Answered step by step

Verified Expert Solution

Question

1 Approved Answer

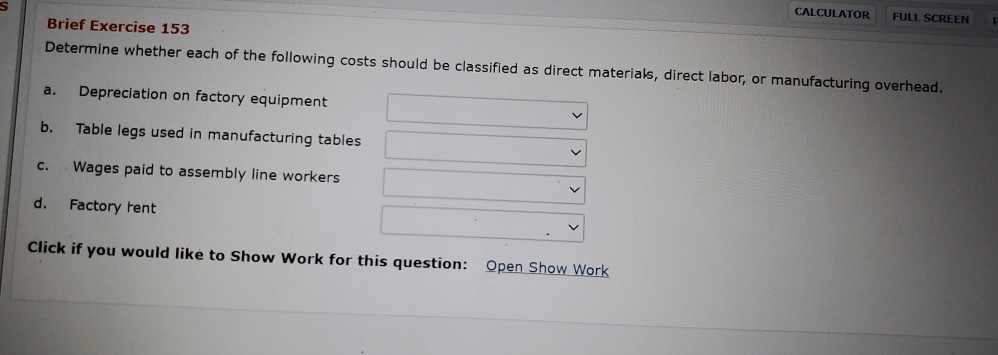

CALCULATOR FULL SCREEN Brief Exercise 153 Determine whether each of the following costs should be classified as direct materials, direct labor, or manufacturing overhead. a.

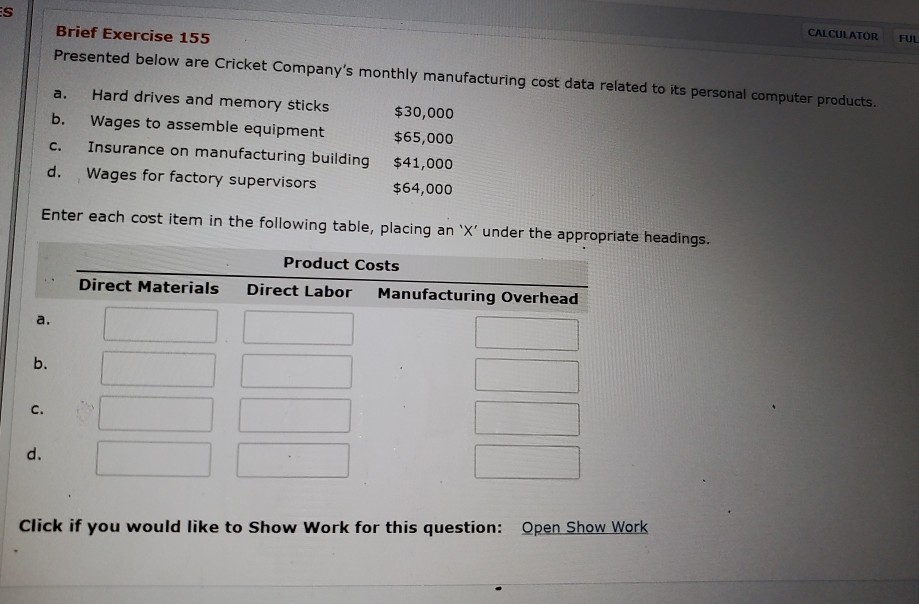

CALCULATOR FULL SCREEN Brief Exercise 153 Determine whether each of the following costs should be classified as direct materials, direct labor, or manufacturing overhead. a. Depreciation on factory equipment b. Table legs used in manufacturing tables C. Wages paid to assembly line workers d. Factory rent Click if you would like to Show Work for this question: Open Show Work ES CALCULATOR FUL Brief Exercise 155 Presented below are Cricket Company's monthly manufacturing cost data related to its personal computer products. a. b. Hard drives and memory sticks Wages to assemble equipment Insurance on manufacturing building Wages for factory supervisors C. $30,000 $65,000 $41,000 $64,000 d. Enter each cost item in the following table, placing an 'X' under the appropriate headings. Direct Materials Product Costs Direct Labor Manufacturing Overhead a. b. C. d. 1 Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started