Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can someone please explain why i got these wrong? especially the most favorable compounding ones. i dont think i understand the concept since i got

can someone please explain why i got these wrong?

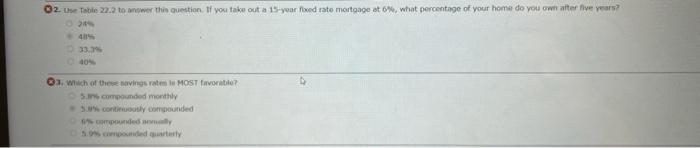

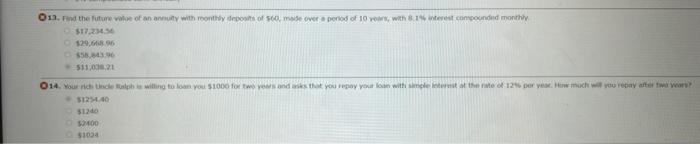

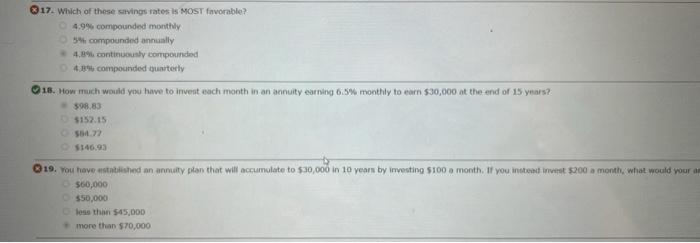

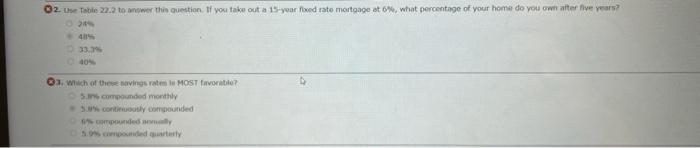

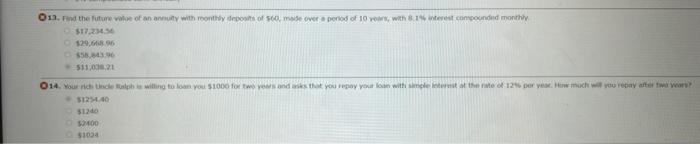

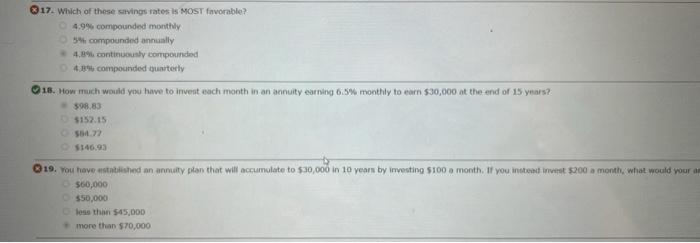

02. Use Table 22.2 to answer this question. If you take out a 15-year foxed rate mortgage at 6%, what percentage of your home do you own after five years? 0 24% D 33.3% 40% 03. Which of these savings rates in MOST favorable? 5.In compounded monthly 5.0% continuously compounded % compounded annually 5.9% compounded quarterly 013. Find the future value of an annuity with monthly deposits of $60, made over a period of 10 years, with 8.1% interest compounded monthly $17,234.36 129,668.96 $58,843.96 $11,038,21 014. Your rich incle Ralph is willing to loan you $1000 for two years and asks that you repay your loan with simple interest at the rate of 12% per year. How much will you repay after two years? $1254,40 $1240 $2400 $1024 17. Which of these savings rates is MOST favorable? 4.9% compounded monthly 5% compounded annually 4.8% continuously compounded 4.8% compounded quarterly 18. How much would you have to invest each month in an annuity earning 6.5% monthly to earn $30,000 at the end of 15 years? $98.83 D$152.15 $64.77 $146.93 19. You have established an annuity plan that will accumulate to $30,000 in 10 years by investing $100 a month. If you instead invest $200 a month, what would your an $60,000 $50,000 less than $45,000 more than $70,000 especially the most favorable compounding ones. i dont think i understand the concept since i got two of them wrong. i though continuous was best because it compounds most frequently?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started