Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Calspect Corporation has annual sales of $37.0 million and all of its sales are credit sales, that is, all sales are made to customers

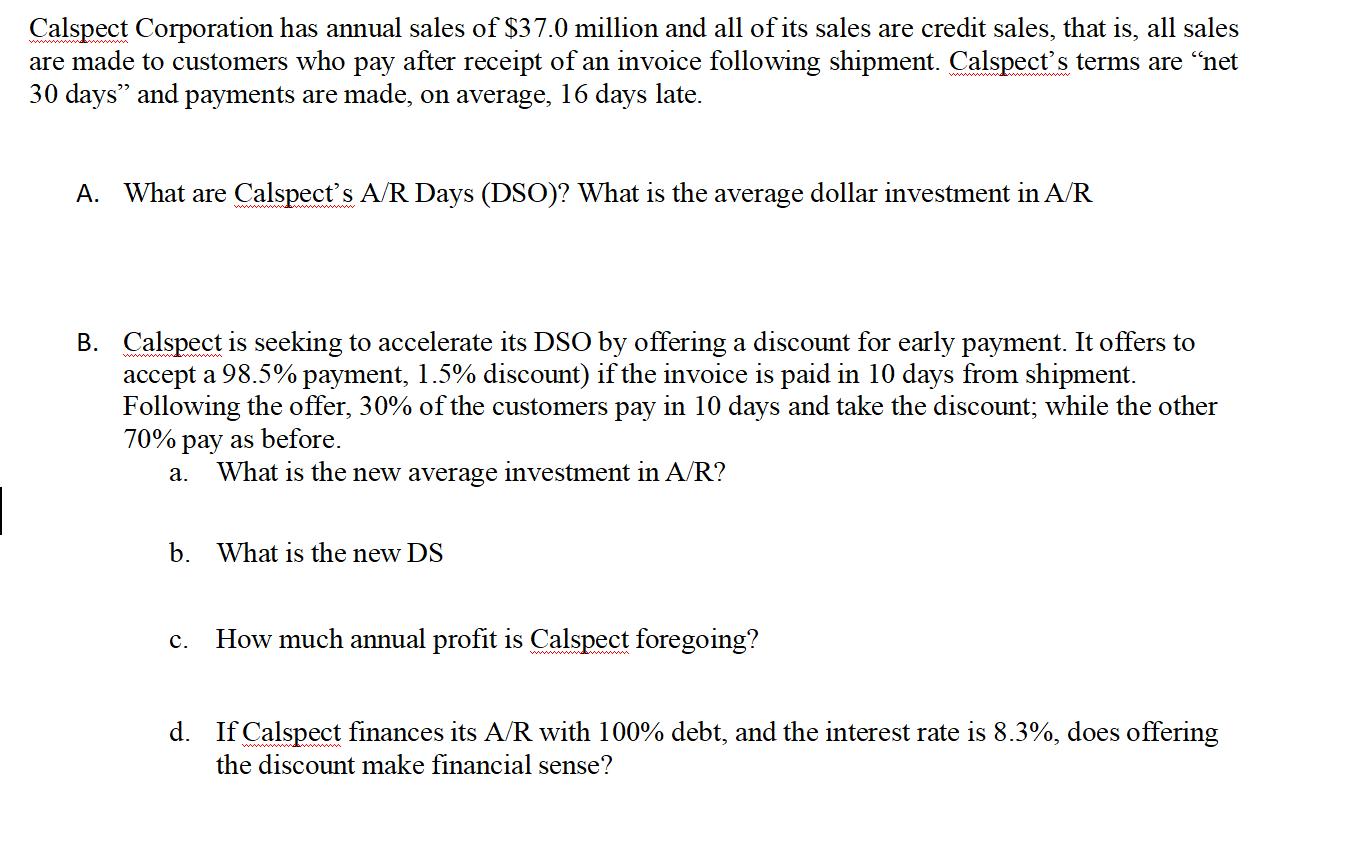

Calspect Corporation has annual sales of $37.0 million and all of its sales are credit sales, that is, all sales are made to customers who pay after receipt of an invoice following shipment. Calspect's terms are "net 30 days" and payments are made, on average, 16 days late. A. What are Calspect's A/R Days (DSO)? What is the average dollar investment in A/R B. Calspect is seeking to accelerate its DSO by offering a discount for early payment. It offers to accept a 98.5% payment, 1.5% discount) if the invoice is paid in 10 days from shipment. Following the offer, 30% of the customers pay in 10 days and take the discount; while the other 70% pay as before. a. What is the new average investment in A/R? b. What is the new DS C. How much annual profit is Calspect foregoing? d. If Calspect finances its A/R with 100% debt, and the interest rate is 8.3%, does offering the discount make financial sense?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A B 1 A Calspects AR Days and Average Dollar Investment in AR 2 3 Annual Cr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started