Question

Calculate the return on assets ? A company had the following information: Cash Notes Payable Office Furniture Building Accounts Payable Common Stock Accounts Receivable Equipment

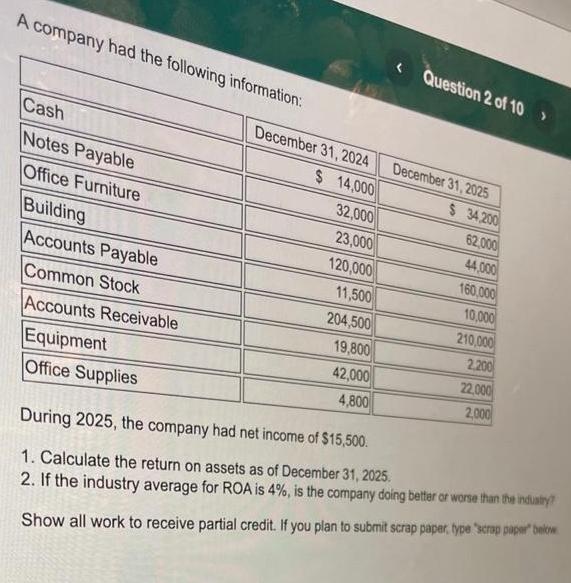

Calculate the return on assets ?

A company had the following information: Cash Notes Payable Office Furniture Building Accounts Payable Common Stock Accounts Receivable Equipment Office Supplies December 31, 2024 $ 14,000 32,000 23,000 120,000 11,500 204,500 19,800 42,000 4,800 Question 2 of 10 > December 31, 2025 $ 34,200 62,000 44,000 160,000 10,000 210,000 2.200 22,000 2,000 During 2025, the company had net income of $15,500. 1. Calculate the return on assets as of December 31, 2025. 2. If the industry average for ROA is 4%, is the company doing better or worse than the industry? Show all work to receive partial credit. If you plan to submit scrap paper, type "scrap paper" below

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Return on assets Return on assets Net Income average of total asset...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: David Spiceland, Wayne Thomas, Don Herrmann

4th edition

1259307956, 978-1259307959

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App