Can you calculate COGS and Gross Margin from the following income statement and balance sheet?

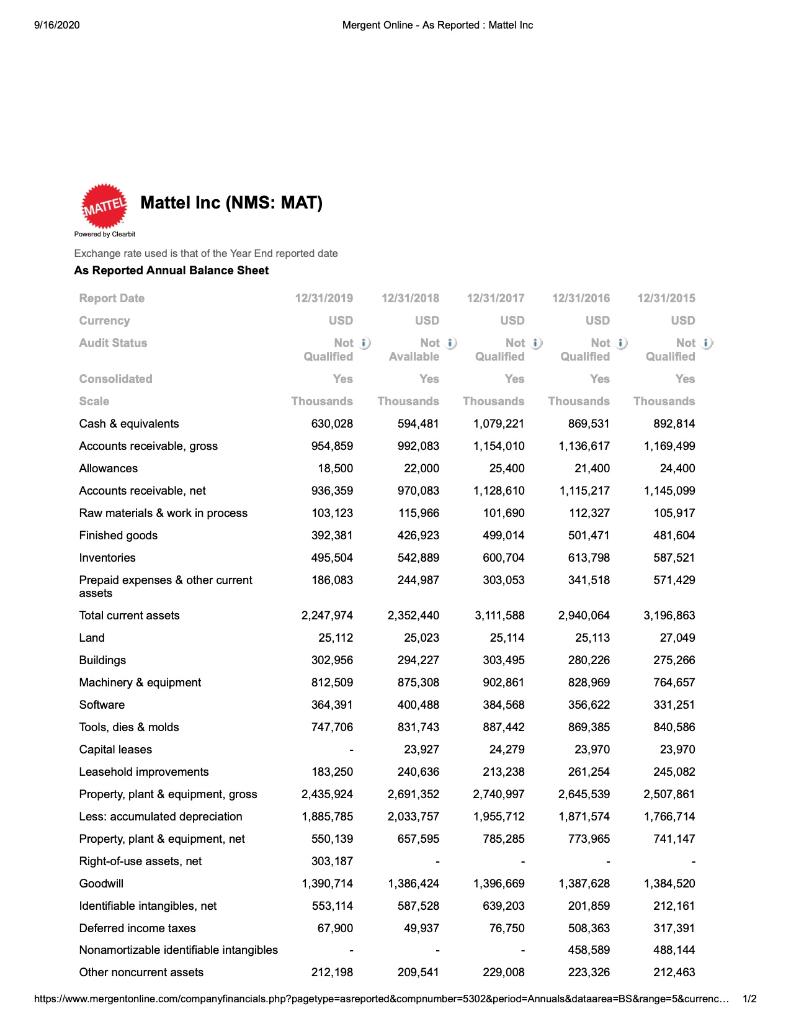

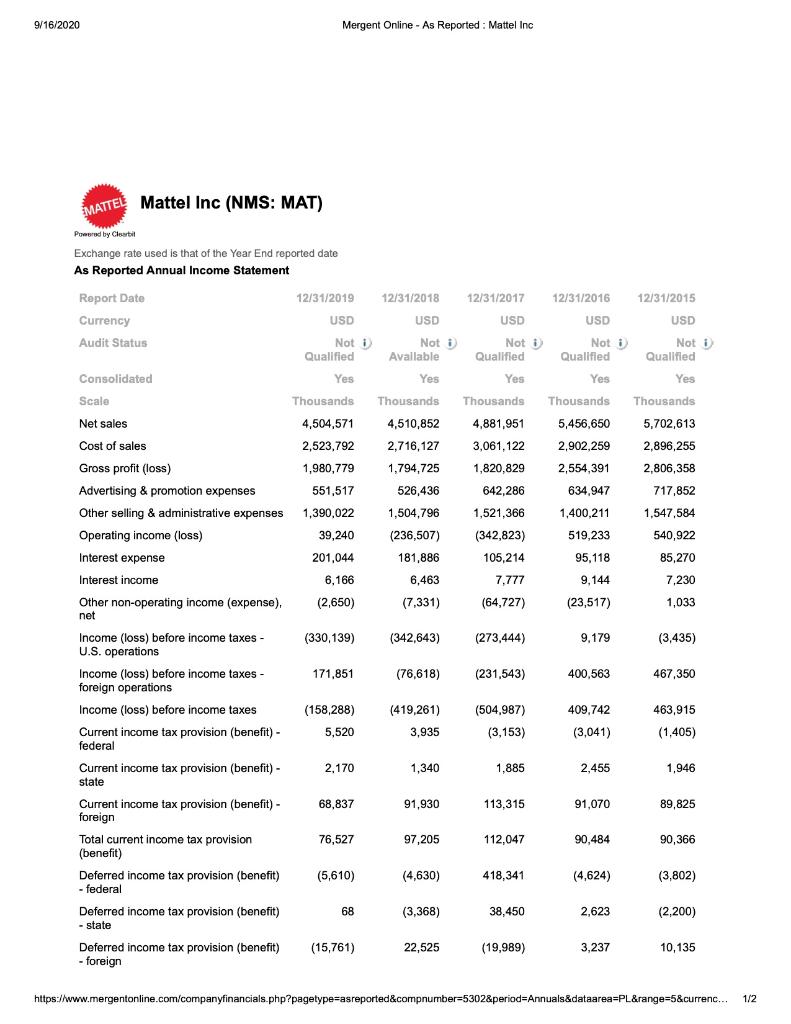

9/16/2020 9/16/2020 Mergent Online - As Reported: Mattel Inc MATTEL Mattel Inc (NMS: MAT) Powered by Cleartit Exchange rate used is that of the Year End reported date As Reported Annual Balance Sheet Report Date 12/31/2019 12/31/2018 12/31/2017 12/31/2016 12/31/2015 Currency USD USD USD USD USD Audit Status Not D Not Not D Not D Not 1 Qualified Available Qualified Qualified Qualified Consolidated Yes Yes Yes Yes Yes Scale Thousands Thousands Thousands Thousands Thousands Cash & equivalents 630,028 594,481 1,079,221 869,531 892,814 Accounts receivable, gross 954,859 992,083 1,154,010 1,136,617 1.169,499 Allowances 18,500 22,000 25,400 21,400 24,400 Accounts receivable, net 936,359 970,083 1,128,610 1.115,217 1,145,099 Raw materials & work in process 103,123 115,966 101,690 112,327 105,917 Finished goods 392,381 426,923 499,014 501,471 481,604 Inventories 495,504 542,889 600,704 613,798 587,521 Prepaid expenses & other current 186,083 244,987 303,053 341,518 571,429 assets Total current assets 2,247,974 2,352,440 3,111,588 2,940,064 3,196,863 Land 25,112 25,023 25,114 25,113 27.049 Buildings 302,956 294,227 303,495 280,226 275,266 Machinery & equipment 812.509 875,308 902,861 828,969 764,657 Software 364,391 400,488 384,568 356,622 331,251 Tools, dies & molds 747,706 831,743 887,442 869,385 840,586 Capital leases 23,927 24,279 23,970 23,970 Leasehold improvements 183,250 240,636 213,238 261,254 245,082 Property, plant & equipment, gross 2,435,924 2,691,352 2,740,997 2,645,539 2,507,861 Less: accumulated depreciation 1,885,785 2,033,757 1,955,712 1,871,574 1,766,714 Property, plant & equipment, net 550,139 657,595 785,285 773,965 741,147 Right-of-use assets, net 303, 187 Goodwill 1,390,714 1,386,424 1,396,669 1,387,628 1,384,520 Identifiable intangibles, net 553,114 587,528 639,203 201,859 212,161 Deferred income taxes 67.900 49,937 76,750 508,363 317,391 Nonamortizable identifiable intangibles 458,589 488,144 Other noncurrent assets 212,198 209,541 229.008 223,326 212,463 https://www.mergentonline.com/companyfinancials.php?pagetype=asreported&compnumber=5302&period=Annuals&dataarea=BS&range=5¤c... 1/2 - 9/16/2020 9/16/2020 Mergent Online - As Reported: Mattel Inc MATTEL Mattel Inc (NMS: MAT) Powered by Claret Exchange rate used is that of the Year End reported date As Reported Annual Income Statement 12/31/2018 Report Date Currency Audit Status 12/31/2019 USD Not D Qualified Yes USD Not Available 12/31/2015 USD Not D Qualified Yes Yes Yes Consolidated Scale Net sales Thousands 4,504,571 2,523,792 1,980,779 551,517 1,390,022 39,240 12/31/2017 12/31/2016 USD USD Not :) Not D Qualified Qualified Yes Thousands Thousands 4,881,951 5,456,650 3,061,122 2,902,259 1,820,829 2,554,391 642,286 634,947 1,521,366 1,400,211 (342,823) 519,233 105,214 95,118 7,777 9,144 (64,727) (23,517) Thousands 4,510,852 2,716,127 1,794,725 526,436 1,504,796 (236,507) 181,886 6,463 (7,331) Thousands 5,702,613 2,896,255 2,806,358 717,852 1,547,584 540,922 85,270 201,044 6,166 (2,650) 7,230 1,033 (330,139) (342,643) (273,444) 9,179 (3,435) 171,851 (76,618) (231,543) 400,563 467,350 Cost of sales Gross profit (loss) Advertising & promotion expenses Other selling & administrative expenses Operating income (loss) Interest expense Interest income Other non-operating income (expense), net Income (loss) before income taxes - U.S. operations Income (loss) before income taxes - foreign operations Income (loss) before income taxes Current income tax provision (benefit) - federal Current income tax provision (benefit) - state Current income tax provision (benefit) - foreign Total current income tax provision (benefit) Deferred income tax provision (benefit) - federal Deferred income tax provision (benefit) - state - Deferred income tax provision (benefit) - foreign (158,288) 409,742 (419,261) 3,935 (504,987) (3,153) 463,915 (1,405) 5,520 (3,041) 2,170 1,340 1,885 2,455 1,946 68,837 91,930 113,315 91,070 89,825 76,527 97,205 112,047 90,484 90,366 (5,610) (4,630) 418,341 (4,624) (3,802) 68 (3,368) 38,450 2,623 (2,200) (15,761) 22,525 (19,989) 3,237 10,135 https://www.mergentonline.com/companyfinancials.php?pagetype=asreported&compnumber=5302&period=Annuals&dataarea=PL&range=5¤c... 1/2