Can someone help me complete these

problems? I need to answer them as journal

entrys in a general ledger format with with debits

on the left and credits on the right. As well as closeing entries.

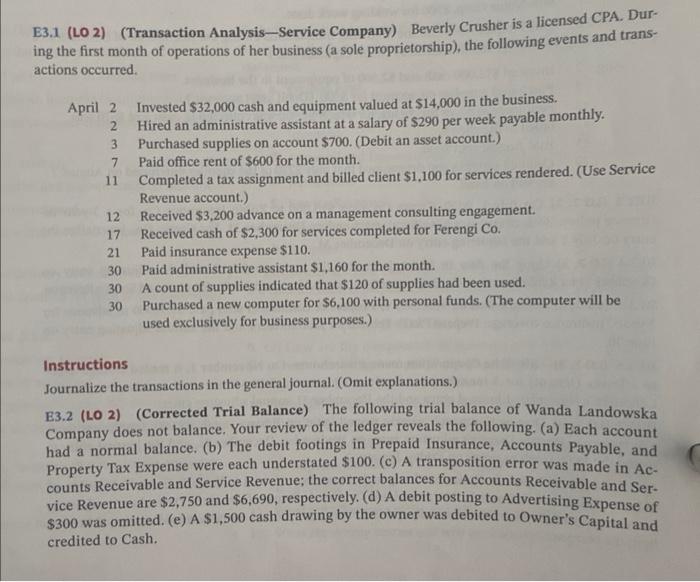

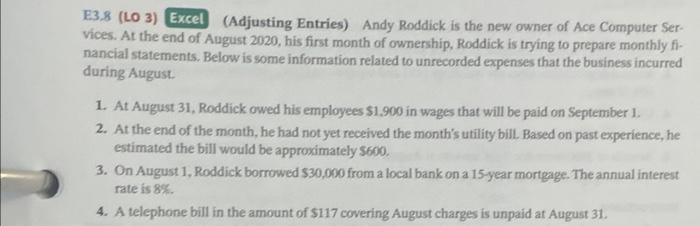

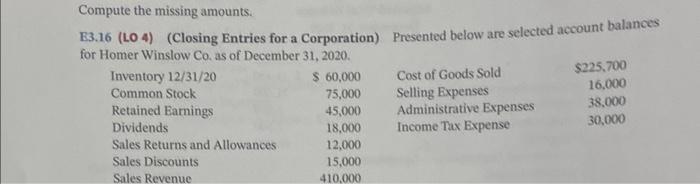

E3.1 (LO 2) (Transaction Analysis-Service Company) Beverly Crusher is a licensed ing the first month of operations of her business (a sole proprietorship), the following events and transactions occurred. April 2 Invested $32,000 cash and equipment valued at $14,000 in the business. 2 Hired an administrative assistant at a salary of $290 per week payable monthly. 3 Purchased supplies on account $700. (Debit an asset account.) 7 Paid office rent of $600 for the month. 11 Completed a tax assignment and billed client $1.100 for services rendered. (Use Service Revenue account.) 12 Received \$3,200 advance on a management consulting engagement. 17 Received cash of $2,300 for services completed for Ferengi Co. 21 Paid insurance expense $110. 30 Paid administrative assistant $1,160 for the month. 30 A count of supplies indicated that $120 of supplies had been used. 30 Purchased a new computer for $6,100 with personal funds. (The computer will be used exclusively for business purposes.) Instructions Journalize the transactions in the general journal. (Omit explanations.) E3.2 (LO 2) (Corrected Trial Balance) The following trial balance of Wanda Landowska Company does not balance. Your review of the ledger reveals the following. (a) Each account had a normal balance. (b) The debit footings in Prepaid Insurance, Accounts Payable, and Property Tax Expense were each understated $100. (c) A transposition error was made in Accounts Receivable and Service Revenue; the correct balances for Accounts Receivable and Service Revenue are $2,750 and $6,690, respectively. (d) A debit posting to Advertising Expense of $300 was omitted. (e) A $1,500 cash drawing by the owner was debited to Owner's Capital and credited to Cash. E3.8 (LO 3) Excel (Adjusting Entries) Andy Roddick is the new owner of Ace Computer Services. At the end of August 2020, his first month of ownership, Roddick is trying to prepare monthly financial statements. Below is some information related to unrecorded expenses that the business incurred during August. 1. At August 31, Roddick owed his employees $1.900 in wages that will be paid on September 1 . 2. At the end of the month, he had not yet received the month's utility bill. Based on past experience, he estimated the bill would be approximately $600. 3. On August 1, Roddick borrowed $30,000 from a local bank on a 15 -year mortgage. The annual interest rate is 8%. 4. A telephone bill in the amount of $117 covering August charges is unpaid at August 31 . Compute the missing amounts: E3.16 (LO 4) (Closing Entries for a Corporation) Presented below are selected account balances for Homer Winslow Co as of Decemher 31.2020