Companies, Inc. (LOW) 1/31/2019 1/31/2018 Total Revenue 71,309,000 68,619,000 Cost of Revenue 48,401,000 45,210,000 Gross Profit 22,908,000 23,409,000 Operating Expenses Research Development Selling General and Administrative 17,413,000 15,376,000 Total Operating Expenses 18,890,000 16,823,000 Operating Income or Loss 6,586,000 4,018,000 Interest Expense 652,000 649,000 Total Other Income/Expenses Net -464,000 5,489,000 Income Before Tax 3,394,000 Income Tax Expense 1,080,000 2,042,000 Income from Continuing Operations 2,314,000 3,447,000 Net Income 2,314,000 3,447,000 Net Income available to common shareholders 2,307,000 3,436,000 Reported EPS Basic 2.84 4.09 Diluted 2.84 4.09 Weighted average shares outstanding Basic 811,000 839,000 Diluted 812,000 840,000 EBITDA 5,653,000 7,678,000