Can you explained in detailed work how to do on Excel?

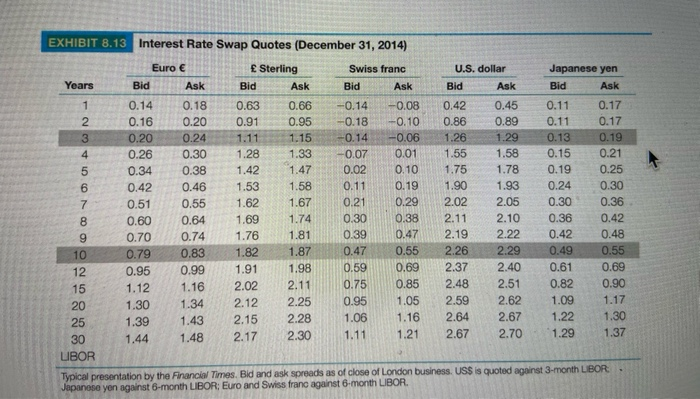

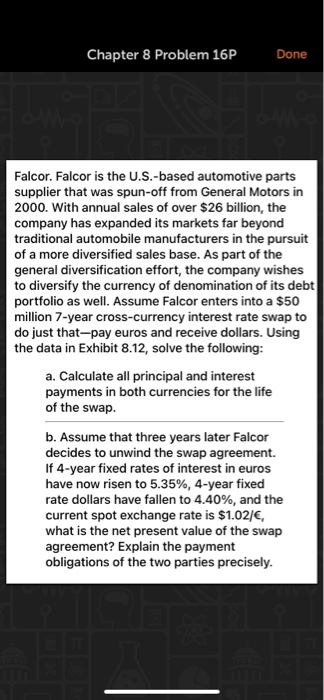

Chapter 8 Problem 16P Done Falcor. Falcor is the U.S.-based automotive parts supplier that was spun-off from General Motors in 2000. With annual sales of over $26 billion, the company has expanded its markets far beyond traditional automobile manufacturers in the pursuit of a more diversified sales base. As part of the general diversification effort, the company wishes to diversify the currency of denomination of its debt portfolio as well. Assume Falcor enters into a $50 million 7-year cross-currency interest rate swap to do just that-pay euros and receive dollars. Using the data in Exhibit 8.12, solve the following: a. Calculate all principal and interest payments in both currencies for the life of the swap. b. Assume that three years later Falcor decides to unwind the swap agreement. If 4-year fixed rates of interest in euros have now risen to 5.35%, 4-year fixed rate dollars have fallen to 4.40%, and the current spot exchange rate is $1.027, what is the net present value of the swap agreement? Explain the payment obligations of the two parties precisely. EXHIBIT 8.13 Interest Rate Swap Quotes (December 31, 2014) 0.36 Euro Sterling Swiss franc U.S. dollar Japanese yen Years Bid Ask Bid Ask Bid Ask Bid Ask Bid Ask 1 0.14 0.18 0.63 0.66 -0.14 -0.08 0.42 0.45 0.11 0.17 2 0.16 0.20 0.91 0.95 -0.18 --0.10 0.86 0.89 0.11 0.17 3 0.20 0.24 1.11 1.15 -0.14 -0.06 1.26 1.29 0.13 0.19 4 0.26 0.30 1.28 1.33 -0.07 0.01 1.55 1.58 0.15 0.21 5 0.34 0.38 1.42 1.47 0.02 0.10 1.75 1.78 0.19 0.25 6 0.42 0.46 1.53 1.58 0.11 0.19 1.90 1.93 0.24 0.30 7 0.51 0.55 1.62 1.67 0.21 0.29 2.02 2.05 0.30 0.36 8 0.60 0.64 1.69 1.74 0.30 0.38 2.11 2.10 0.42 9 0.70 0.74 1.76 1.81 0.39 0.47 2.19 2.22 0.42 0.48 10 0.79 0.83 1.82 1.87 0.47 0.55 2.26 2.29 0.49 0.55 12 0.95 0.99 1.91 1.98 0.59 0.69 2.37 2.40 0.61 0.69 15 1.12 1.16 2.02 2.11 0.75 0.85 2.48 2.51 0.82 0.90 1.30 1.34 2.12 2.25 0.95 1.05 2.59 2.62 1.09 1.17 25 1.39 1.43 2.15 2.28 1.06 1.16 2.64 2.67 1.22 1.30 30 1.44 1.48 2.17 2.30 1.11 1.21 2.67 2.70 1.29 1.37 LIBOR Typical presentation by the Financial Times. Bid and ask spreads as of close of London business. US$ is quoted against 3-month LIBOR. Japanese yen against 6-month LIBOR: Euro and Swiss franc against 6-month LIBOR 20 8.16 Falcor (US). Falcor is the U.S.-based automotive parts supplier that was spun off from General Motors in 2000. With annual sales of over $26 billion, the company has expanded its markets far beyond traditional automobile manufacturers in the pursuit of a more diversified sales base. As part of the general diversification effort, the company wishes to diversify the currency of denomination of its debt portfolio as well. Assume Falcor enters into a $50 million 7-year cross-currency interest rate swap to do just that-pay euros and receive dollars. Using the data in Exhibit 8.13, solve the following: a. Calculate all principal and interest payments in both currencies for the life of the swap. b. Assume that three years later Falcor decides to unwind the swap agreement. If 4-year fixed rates of interest in euros have now risen to 5.35%, 4-year fixed-rate dollars have fallen to 4.40%, and the current spot exchange rate is $1.02/, what is the net present value of the swap agreement? Explain the payment obligations of the two parties precisely. Chapter 8 Problem 16P Done Falcor. Falcor is the U.S.-based automotive parts supplier that was spun-off from General Motors in 2000. With annual sales of over $26 billion, the company has expanded its markets far beyond traditional automobile manufacturers in the pursuit of a more diversified sales base. As part of the general diversification effort, the company wishes to diversify the currency of denomination of its debt portfolio as well. Assume Falcor enters into a $50 million 7-year cross-currency interest rate swap to do just that-pay euros and receive dollars. Using the data in Exhibit 8.12, solve the following: a. Calculate all principal and interest payments in both currencies for the life of the swap. b. Assume that three years later Falcor decides to unwind the swap agreement. If 4-year fixed rates of interest in euros have now risen to 5.35%, 4-year fixed rate dollars have fallen to 4.40%, and the current spot exchange rate is $1.027, what is the net present value of the swap agreement? Explain the payment obligations of the two parties precisely. EXHIBIT 8.13 Interest Rate Swap Quotes (December 31, 2014) 0.36 Euro Sterling Swiss franc U.S. dollar Japanese yen Years Bid Ask Bid Ask Bid Ask Bid Ask Bid Ask 1 0.14 0.18 0.63 0.66 -0.14 -0.08 0.42 0.45 0.11 0.17 2 0.16 0.20 0.91 0.95 -0.18 --0.10 0.86 0.89 0.11 0.17 3 0.20 0.24 1.11 1.15 -0.14 -0.06 1.26 1.29 0.13 0.19 4 0.26 0.30 1.28 1.33 -0.07 0.01 1.55 1.58 0.15 0.21 5 0.34 0.38 1.42 1.47 0.02 0.10 1.75 1.78 0.19 0.25 6 0.42 0.46 1.53 1.58 0.11 0.19 1.90 1.93 0.24 0.30 7 0.51 0.55 1.62 1.67 0.21 0.29 2.02 2.05 0.30 0.36 8 0.60 0.64 1.69 1.74 0.30 0.38 2.11 2.10 0.42 9 0.70 0.74 1.76 1.81 0.39 0.47 2.19 2.22 0.42 0.48 10 0.79 0.83 1.82 1.87 0.47 0.55 2.26 2.29 0.49 0.55 12 0.95 0.99 1.91 1.98 0.59 0.69 2.37 2.40 0.61 0.69 15 1.12 1.16 2.02 2.11 0.75 0.85 2.48 2.51 0.82 0.90 1.30 1.34 2.12 2.25 0.95 1.05 2.59 2.62 1.09 1.17 25 1.39 1.43 2.15 2.28 1.06 1.16 2.64 2.67 1.22 1.30 30 1.44 1.48 2.17 2.30 1.11 1.21 2.67 2.70 1.29 1.37 LIBOR Typical presentation by the Financial Times. Bid and ask spreads as of close of London business. US$ is quoted against 3-month LIBOR. Japanese yen against 6-month LIBOR: Euro and Swiss franc against 6-month LIBOR 20 8.16 Falcor (US). Falcor is the U.S.-based automotive parts supplier that was spun off from General Motors in 2000. With annual sales of over $26 billion, the company has expanded its markets far beyond traditional automobile manufacturers in the pursuit of a more diversified sales base. As part of the general diversification effort, the company wishes to diversify the currency of denomination of its debt portfolio as well. Assume Falcor enters into a $50 million 7-year cross-currency interest rate swap to do just that-pay euros and receive dollars. Using the data in Exhibit 8.13, solve the following: a. Calculate all principal and interest payments in both currencies for the life of the swap. b. Assume that three years later Falcor decides to unwind the swap agreement. If 4-year fixed rates of interest in euros have now risen to 5.35%, 4-year fixed-rate dollars have fallen to 4.40%, and the current spot exchange rate is $1.02/, what is the net present value of the swap agreement? Explain the payment obligations of the two parties precisely