Answered step by step

Verified Expert Solution

Question

1 Approved Answer

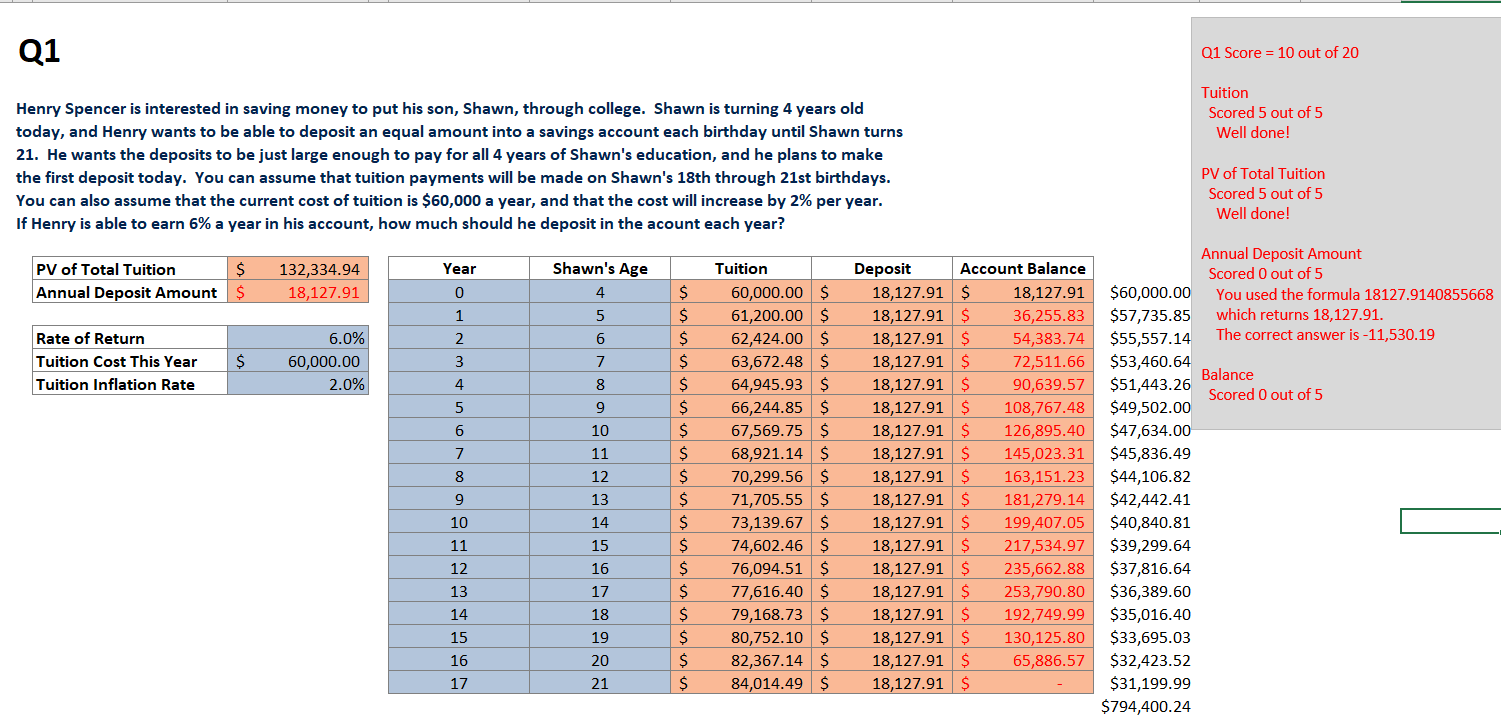

Can someone explain how to find the annual deposit amount listed in the feedback and what formula to use in excel to get it? I

Can someone explain how to find the annual deposit amount listed in the feedback and what formula to use in excel to get it? I do not understand how you would attain that.

Q1 Q1 Score = 10 out of 20 Tuition Scored 5 out of 5 Well done! Henry Spencer is interested in saving money to put his son, Shawn, through college. Shawn is turning 4 years old today, and Henry wants to be able to deposit an equal amount into a savings account each birthday until Shawn turns 21. He wants the deposits to be just large enough to pay for all 4 years of Shawn's education, and he plans to make the first deposit today. You can assume that tuition payments will be made on Shawn's 18th through 21st birthdays. You can also assume that the current cost of tuition is $60,000 a year, and that the cost will increase by 2% per year. If Henry is able to earn 6% a year in his account, how much should he deposit in the acount each year? PV of Total Tuition Scored 5 out of 5 Well done! PV of Total Tuition Annual Deposit Amount $ $ 132,334.94 18,127.91 Year 0 Shawn's Age 4 Annual Deposit Amount Scored 0 out of 5 You used the formula 18127.9140855668 which returns 18,127.91. The correct answer is -11,530.19 1 5 Rate of Return Tuition Cost This Year Tuition Inflation Rate $ 6.0% 60,000.00 2.0% 6 7 2 3 4 5 8 Balance Scored 0 out of 5 9 6 10 11 7 8 9 12 13 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Tuition 60,000.00 $ 61,200.00 $ 62,424.00 $ 63,672.48 $ 64,945.93 $ 66,244.85 $ 67,569.75 $ 68,921.14 $ 70,299.56 $ 71,705.55 $ 73,139.67 $ 74,602.46 $ 76,094.51 $ 77,616.40 $ 79,168.73 $ 80,752.10 $ 82,367.14 $ 84,014.49 $ Deposit Account Balance 18,127.91 $ 18,127.91 $60,000.00 18,127.91 $ 36,255.83 $57,735.85 18,127.91 $ 54,383.74 $55,557.14 18,127.91 $ 72,511.66 $53,460.64 18,127.91 $ 90,639.57 $51,443.26 18,127.91 $ 108,767.48 $49,502.00 18,127.91 $ 126,895.40 $47,634.00 18,127.91 $ 145,023.31 $45,836.49 18,127.91 $ 163,151.23 $44,106.82 18,127.91 $ 181,279.14 $42,442.41 18,127.91 $ 199,407.05 $40,840.81 18,127.91 $ 217,534.97 $39,299.64 18,127.91 $ 235,662.88 $37,816.64 18,127.91 $ 253,790.80 $36,389.60 18,127.91 $ 192,749.99 $35,016.40 18,127.91 $ 130,125.80 $33,695.03 18,127.91 $ 65,886.57 $32,423.52 18,127.91 $ $31,199.99 $794,400.24 10 14 11 15 16 12 13 17 14 18 19 15 16 17 20 21 Q1 Q1 Score = 10 out of 20 Tuition Scored 5 out of 5 Well done! Henry Spencer is interested in saving money to put his son, Shawn, through college. Shawn is turning 4 years old today, and Henry wants to be able to deposit an equal amount into a savings account each birthday until Shawn turns 21. He wants the deposits to be just large enough to pay for all 4 years of Shawn's education, and he plans to make the first deposit today. You can assume that tuition payments will be made on Shawn's 18th through 21st birthdays. You can also assume that the current cost of tuition is $60,000 a year, and that the cost will increase by 2% per year. If Henry is able to earn 6% a year in his account, how much should he deposit in the acount each year? PV of Total Tuition Scored 5 out of 5 Well done! PV of Total Tuition Annual Deposit Amount $ $ 132,334.94 18,127.91 Year 0 Shawn's Age 4 Annual Deposit Amount Scored 0 out of 5 You used the formula 18127.9140855668 which returns 18,127.91. The correct answer is -11,530.19 1 5 Rate of Return Tuition Cost This Year Tuition Inflation Rate $ 6.0% 60,000.00 2.0% 6 7 2 3 4 5 8 Balance Scored 0 out of 5 9 6 10 11 7 8 9 12 13 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Tuition 60,000.00 $ 61,200.00 $ 62,424.00 $ 63,672.48 $ 64,945.93 $ 66,244.85 $ 67,569.75 $ 68,921.14 $ 70,299.56 $ 71,705.55 $ 73,139.67 $ 74,602.46 $ 76,094.51 $ 77,616.40 $ 79,168.73 $ 80,752.10 $ 82,367.14 $ 84,014.49 $ Deposit Account Balance 18,127.91 $ 18,127.91 $60,000.00 18,127.91 $ 36,255.83 $57,735.85 18,127.91 $ 54,383.74 $55,557.14 18,127.91 $ 72,511.66 $53,460.64 18,127.91 $ 90,639.57 $51,443.26 18,127.91 $ 108,767.48 $49,502.00 18,127.91 $ 126,895.40 $47,634.00 18,127.91 $ 145,023.31 $45,836.49 18,127.91 $ 163,151.23 $44,106.82 18,127.91 $ 181,279.14 $42,442.41 18,127.91 $ 199,407.05 $40,840.81 18,127.91 $ 217,534.97 $39,299.64 18,127.91 $ 235,662.88 $37,816.64 18,127.91 $ 253,790.80 $36,389.60 18,127.91 $ 192,749.99 $35,016.40 18,127.91 $ 130,125.80 $33,695.03 18,127.91 $ 65,886.57 $32,423.52 18,127.91 $ $31,199.99 $794,400.24 10 14 11 15 16 12 13 17 14 18 19 15 16 17 20 21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started