Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CAN SOMEONE PREPARE A STATEMENT OF CASH FLOWS USING THE DIRECT METHOD PLEASE. NO ONE HAS BEEN ANSWERING MY QUESTIONS *what is the additional info

CAN SOMEONE PREPARE A STATEMENT OF CASH FLOWS USING THE DIRECT METHOD PLEASE. NO ONE HAS BEEN ANSWERING MY QUESTIONS

*what is the additional info you need? this is all the information that comes with the question.

**Prepare a statement of cash flows using the direct method.

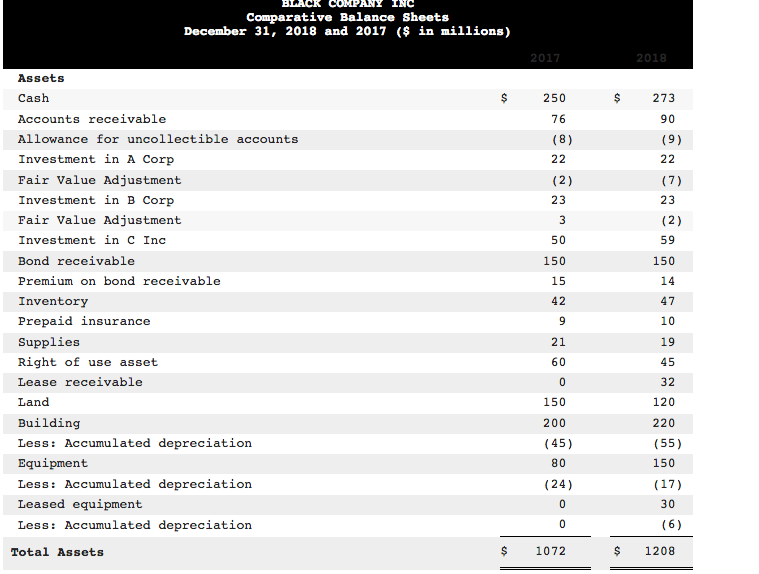

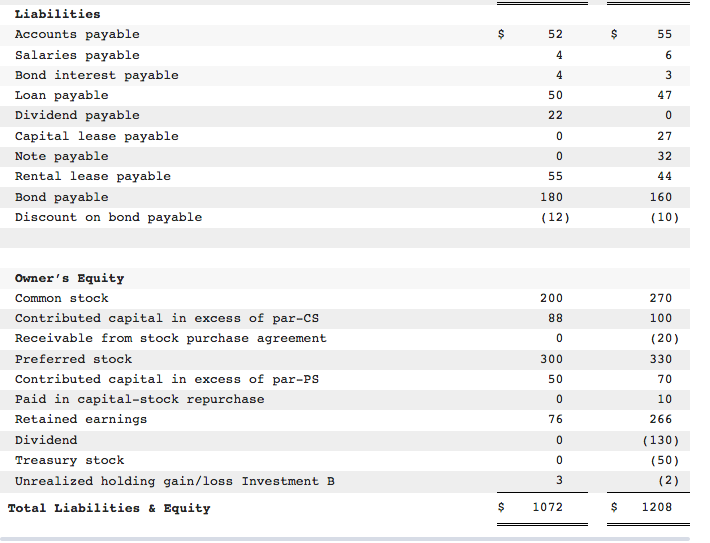

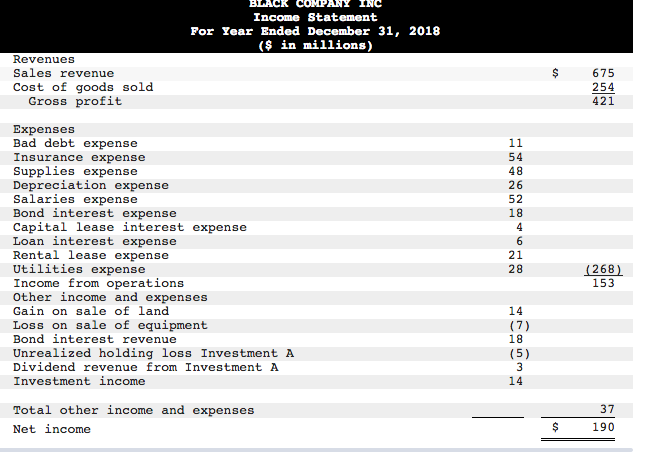

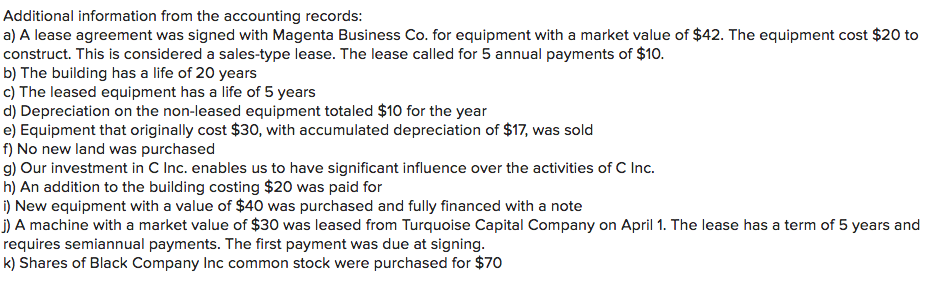

BLACK COMPANY INC Comparative Balance Sheets December 31, 2018 and 2017 ($ in millions) 2017 2018 $ $ 250 76 273 90 (9) 22 (7) Assets Cash Accounts receivable Allowance for uncollectible accounts Investment in A Corp Fair Value Adjustment Investment in B Corp Fair Value Adjustment Investment in C Inc Bond receivable Premium on bond receivable Inventory Prepaid insurance Supplies Right of use asset Lease receivable Land Building Less: Accumulated depreciation Equipment Less: Accumulated depreciation Leased equipment Less: Accumulated depreciation 0 150 200 (45) 120 220 (55) 150 (17) (24) 30 (6) O 1072 Total Assets $ $ 1208 $ 55 Liabilities Accounts payable Salaries payable Bond interest payable Loan payable Dividend payable Capital lease payable Note payable Rental lease payable Bond payable Discount on bond payable 44 55 180 (12) 160 (10) 270 100 (20) 330 70 Owner's Equity Common stock Contributed capital in excess of par-cs Receivable from stock purchase agreement Preferred stock Contributed capital in excess of par-PS Paid in capital-stock repurchase Retained earnings Dividend Treasury stock Unrealized holding gain/loss Investment B Total Liabilities & Equity 266 (130) (50) (2) $ 1072 $ 1208 BLACK COMPANY INC Income Statement For Year Ended December 31, 2018 ($ in millions) 675 Revenues Sales revenue Cost of goods sold Gross profit Expenses Bad debt expense Insurance expense Supplies expense Depreciation expense Salaries expense Bond interest expense Capital lease interest expense Loan interest expense Rental lease expense Utilities expense Income from operations Other income and expenses Gain on sale of land Loss on sale of equipment Bond interest revenue Unrealized holding loss Investment A Dividend revenue from Investment A Investment income (268) 153 Total other income and expenses Net income $ 190 Additional information from the accounting records: a) A lease agreement was signed with Magenta Business Co. for equipment with a market value of $42. The equipment cost $20 to construct. This is considered a sales-type lease. The lease called for 5 annual payments of $10. b) The building has a life of 20 years c) The leased equipment has a life of 5 years d) Depreciation on the non-leased equipment totaled $10 for the year e) Equipment that originally cost $30, with accumulated depreciation of $17, was sold f) No new land was purchased g) Our investment in C Inc. enables us to have significant influence over the activities of C Inc. h) An addition to the building costing $20 was paid for i) New equipment with a value of $40 was purchased and fully financed with a note j) A machine with a market value of $30 was leased from Turquoise Capital Company on April 1. The lease has a term of 5 years and requires semiannual payments. The first payment was due at signing. k) Shares of Black Company Inc common stock were purchased for $70 BLACK COMPANY INC Comparative Balance Sheets December 31, 2018 and 2017 ($ in millions) 2017 2018 $ $ 250 76 273 90 (9) 22 (7) Assets Cash Accounts receivable Allowance for uncollectible accounts Investment in A Corp Fair Value Adjustment Investment in B Corp Fair Value Adjustment Investment in C Inc Bond receivable Premium on bond receivable Inventory Prepaid insurance Supplies Right of use asset Lease receivable Land Building Less: Accumulated depreciation Equipment Less: Accumulated depreciation Leased equipment Less: Accumulated depreciation 0 150 200 (45) 120 220 (55) 150 (17) (24) 30 (6) O 1072 Total Assets $ $ 1208 $ 55 Liabilities Accounts payable Salaries payable Bond interest payable Loan payable Dividend payable Capital lease payable Note payable Rental lease payable Bond payable Discount on bond payable 44 55 180 (12) 160 (10) 270 100 (20) 330 70 Owner's Equity Common stock Contributed capital in excess of par-cs Receivable from stock purchase agreement Preferred stock Contributed capital in excess of par-PS Paid in capital-stock repurchase Retained earnings Dividend Treasury stock Unrealized holding gain/loss Investment B Total Liabilities & Equity 266 (130) (50) (2) $ 1072 $ 1208 BLACK COMPANY INC Income Statement For Year Ended December 31, 2018 ($ in millions) 675 Revenues Sales revenue Cost of goods sold Gross profit Expenses Bad debt expense Insurance expense Supplies expense Depreciation expense Salaries expense Bond interest expense Capital lease interest expense Loan interest expense Rental lease expense Utilities expense Income from operations Other income and expenses Gain on sale of land Loss on sale of equipment Bond interest revenue Unrealized holding loss Investment A Dividend revenue from Investment A Investment income (268) 153 Total other income and expenses Net income $ 190 Additional information from the accounting records: a) A lease agreement was signed with Magenta Business Co. for equipment with a market value of $42. The equipment cost $20 to construct. This is considered a sales-type lease. The lease called for 5 annual payments of $10. b) The building has a life of 20 years c) The leased equipment has a life of 5 years d) Depreciation on the non-leased equipment totaled $10 for the year e) Equipment that originally cost $30, with accumulated depreciation of $17, was sold f) No new land was purchased g) Our investment in C Inc. enables us to have significant influence over the activities of C Inc. h) An addition to the building costing $20 was paid for i) New equipment with a value of $40 was purchased and fully financed with a note j) A machine with a market value of $30 was leased from Turquoise Capital Company on April 1. The lease has a term of 5 years and requires semiannual payments. The first payment was due at signing. k) Shares of Black Company Inc common stock were purchased for $70Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started