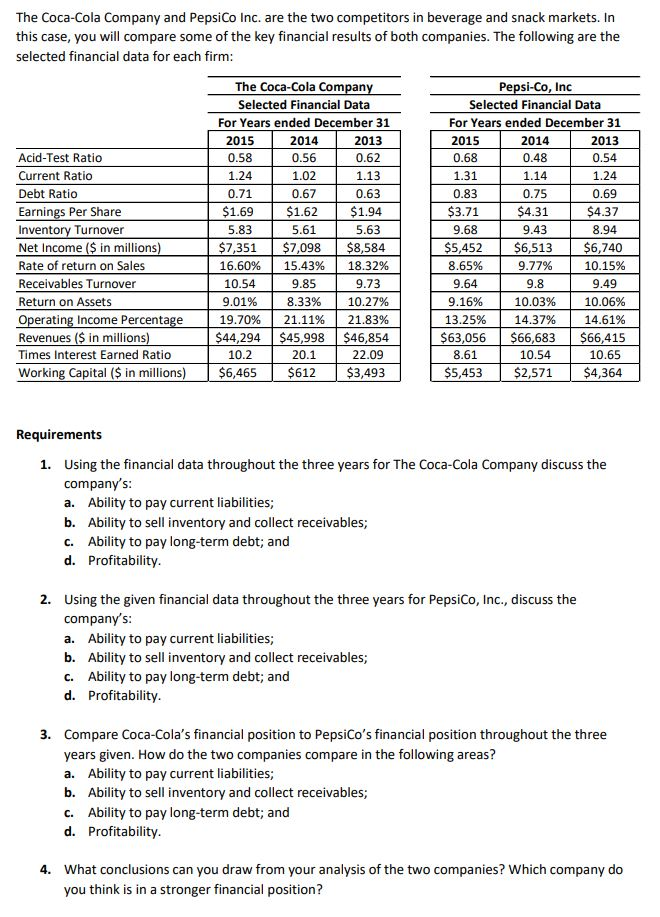

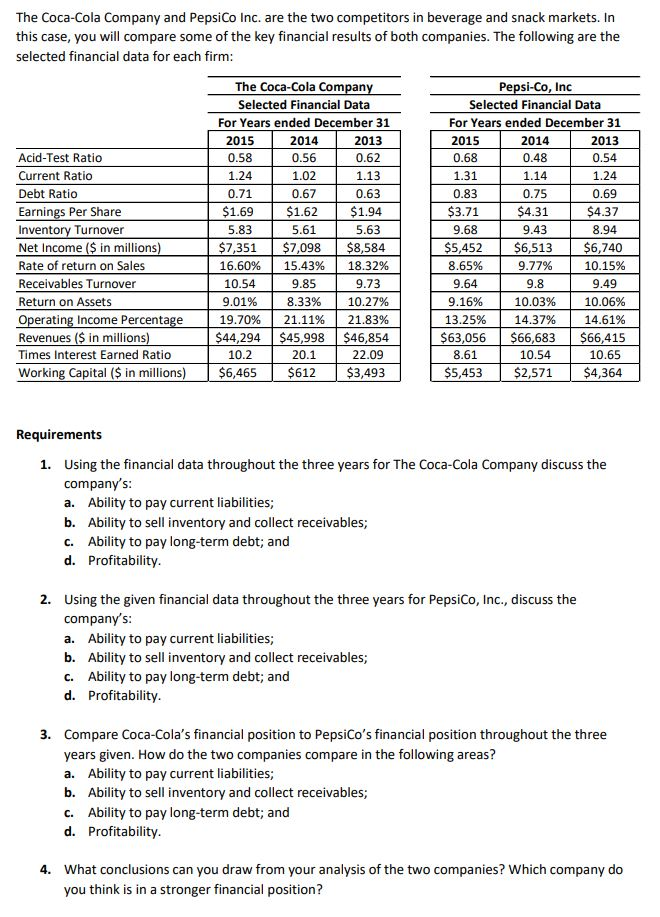

The Coca-Cola Company and PepsiCo Inc. are the two competitors in beverage and snack markets. In this case, you will compare some of the key financial results of both companies. The following are the selected financial data for each firm: Acid-Test Ratio Current Ratio Debt Ratio Earnings Per Share Inventory Turnover Net Income ($ in millions) Rate of return on Sales Receivables Turnover Return on Assets Operating Income Percentage Revenues ($ in millions) Times Interest Earned Ratio Working Capital ($ in millions) The Coca-Cola Company Selected Financial Data For Years ended December 31 2015 2014 2013 0.58 0.56 0.62 1.24 1.02 1.13 0.71 0.67 0.63 $1.69 $1.62 $1.94 5.83 5,61 5.63 $7,351 $7,098 $8,584 16.60% 15.43% 18.32% 10.54 9.85 9.73 9.01% 8.33% 10.27% 19.70% 21.11% 21.83% $44,294 $45,998 $46,854 10.2 20.1 22.09 $6,465 $612 $3,493 Pepsi-Co, Inc Selected Financial Data For Years ended December 31 2015 2014 2013 0.68 0.48 0.54 1.31 1.14 1.24 0.83 0.75 0.69 $3.71 $4.31 $4.37 9.68 9.43 8.94 $5,452 $6,513 $6,740 8.65% 9.77% 10.15% 9.64 9.8 9.49 9.16% 10.03% 10.06% 13.25% 14.37% 14.61% $63,056 $66,683 $66,415 8.61 1 10.54 10.65 $5,453 $2,571 $4,364 Requirements 1. Using the financial data throughout the three years for The Coca-Cola Company discuss the company's: a. Ability to pay current liabilities; b. Ability to sell inventory and collect receivables; C. Ability to pay long-term debt; and d. Profitability. 2. Using the given financial data throughout the three years for PepsiCo, Inc., discuss the company's: a. Ability to pay current liabilities; b. Ability to sell inventory and collect receivables, C. Ability to pay long-term debt; and d. Profitability. 3. Compare Coca-Cola's financial position to PepsiCo's financial position throughout the three years given. How do the two companies compare in the following areas? a. Ability to pay current liabilities; b. Ability to sell inventory and collect receivables; C. Ability to pay long-term debt; and d. Profitability. 4. What conclusions can you draw from your analysis of the two companies? Which company do you think is in a stronger financial position