can someone give me the answer to 4-12 in full detail with work thank you

thank you

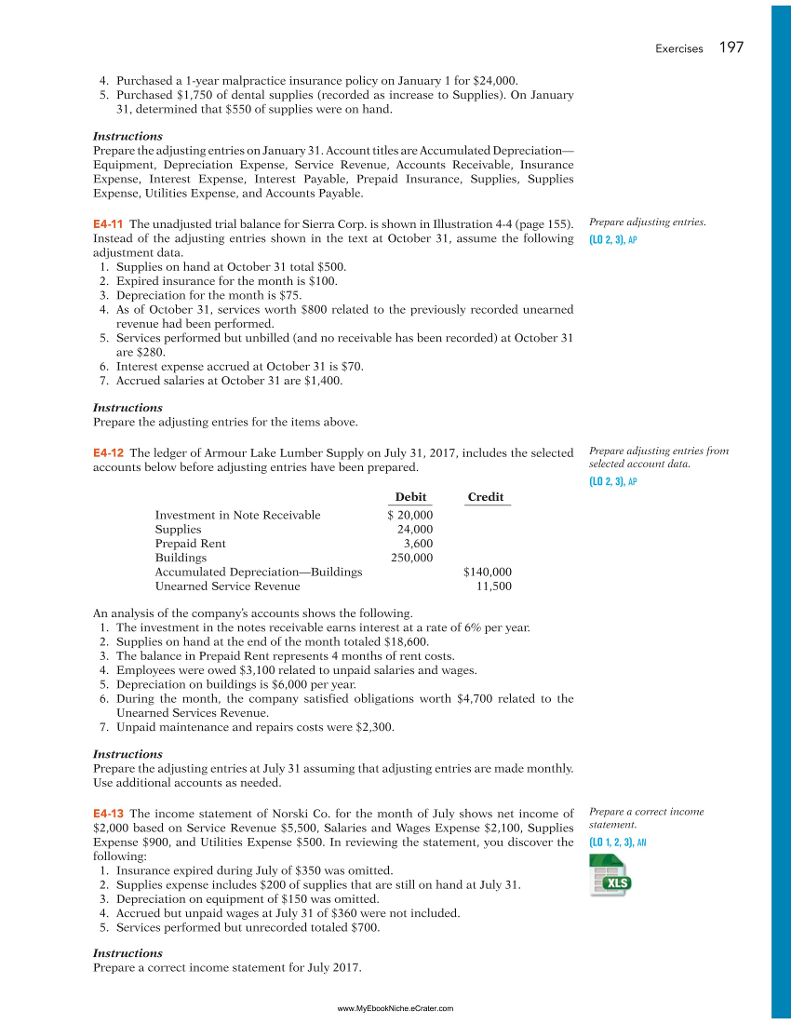

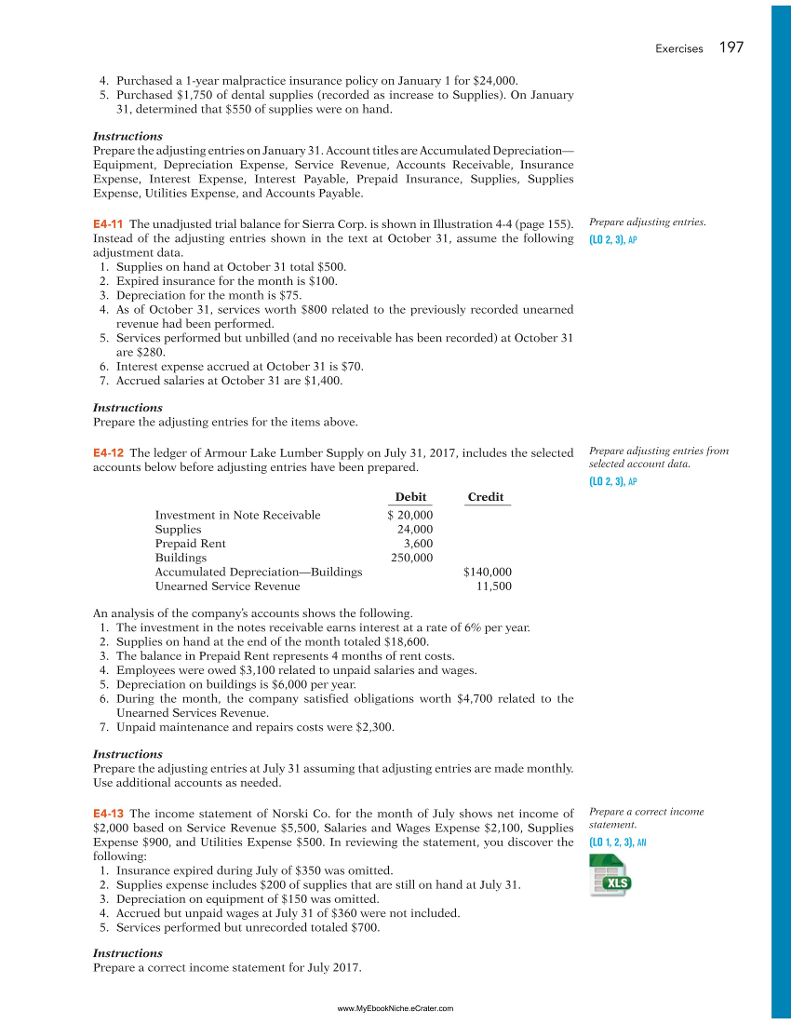

Purchased a 1-year malpractice insurance policy on January 1 for $24,000. Purchased $1, 750 of dental supplies (recorded as increase to Supplies). On January 31, determined that $550 of supplies were on hand. Prepare the adjusting entries on January 31. Account titles are Accumulated Depreciation-Equipment, Depreciation Expense. Service Revenue, Accounts Receivable, Insurance Expense. Interest Expense, Interest Payable, Prepaid Insurance, Supplies. Supplies Expense, Utilities Expense, and Accounts Payable. The unadjusted trial balance for Sierra Coip. is shown in Illustration 4-4 (page 155). Instead of the adjusting entries shown in the text at October 31, assume the following adjustment data. Supplies on hand at October 31 total $500. Expired insurance for the month is $ 100. Depreciation for the month is $75. As of October 31, services worth $800 related to the previously recorded unearned revenue had been performed. Services performed but unbilled (and no receivable has been recorded) at October 31 are $280. Interest expense accrued at October 31 is $70. Accrued salaries at October 31 are $1, 400. The ledger of Armour Lake Lumber Supply on July 31, 2017, includes the selected Prepare adjusting entries from accounts below before adjusting entries have been prepared. An analysis of the company's accounts shows the following. The investment in the notes receivable earns interest at a rale of 6% per year. Supplies on hand at the end of the month totaled $18, 600. The balance in Prepaid Rent represents 4 months of rent costs. Employees were owed $3, 100 related to unpaid salaries and wages. Depreciation on buildings is $6,000 per year. During the month, the company satisfied obligations worth $4, 700 related to the Unearned Services Revenue. Unpaid maintenance and repairs costs were $2, 300. Prepare the adjusting entries at July 31 assuming that adjusting entries are made monthly. Use additional accounts as needed. The income statement of Norski Co. for the month of July shows net income of $2,000 based on Service Revenue $5, 500, Salaries and Wages Expense $2, 100, Supplies Expense $900, and Utilities Expense $500. In reviewing the statement, you discover the following: Insurance expired during July of $350 was omitted. Supplies expense includes $200 of supplies that are still on hand at July 31. Depreciation on equipment of $ 150 was omitted. Accrued but unpaid wages at July 31 of $360 were not included. Services performed but unrecorded totaled $700. Prepare a correct income statement for July 2017

thank you

thank you