Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can anyone complete question 5,6 and 7 please answer all three remaining. bbviously Corporation Inc., is considering the sale of Option A $500,000 bond issue.

can anyone complete question 5,6 and 7 please answer all three remaining.

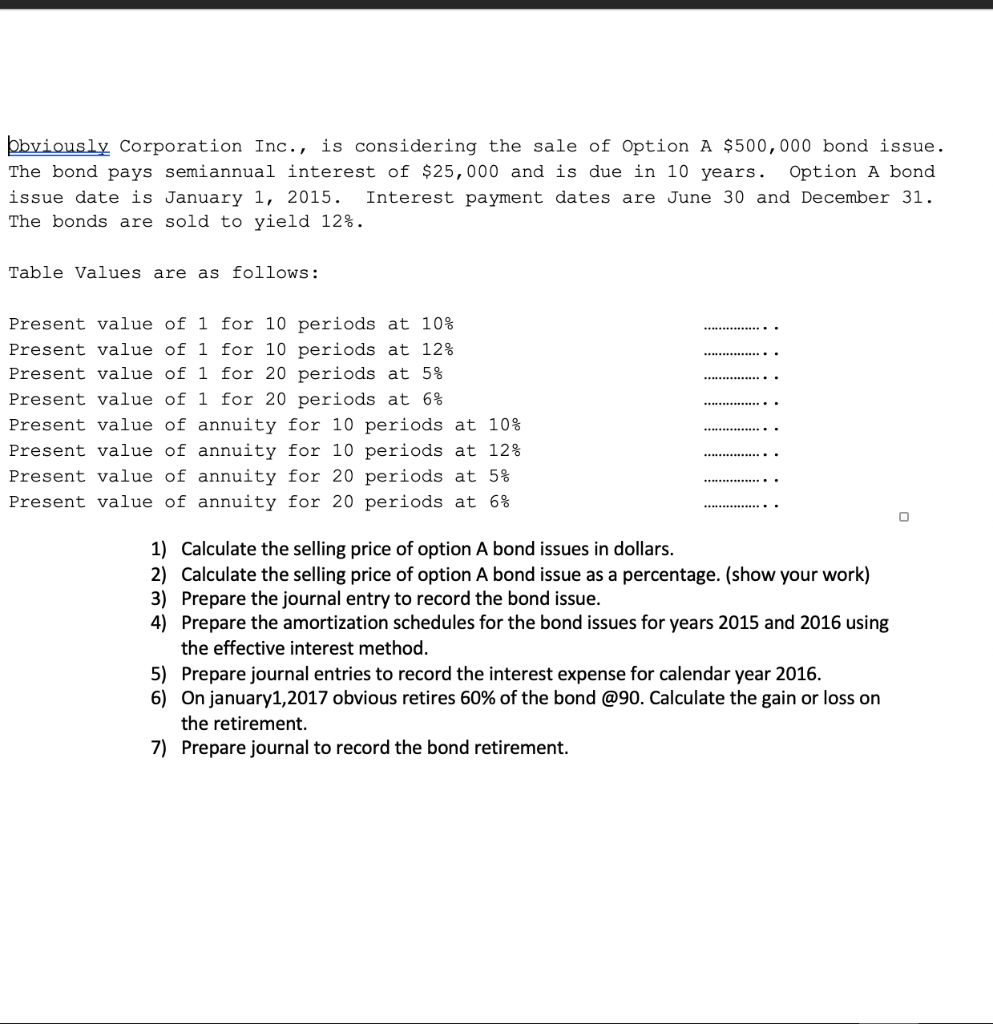

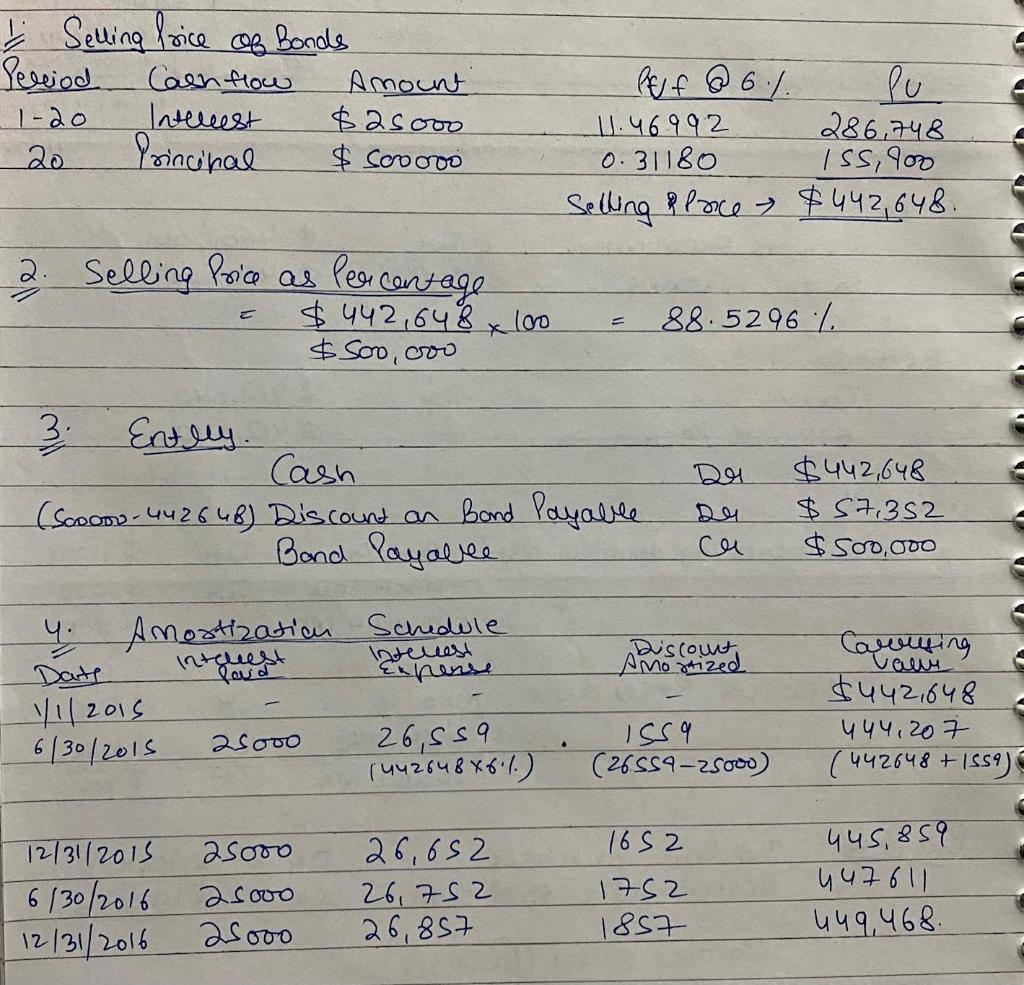

bbviously Corporation Inc., is considering the sale of Option A $500,000 bond issue. The bond pays semiannual interest of $25,000 and is due in 10 years. Option A bond issue date is January 1, 2015. Interest payment dates are June 30 and December 31. The bonds are sold to yield 12%. Table Values are as follows: Present value of 1 for 10 periods at 10% Present value of 1 for 10 periods at 12% Present value of 1 for 20 periods at 5% Present value of 1 for 20 periods at 6% Present value of annuity for 10 periods at 10% Present value of annuity for 10 periods at 12% Present value of annuity for 20 periods at 5% Present value of annuity for 20 periods at 6% 1) Calculate the selling price of option A bond issues in dollars. 2) Calculate the selling price of option A bond issue as a percentage. (show your work) 3) Prepare the journal entry to record the bond issue. 4) Prepare the amortization schedules for the bond issues for years 2015 and 2016 using the effective interest method. 5) Prepare journal entries to record the interest expense for calendar year 2016. 6) On january1,2017 obvious retires 60% of the bond @90. Calculate the gain or loss on the retirement. 7) Prepare journal to record the bond retirement. Selling Price of Bonds Period Cash flow Amount 1 1-20 Interest $25000 20 Principal $ Scoooo Ref @ 6% lu 11.46992 286,748 0.31180 ( ISS, 900 Selling & lace $442,648. 2. Selling Price as Percentage $ 442,648 $Soo, cooo 100 88.5296 % Di 3 Entlly. Cash (Soooo - 442646) Discount on Bond Payable Band Payalee $442,648 $57,352 $ soo,000 ce Ano y Amortization Schedule Date Interest Expense 11/2015 6/30/2015 2 Sooo 26,559 1442648X6"(.) Cawiting Tawe $442,648 444,207 (442648+ +1959) ISS 9 (26559-2500) 445, 859 12/31/2013 6/30/2016 12/31/2016 25000 asovo 28000 26,652 26,752 26,857 1652 1752 1857 447611 449,468Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started