Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone answer this by explanation per each question? Not equation wise. Thanks. Polymerco has the following highly condense income statement, given in the table

Can someone answer this by explanation per each question? Not equation wise. Thanks.

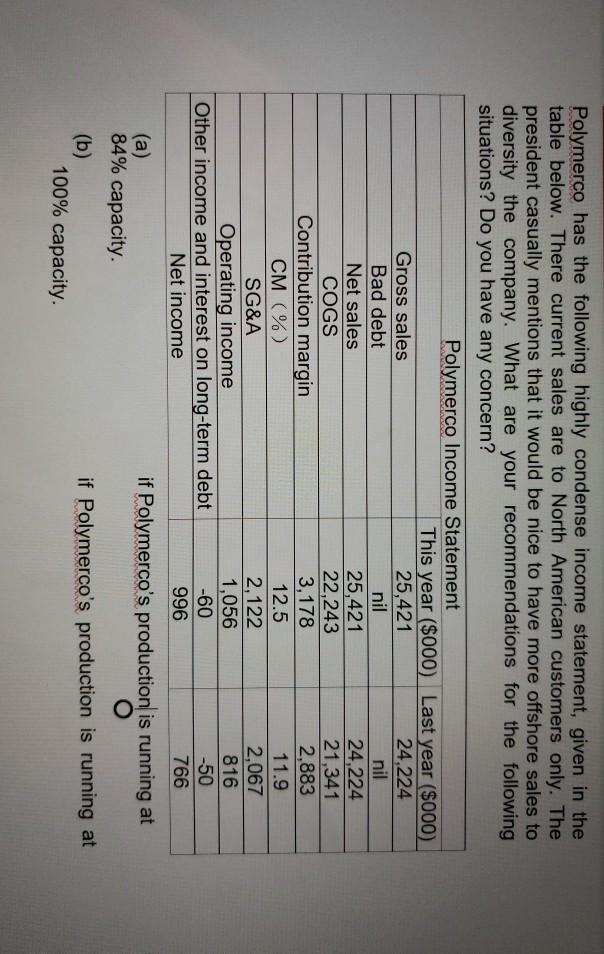

Polymerco has the following highly condense income statement, given in the table below. There current sales are to North American customers only. The president casually mentions that it would be nice to have more offshore sales to diversity the company. What are your recommendations for the following situations? Do you have any concern? Polymerco Income Statement This year ($000) Last year ($000) Gross sales 25,421 24,224 Bad debt nil nil Net sales 25,421 24,224 COGS 22,243 21,341 Contribution margin 3,178 2,883 CM (%) 12.5 11.9 SG&A 2,122 2,067 Operating income 1,056 816 Other income and interest on long-term debt -60 -50 Net income 996 766 if Polymerco's production is running at 84% capacity. (b) if Polymerco's production is running at 100% capacity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started