Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you help me do this question please... P 3-6 Consolidation After Acquisition Harrison PLC acquires 80 percent of David PLC for $2,080,000 on January

can you help me do this question please...

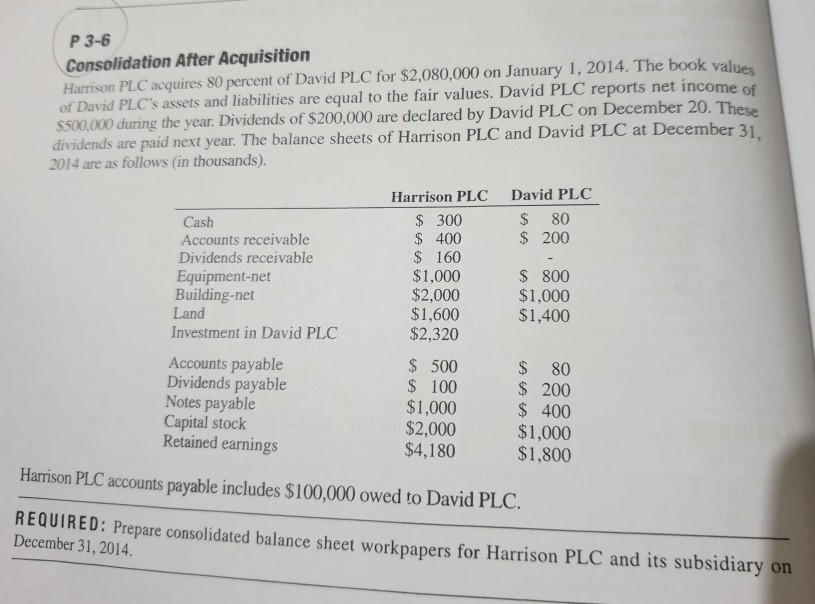

P 3-6 Consolidation After Acquisition Harrison PLC acquires 80 percent of David PLC for $2,080,000 on January 1, 2014. The book values of David PLC's assets and liabilities are equal to the fair values. David PLC reports net income $500.000 during the year. Dividends of $200.000 are declared by David PLC on December 20. These of dividends are paid next year. The balance sheets of Harrison PLC and David PLC at December 3 2014 are as follows (in thousands). 1, Harrison PLC $ 300 S 400 160 $1,000 $2,000 $1,600 $2,320 David PLC $ 80 200 Cash Accounts receivable Dividends receivable Equipment-net Building-net Land Investment in David PLC 800 $1,000 $1,400 Accounts payable Dividends payable Notes payable Capital stock Retained earnings 500 100 $1,000 $2,000 $4,180 $ 80 200 400 $1,000 $1,800 Harrison PLC accounts payable includes $100,000 owed to David PLC. December 31, 2014. repare consolidated balance sheet workpapers for Harrison PLC and its subsidiary onStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started