Answered step by step

Verified Expert Solution

Question

1 Approved Answer

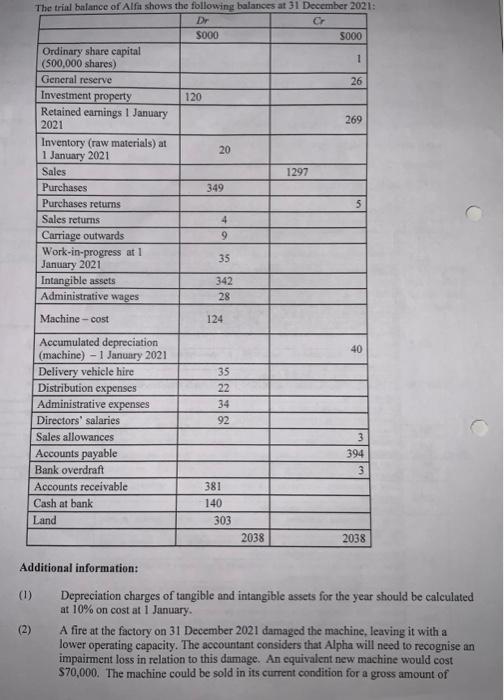

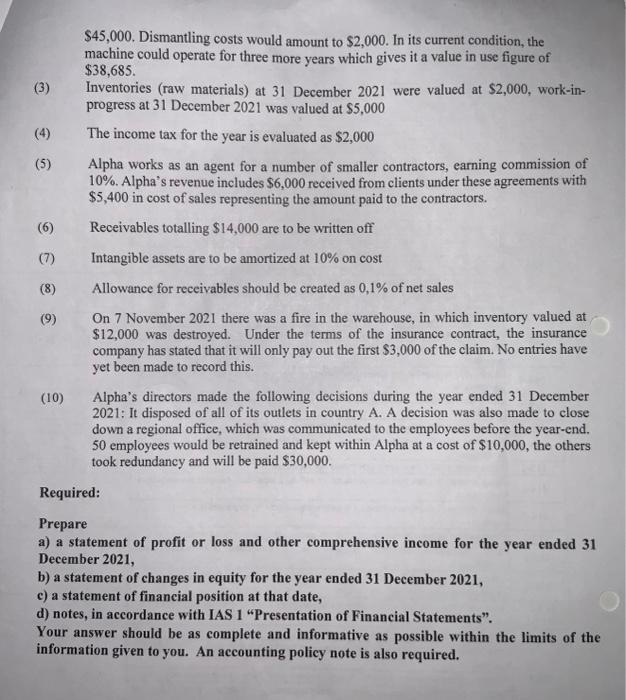

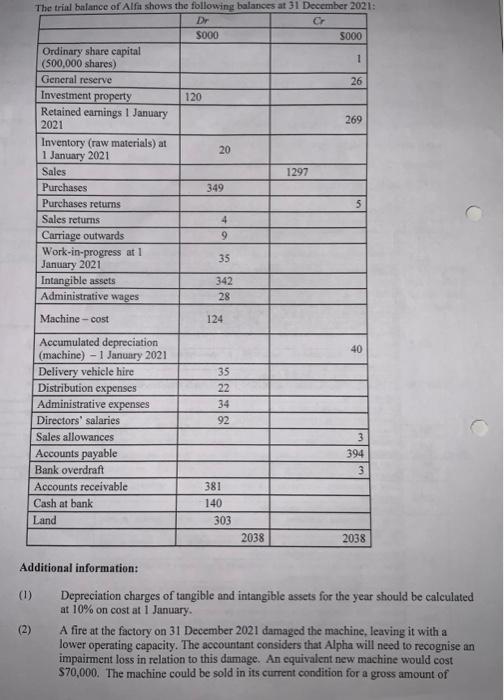

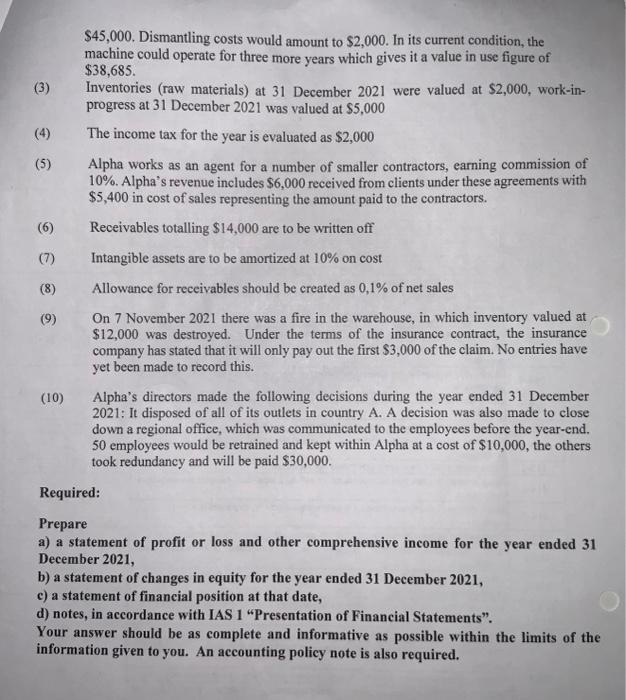

can someone help me with this homework? Additional information: (1) Depreciation charges of tangible and intangible assets for the year should be calculated at 10%

can someone help me with this homework?

Additional information: (1) Depreciation charges of tangible and intangible assets for the year should be calculated at 10% on cost at 1 January. (2) A fire at the factory on 31 December 2021 damaged the machine, leaving it with a lower operating capacity. The accountant considers that Alpha will need to recognise an impairment loss in relation to this damage. An equivalent new machine would cost $70,000. The machine could be sold in its current condition for a gross amount of $45,000. Dismantling costs would amount to $2,000. In its current condition, the machine could operate for three more years which gives it a value in use figure of $38,685. (3) Inventories (raw materials) at 31 December 2021 were valued at $2,000, work-inprogress at 31 December 2021 was valued at $5,000 (4) The income tax for the year is evaluated as $2,000 (5) Alpha works as an agent for a number of smaller contractors, earning commission of 10%. Alpha's revenue includes $6,000 received from clients under these agreements with $5,400 in cost of sales representing the amount paid to the contractors. (6) Receivables totalling $14,000 are to be written off (7) Intangible assets are to be amortized at 10% on cost (8) Allowance for receivables should be created as 0,1% of net sales (9) On 7 November 2021 there was a fire in the warehouse, in which inventory valued at $12,000 was destroyed. Under the terms of the insurance contract, the insurance company has stated that it will only pay out the first $3,000 of the claim. No entries have yet been made to record this. (10) Alpha's directors made the following decisions during the year ended 31 December 2021: It disposed of all of its outlets in country A. A decision was also made to close down a regional office, which was communicated to the employees before the year-end. 50 employees would be retrained and kept within Alpha at a cost of $10,000, the others took redundancy and will be paid $30,000. Required: Prepare a) a statement of profit or loss and other comprehensive income for the year ended 31 December 2021 , b) a statement of changes in equity for the year ended 31 December 2021 , c) a statement of financial position at that date, d) notes, in accordance with IAS 1 "Presentation of Financial Statements". Your answer should be as complete and informative as possible within the limits of the information given to you. An accounting policy note is also required. Additional information: (1) Depreciation charges of tangible and intangible assets for the year should be calculated at 10% on cost at 1 January. (2) A fire at the factory on 31 December 2021 damaged the machine, leaving it with a lower operating capacity. The accountant considers that Alpha will need to recognise an impairment loss in relation to this damage. An equivalent new machine would cost $70,000. The machine could be sold in its current condition for a gross amount of $45,000. Dismantling costs would amount to $2,000. In its current condition, the machine could operate for three more years which gives it a value in use figure of $38,685. (3) Inventories (raw materials) at 31 December 2021 were valued at $2,000, work-inprogress at 31 December 2021 was valued at $5,000 (4) The income tax for the year is evaluated as $2,000 (5) Alpha works as an agent for a number of smaller contractors, earning commission of 10%. Alpha's revenue includes $6,000 received from clients under these agreements with $5,400 in cost of sales representing the amount paid to the contractors. (6) Receivables totalling $14,000 are to be written off (7) Intangible assets are to be amortized at 10% on cost (8) Allowance for receivables should be created as 0,1% of net sales (9) On 7 November 2021 there was a fire in the warehouse, in which inventory valued at $12,000 was destroyed. Under the terms of the insurance contract, the insurance company has stated that it will only pay out the first $3,000 of the claim. No entries have yet been made to record this. (10) Alpha's directors made the following decisions during the year ended 31 December 2021: It disposed of all of its outlets in country A. A decision was also made to close down a regional office, which was communicated to the employees before the year-end. 50 employees would be retrained and kept within Alpha at a cost of $10,000, the others took redundancy and will be paid $30,000. Required: Prepare a) a statement of profit or loss and other comprehensive income for the year ended 31 December 2021 , b) a statement of changes in equity for the year ended 31 December 2021 , c) a statement of financial position at that date, d) notes, in accordance with IAS 1 "Presentation of Financial Statements". Your answer should be as complete and informative as possible within the limits of the information given to you. An accounting policy note is also required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started