Can someone please help me with the cash budget? Im getting so confused with the borrowing and the interest.

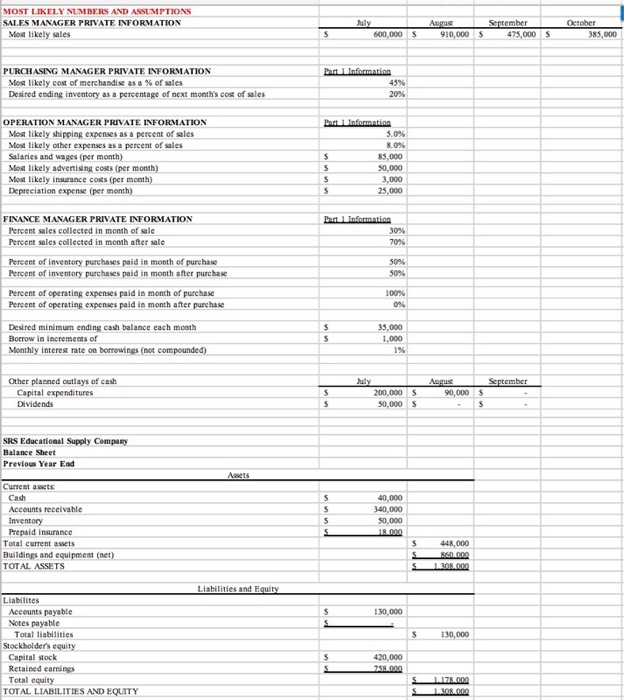

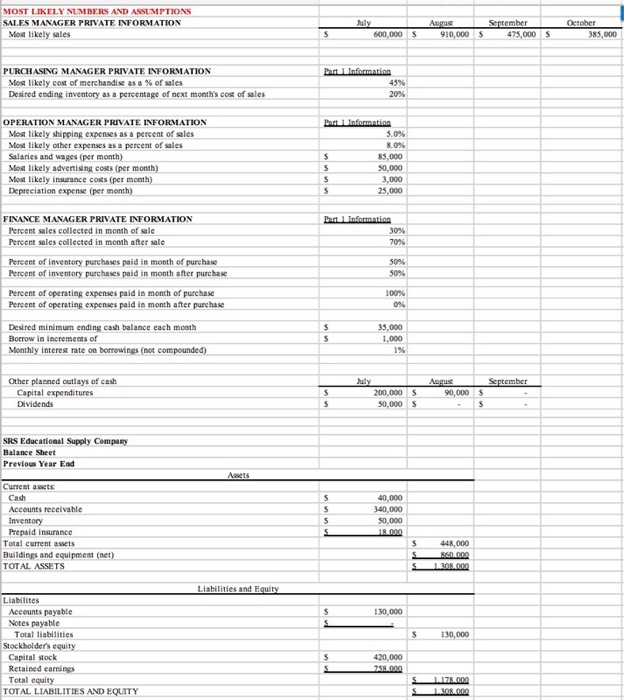

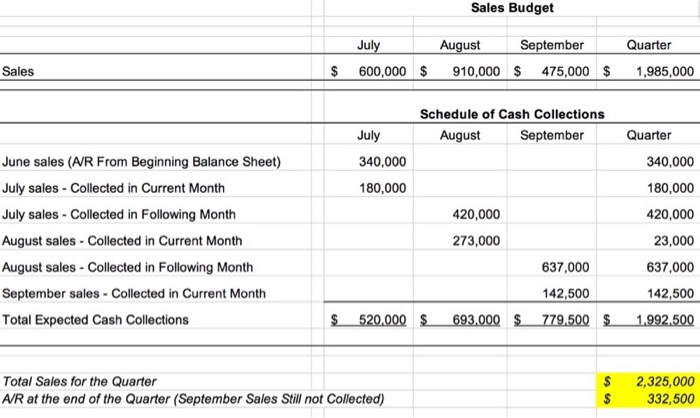

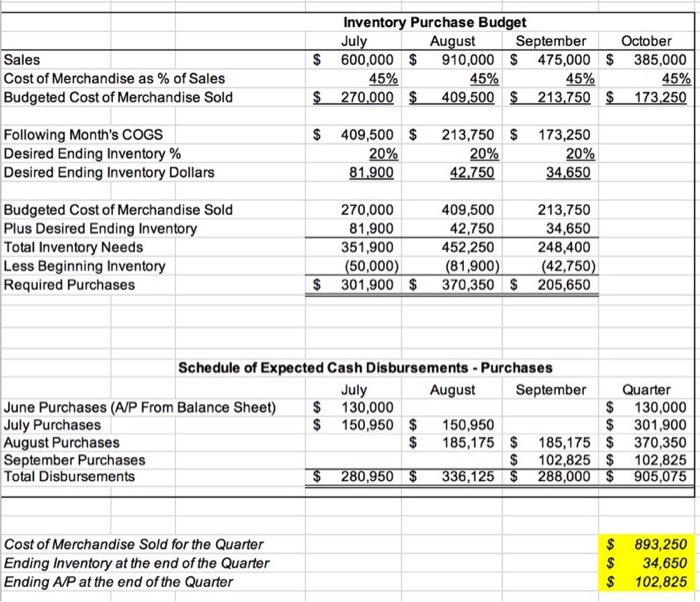

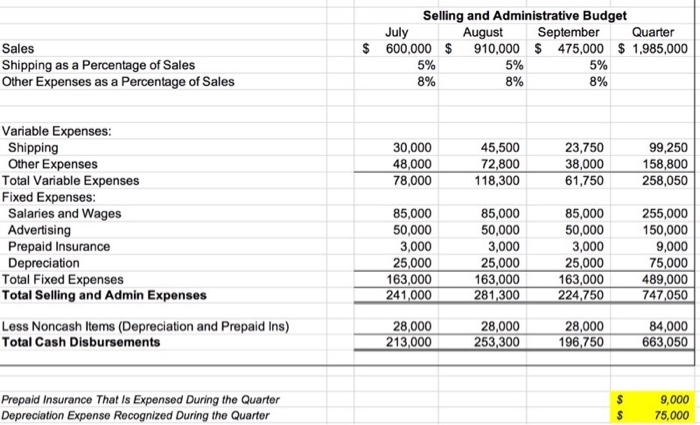

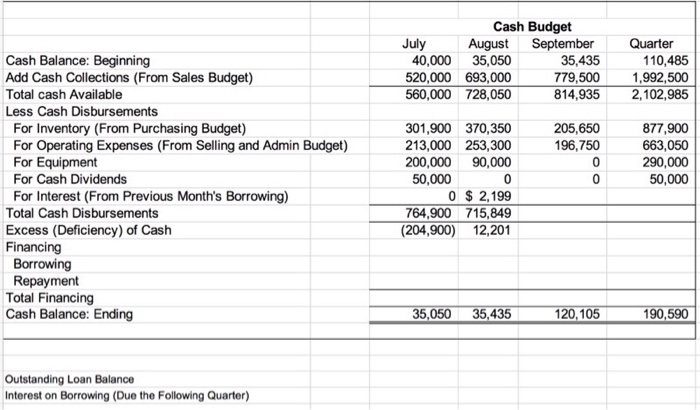

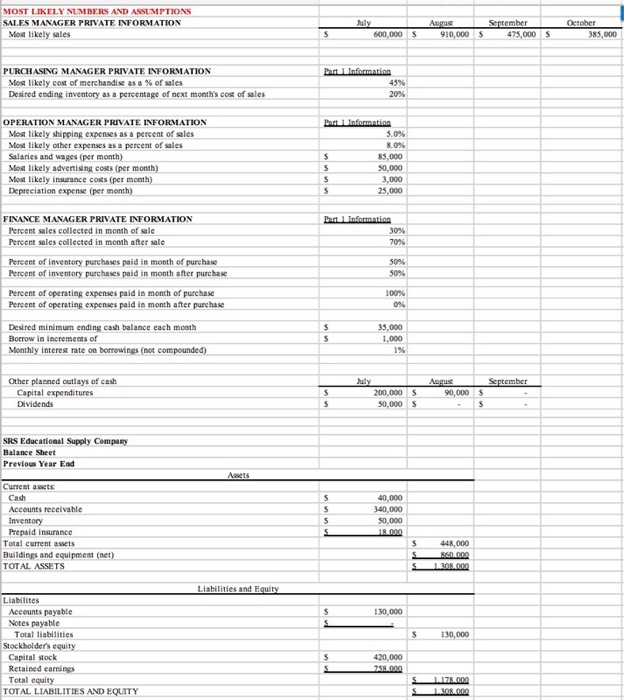

MOST LIKELY NUMBERS AND ASSUMPTIONS SALES MANAGER PRIVATE INFORMATION ember Most likely sales 600,000 10,000 475,000 385,000 PURCHASING MANAGER PRIVATE INFORMATION Most likely cost of merchandise as % of sales Desired coding inventory as a percentage of next month's co of sales 20% OPERATION MANAGER PRIVATE INFORMATION likely shipping expenses as a percent of sales Most likely other expenses as a percent of sales Salaries and wages (per month) Most likely advetisng costs (per month) Most likely insurance coss (per Depreeiation expense (per 8.0% 85,000 50,000 3,000 25,000 FINANCE MANAGER PRIVATE INFORMATION Percent ales collected in month of sale Percent sales collected in month after sale 30% Pereent of inventory purchases paid in month of purehase Percent of inventory purchases paid in month after purchase 50% Percent of operating expenses paid in month of purchase Percent of operating expenses paid in month after purchase 100% Desired minimum ending cash balance each moath Borrow in increments of Monthly interes rate on borrowings (not 35,000 1% Other planned outlays of cash Capital expenditures Dividends 200,000 S 50,000 S 90,000 SRS Educational Supply Company Balance Sheet Previous Year End Currest assets Cash Accounts receivable 40,000 40,000 50,000 Prepaid insurance Total current assets Buildings and equipment TOTAL ASSETS 448,000 Liabilities and E Liabilites Accounts payable Notes payable 130,000 Total liabilities 130,000 Stockholders e Capital stock Retained earnings Total equity TOTAL LIABILITIES AND EQUITY Sales Budget August September Quarter Sales $600,000 910,000 475,0001,985,000 Schedule of Cash Collections August July 340,000 180,000 September Quarter June sales (A/R From Beginning Balance Sheet) July sales-Collected in Current Month July sales-Collected in Following Month August sales-Collected in Current Month August sales-Collected in Following Month September sales-Collected in Current Month Total Expected Cash Collections 340,000 180,000 420,000 23,000 637,000 142,500 420,000 273,000 637,000 142,500 Total Sales for the Quarter A/R at the end of the Quarter (September Sales Still not Collecte) $ 2,325,000 $ 332,500 Inventory Purchase Budget Jul August September October Sales Cost of Merchandise as % of Sales Budgeted Cost of Merchandise Sold 600,000 $ 910,000 S 475,000 S 385,000 45% 4596 45% 45% $ 270,000$409500213750 173.250 Following Month's COGS Desired Ending Inventory % Desired Ending Inventory Dollars $ 409,500 $ 213,750 $ 173,250 20% 8190042.750 34,650 20% 2096 213,750 34,650 Budgeted Cost of Merchandise Sold Plus Desired Ending Inventory Total Inventory Needs Less Beginning Inventory Required Purchases 270,000 81,900 351,900 409,500 42,750 452,250 248400 (50,000)81,900)(42.750) $ 301,900 $370,350 S 205,650 Schedule of Expected Cash Disbursements-Purchases August September Quater July June Purchases (A/P From Balance Sheet) s 130,000 July Purchases August Purchases September Purchases Total Disbursements $ 130,000 $ 301,900 $ 185,175$ 185,175 $ 370,350 $ 102,825 102,825 150,950 150,950 $ 280,950 $ 336,125 288,000$ 905,075 Cost of Merchandise Sold for the Quarter Ending Inventory at the end of the Quarter Ending A/P at the end of the Quarter $893,250 $ 34,650 $ 102,825 Selling and Administrative Budget September Quarter July 600,000910,000 475,000 1,985,000 August Sales Shipping as a Percentage of Sales Other Expenses as a Percentage of Sales 5% 8% 5% 8% 5% 8% Variable Expenses Shipping Other Expenses 30,000 48,000 78,000 45,500 72,800 118,300 23,750 38,000 61,750 99,250 158,800 258,050 Total Variable Expenses Fixed Expenses 85,000 50,000 3,000 25,000 163,000 241000 85,000 50,000 3,000 25,000 163,000 281,300 255,000 50,000 9,000 75,000 489,000 747,050 85,000 50,000 Salaries and Wages Advertising Prepaid Insurance Depreciation 3,000 Total Fixed Expenses Total Selling and Admin Expenses 5 25,000 163,000 224.750 Less Noncash ltems (Depreciation and Prepaid Ins) Total Cash Disbursements 28,000 213,000 28,000 196,750 28,000 253,300108 76084,000 663,050 Prepaid Insurance That Is Expensed During the Quarter Depreciation Expense Recognized During the Quarter 9,000 S 75,000 Cash Budget August July Quarter Cash Balance: Beginning Add Cash Collections (From Sales Budget) Total cash Available Less Cash Disbursements 40,000 35,050 520,000 693,000 560,000 728,050 110,485 1,992,500 814,935 2,102,985 35,435 779,500 For Inventory (From Purchasing Budget) For Operating Expenses (From Selling and Admin Budget) For Equipment For Cash Dividends For Interest (From Previous Month's Borrowing) 301,900370,350 213,000 253,300 200,000 90,000 205,650 196,750 877,900 663,050 290,000 50,000 50,000 0 $ 2,199 764,900 715,849 Total Cash Disbursements Excess (Deficiency) of Cash Financing (204,900) 12,20 Borrowing Repayment Total Financing Cash Balance: Ending 435 120,105 190,590 Outstanding Loan Balance Interest on Borrowing (Due the Following Quarter)