Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can someone please help me with the explanation and CORRECT answer for this problem and every breakdown? The ones that are wrong were from someone

Can someone please help me with the explanation and CORRECT answer for this problem and every breakdown? The ones that are wrong were from someone one chegg. please help me with the correct information

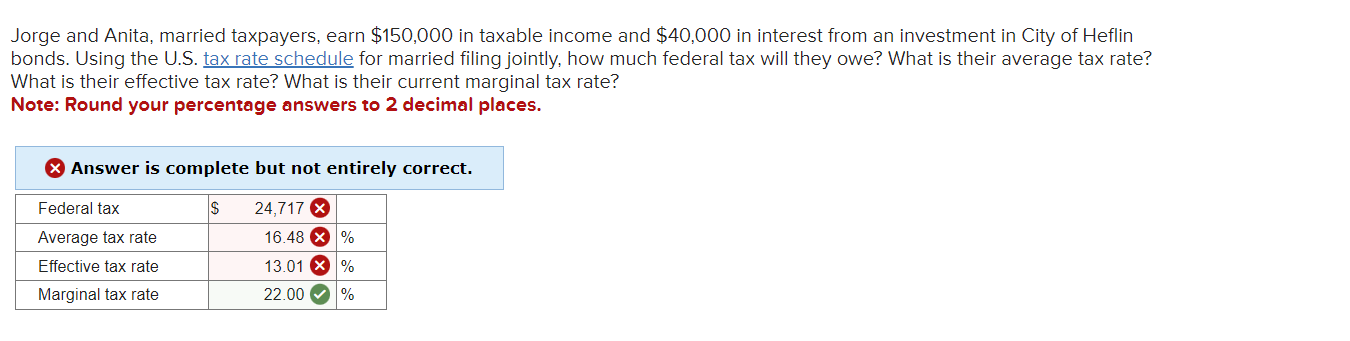

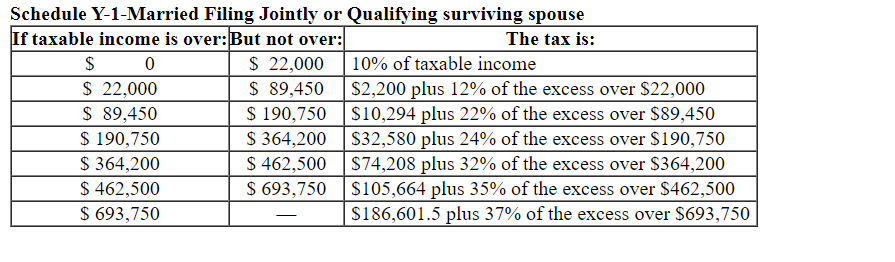

Jorge and Anita, married taxpayers, earn $150,000 in taxable income and $40,000 in interest from an investment in City of Heflin bonds. Using the U.S. for married filing jointly, how much federal tax will they owe? What is their average tax rate? What is their effective tax rate? What is their current marginal tax rate? Note: Round your percentage answers to 2 decimal places. Answer is comnlete hut not entirely rorrect. Schedule Y-1-Married Filing Jointly or Qualifying surviving spouse \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$0 & $22,000 & 10% of taxable income \\ \hline$22,000 & $89,450 & $2,200 plus 12% of the excess over $22,000 \\ \hline$89,450 & $190,750 & $10,294 plus 22% of the excess over $89,450 \\ \hline$190,750 & $364,200 & $32,580 plus 24% of the excess over $190,750 \\ \hline$364,200 & $462,500 & $74,208 plus 32% of the excess over $364,200 \\ \hline$462,500 & $693,750 & $105,664 plus 35% of the excess over $462,500 \\ \hline$693,750 & - & $186,601.5 plus 37% of the excess over $693,750 \\ \hline \end{tabular}

Jorge and Anita, married taxpayers, earn $150,000 in taxable income and $40,000 in interest from an investment in City of Heflin bonds. Using the U.S. for married filing jointly, how much federal tax will they owe? What is their average tax rate? What is their effective tax rate? What is their current marginal tax rate? Note: Round your percentage answers to 2 decimal places. Answer is comnlete hut not entirely rorrect. Schedule Y-1-Married Filing Jointly or Qualifying surviving spouse \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$0 & $22,000 & 10% of taxable income \\ \hline$22,000 & $89,450 & $2,200 plus 12% of the excess over $22,000 \\ \hline$89,450 & $190,750 & $10,294 plus 22% of the excess over $89,450 \\ \hline$190,750 & $364,200 & $32,580 plus 24% of the excess over $190,750 \\ \hline$364,200 & $462,500 & $74,208 plus 32% of the excess over $364,200 \\ \hline$462,500 & $693,750 & $105,664 plus 35% of the excess over $462,500 \\ \hline$693,750 & - & $186,601.5 plus 37% of the excess over $693,750 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started