Answered step by step

Verified Expert Solution

Question

1 Approved Answer

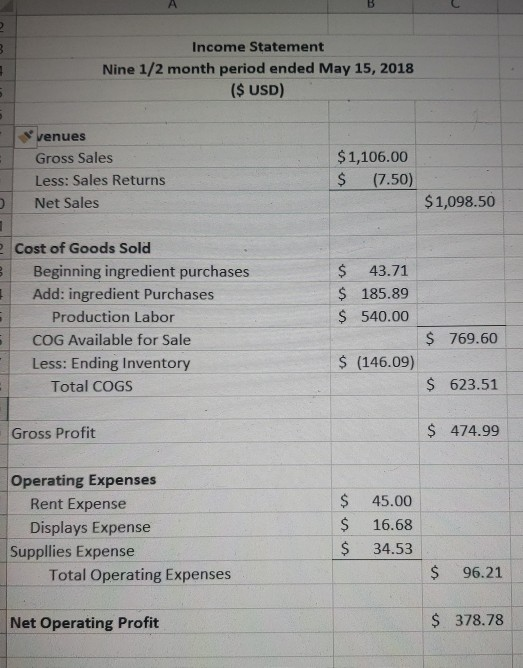

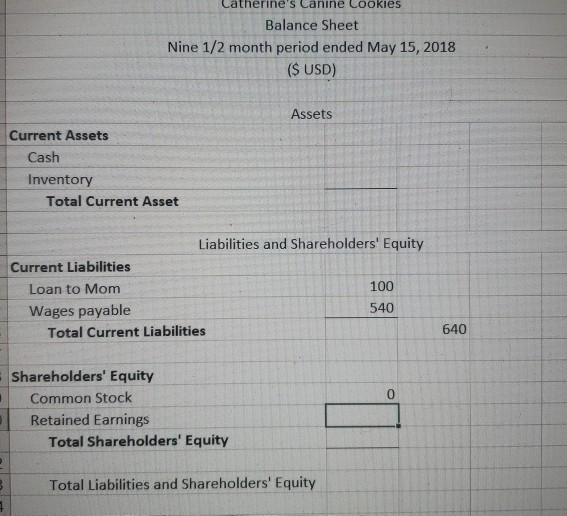

can you help me arrange my balance statement from the income statement? 8 : Income Statement Nine 1/2 month period ended May 15, 2018 ($

can you help me arrange my balance statement from the income statement?

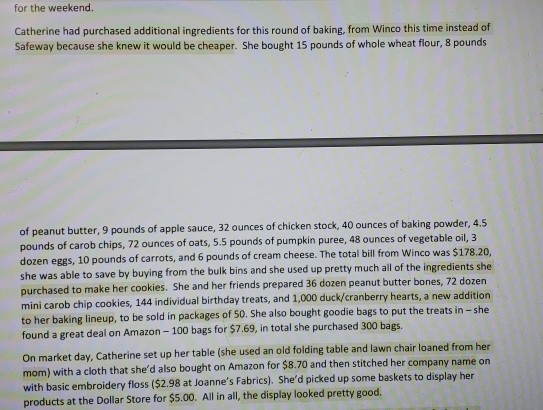

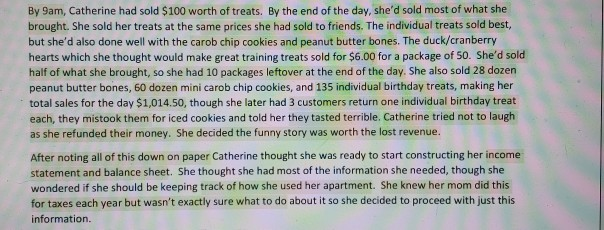

8 : Income Statement Nine 1/2 month period ended May 15, 2018 ($ USD) 5 venues Gross Sales Less: Sales Returns Net Sales $1,106.00 $ (7.50) $1,098.50 an . e Cost of Goods Sold Beginning ingredient purchases Add: ingredient Purchases Production Labor COG Available for Sale Less: Ending Inventory Total COGS $ 43.71 $ 185.89 $ 540.00 $ 769.60 $ (146.09) $ 623.51 Gross Profit $ 474.99 Operating Expenses Rent Expense Displays Expense Suppllies Expense Total Operating Expenses $ $ $ 45.00 16.68 34.53 $ 96.21 Net Operating Profit $ 378.78 atherine's Canine Cookies Balance Sheet Nine 1/2 month period ended May 15, 2018 ($ USD) Assets Current Assets Cash Inventory Total Current Asset Liabilities and Shareholders' Equity Current Liabilities Loan to Mom 100 Wages payable 540 Total Current Liabilities 640 Shareholders' Equity Common Stock Retained Earnings Total Shareholders' Equity e 3 Total Liabilities and Shareholders' Equity for the weekend. Catherine had purchased additional ingredients for this round of baking, from Winco this time instead of Safeway because she knew it would be cheaper. She bought 15 pounds of whole wheat flour, 8 pounds of peanut butter, 9 pounds of apple sauce, 32 ounces of chicken stock, 40 ounces of baking powder, 4.5 pounds of carob chips, 72 ounces of oats, 5.5 pounds of pumpkin puree, 48 ounces of vegetable oil, 3 dozen eggs, 10 pounds of carrots, and 6 pounds of cream cheese. The total bill from Winco was $178.20, she was able to save by buying from the bulk bins and she used up pretty much all of the ingredients she purchased to make her cookies. She and her friends prepared 36 dozen peanut butter bones, 72 dozen mini carob chip cookies, 144 individual birthday treats, and 1,000 duck/cranberry hearts, a new addition to her baking lineup, to be sold in packages of 50. She also bought goodie bags to put the treats in-she found a great deal on Amazon - 100 bags for $7.69, in total she purchased 300 bags. On market day, Catherine set up her table (she used an old folding table and lawn chair loaned from her mom) with a cloth that she'd also bought on Amazon for $8.70 and then stitched her company name on with basic embroidery floss ($2.98 at Joanne's Fabrics). She'd picked up some baskets to display her products at the Dollar Store for $5.00. All in all, the display looked pretty good. By 9am, Catherine had sold $100 worth of treats. By the end of the day, she'd sold most of what she brought. She sold her treats at the same prices she had sold to friends. The individual treats sold best, but she'd also done well with the carob chip cookies and peanut butter bones. The duck/cranberry hearts which she thought would make great training treats sold for $6.00 for a package of 50. She'd sold half of what she brought, so she had 10 packages leftover at the end of the day. She also sold 28 dozen peanut butter bones, 60 dozen mini carob chip cookies, and 135 individual birthday treats, making her total sales for the day $1,014.50, though she later had 3 customers return one individual birthday treat each, they mistook them for iced cookies and told her they tasted terrible. Catherine tried not to laugh as she refunded their money. She decided the funny story was worth the lost revenue. After noting all of this down on paper Catherine thought she was ready to start constructing her income statement and balance sheet. She thought she had most of the information she needed, though she wondered if she should be keeping track of how she used her apartment. She knew her mom did this for taxes each year but wasn't exactly sure what to do about it so she decided to proceed with just this information

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started