Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone please explain #1, this step by step? Not sure how to even start this. I am trying to learn how to do this

Can someone please explain #1, this step by step? Not sure how to even start this. I am trying to learn how to do this so if you can please explain why you did what you did, I would greatly appreciate it.

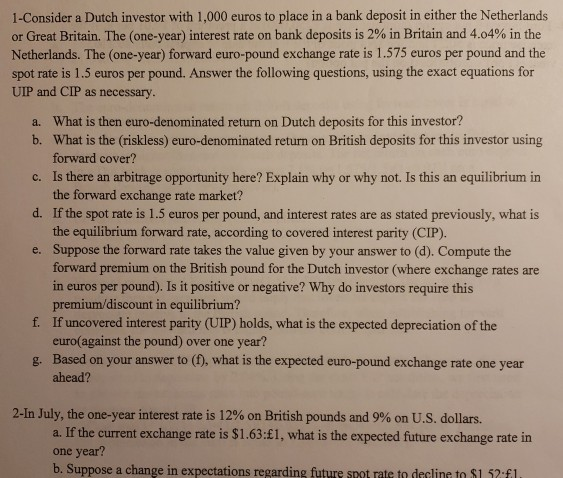

1-Consider a Dutch investor with 1,000 euros to place in a bank deposit in either the Netherlands or Great Britain. The (one-year) interest rate on bank deposits is 2% in Britain and 4.04% in the Netherlands. The (one-year) forward euro-pound exchange rate is 1.575 euros per pound and the spot rate is 1.5 euros per pound. Answer the following questions, using the exact equations for UIP and CIP as necessary What is then euro-denominated return on Dutch deposits for this investor? forward cover? the forward exchange rate market? a. b. What is the (riskless) euro-denominated return on British deposits for this investor using c. Is there an arbitrage opportunity here? Explain why or why not. Is this an equilibrium in d. If the spot rate is 1.5 euros per pound, and interest rates are as stated previously, what is e. Suppose the forward rate takes the value given by your answer to (d). Compute the the equilibrium forward rate, according to covered interest parity (CIP). forward premium on the British pound for the Dutch investor (where exchange rates are in euros per pound). Is it positive or negative? Why do investors require this premium/discount in equilibrium? f. If uncovered interest parity (UIP) holds, what is the expected depreciation of the euro(against the pound) over one year? Based on your answer to (1), what is the expected euro-pound exchange rate one year ahead? g. 2-In July, the one-year interest rate is 12% on British pounds and 9% on U.S. dollars. a. If the current exchange rate is $1.63:l, what is the expected future exchange rate in one year? b. Suppose a change in expectations regarding future spot rate to decline to $1 52f1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started