Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calibri 10 ' ' General X Cut b Copy Format Painter ab Wrap Text Merge & Center BIU a A- Insert Dele g%98 Conditional Format

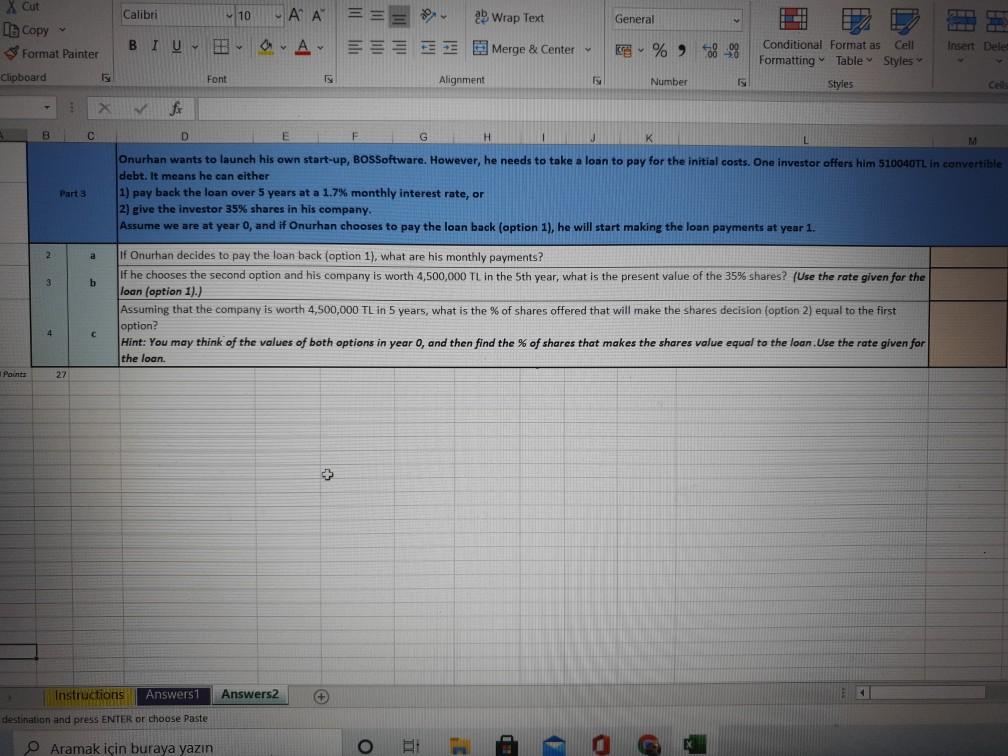

Calibri 10 ' ' General X Cut b Copy Format Painter ab Wrap Text Merge & Center BIU a A- Insert Dele g%98 Conditional Format as Cell Formatting Table Styles Clipboard Font Alignment Number Styles CA fr B D E F G H 1 K L M Part 3 Onurhan wants to launch his own start-up, BOSSoftware. However, he needs to take a loan to pay for the initial costs. One investor offers him 510040TL in convertible debt. It means he can either 1) pay back the loan over 5 years at a 1.7% monthly interest rate, or 2) give the investor 35% shares in his company. Assume we are at year 0, and if Onurhan chooses to pay the loan back (option 1), he will start making the loan payments at year 1. 2 a a 3 b If Onurhan decides to pay the loan back (option 1), what are his monthly payments? If he chooses the second option and his company is worth 4,500,000 TL in the 5th year, what is the present value of the 35% shares? (Use the rate given for the loan (option 1).) Assuming that the company is worth 4,500,000 TL in 5 years, what is the % of shares offered that will make the shares decision (option 2) equal to the first option? Hint: You may think of the values of both options in year 0, and then find the % of shares that makes the shares value equal to the loan. Use the rate given for the loan 4 C Pants 27 Instructions Answers1 Answers + destination and press ENTER or choose Paste Aramak iin buraya yazn

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started