Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone help with these questions? It's a homework 4. A trader enters a long position on 2 units of Brent Crude Oil futures contracts

Can someone help with these questions? It's a homework

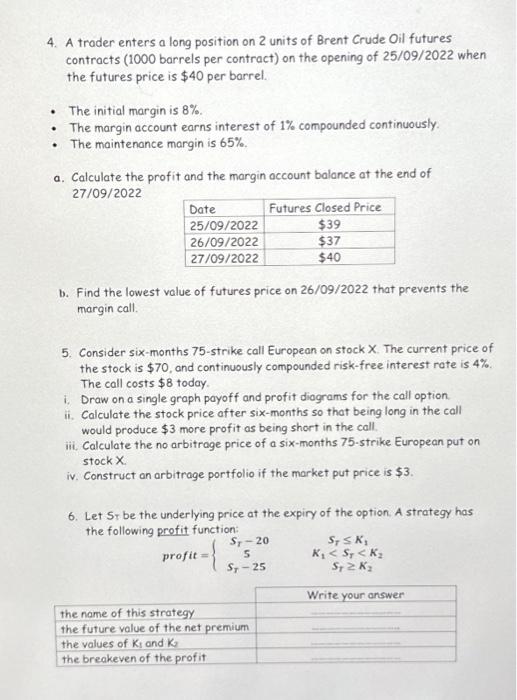

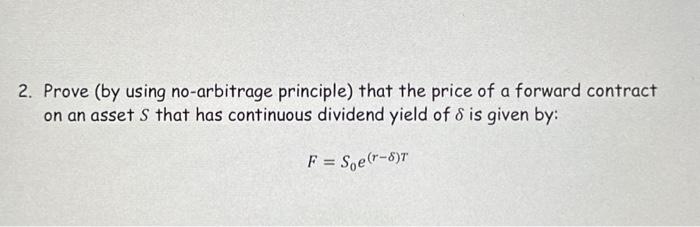

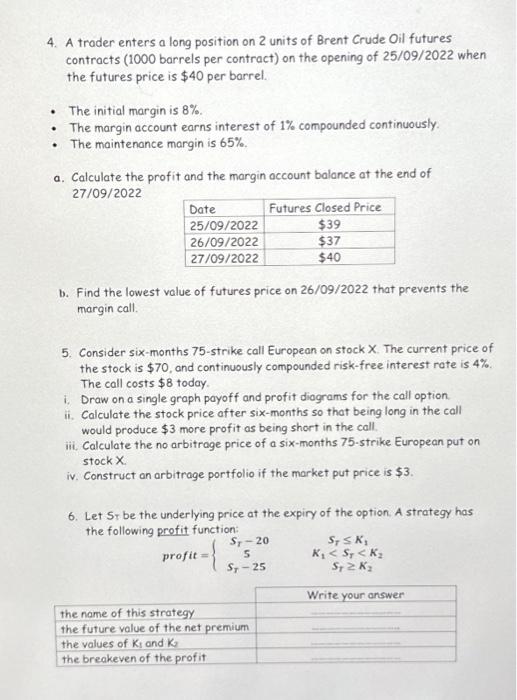

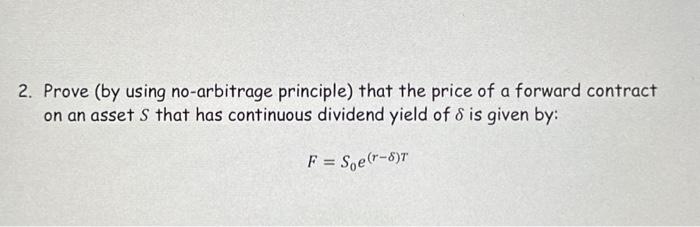

4. A trader enters a long position on 2 units of Brent Crude Oil futures contracts ( 1000 barrels per contract) on the opening of 25/09/2022 when the futures price is $40 per barrel. - The initial margin is 8%. - The margin account earns interest of 1% compounded continuously. - The maintenance margin is 65%. a. Calculate the profit and the margin account balance at the end of 27/09/2022 b. Find the lowest value of futures price on 26/09/2022 that prevents the margin call. 5. Consider six-months 75 -strike call European on stock X. The current price of the stock is $70, and continuously compounded risk-free interest rate is 4%. The call costs $8 today. i. Draw on a single graph payoff and profit diograms for the call option. ii. Calculate the stock price after six-months so that being long in the call would produce $3 more profit as being short in the call. iii. Calculate the no arbitrage price of a six-months 75-strike European put on stock X. iv. Construct an arbitrage portfolio if the market put price is $3. 6. Let S r be the underlying price at the expiry of the option. A strategy has the following profit function: profit=ST205ST25STK3K1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started