Can you help me with this assignment?

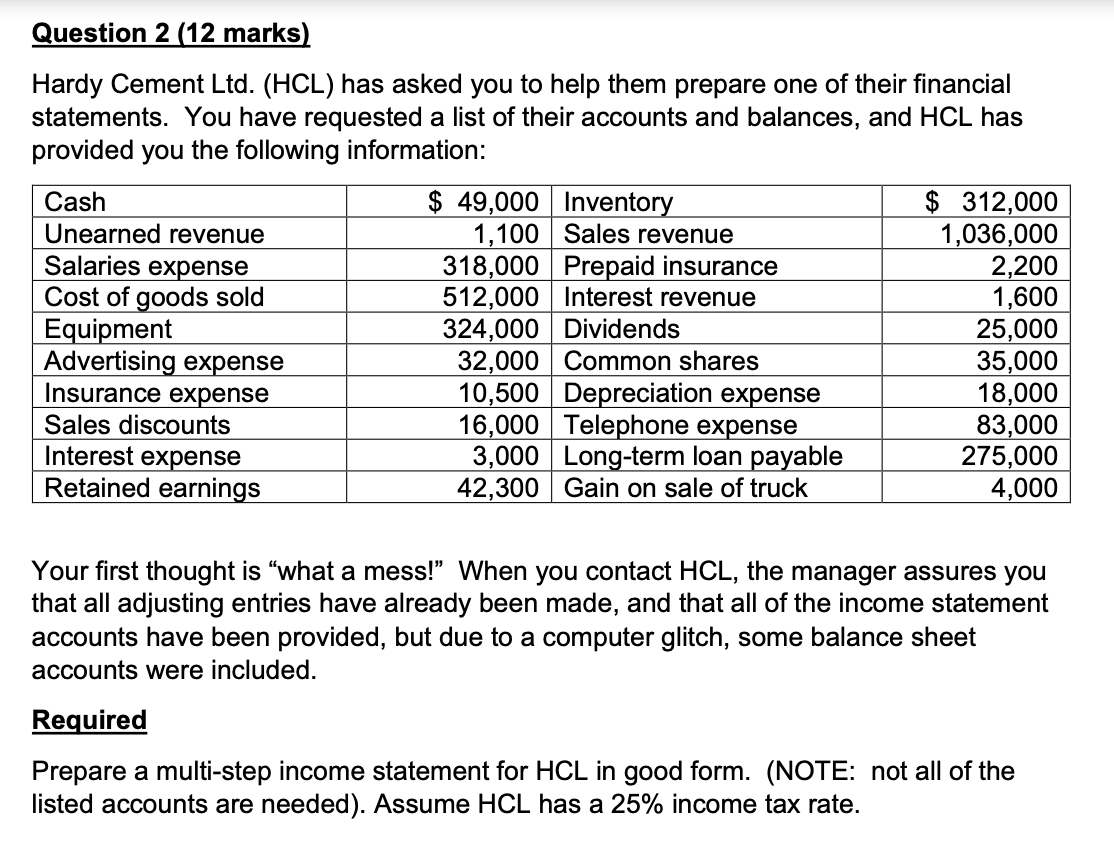

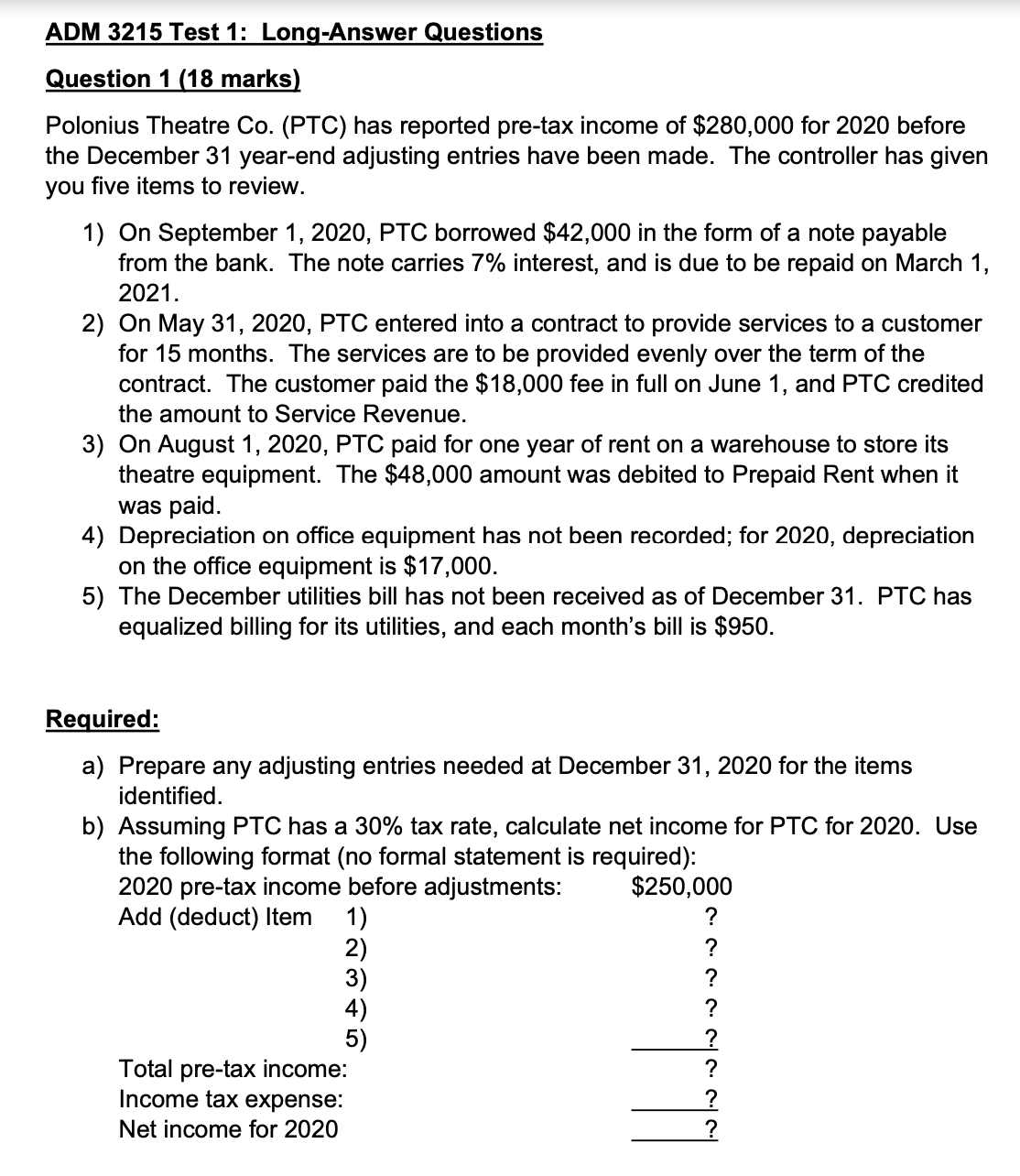

ADM 3215 Test 1: Long-Answer Questions Question 1 (18 marks) Polonius Theatre Co. (PTC) has reported pre-tax income of $280,000 for 2020 before the December 31 year-end adjusting entries have been made. The controller has given you ve items to review. 1) On September 1, 2020, PTC borrowed $42,000 in the form of a note payable from the bank. The note carries 7% interest, and is due to be repaid on March 1, 2021. 2) On May 31, 2020, PTC entered into a contract to provide services to a customer for 15 months. The services are to be provided evenly over the term of the contract. The customer paid the $18,000 fee in full on June 1, and PTC credited the amount to Service Revenue. 3) On August 1, 2020, PTC paid for one year of rent on a warehouse to store its theatre equipment. The $48,000 amount was debited to Prepaid Rent when it was paid. 4) Depreciation on ofce equipment has not been recorded; for 2020, depreciation on the ofce equipment is $17,000. 5) The December utilities bill has not been received as of December 31. PTC has equalized billing for its utilities, and each month's bill is $950. Reguired: a) Prepare any adjusting entries needed at December 31, 2020 for the items identied. b) Assuming PTC has a 30% tax rate, calculate net income for PTC for 2020. Use the following format (no formal statement is required): 2020 pre-tax income before adjustments: $250,000 Add (deduct) Item 1) ? 2) ? 3) ? 4) ? 5) ? Total pre-tax income: ? Income tax expense: ? Net income for 2020 '0 Question 2 (12 marks) Hardy Cement Lid. (HCL) has asked you to help them prepare one of their financial statements. You have requested a list of their accounts and balances, and HCL has provided you the following information: Cash $ 49,000 Inventory $ 312,000 Unearned revenue 1, 100 Sales revenue 1,036,000 Salaries expense 318,000 Prepaid insurance 2,200 Cost of goods sold 512,000 Interest revenue 1,600 Equipment 324,000 Dividends 25,000 Advertising expense 32,000 Common shares 35,000 Insurance expense 10,500 Depreciation expense 18,000 Sales discounts 16,000 Telephone expense 83,000 Interest expense 3,000 Long-term loan payable 275,000 Retained earnings 42,300 Gain on sale of truck 4,000 Your first thought is "what a mess!" When you contact HCL, the manager assures you that all adjusting entries have already been made, and that all of the income statement accounts have been provided, but due to a computer glitch, some balance sheet accounts were included. Required Prepare a multi-step income statement for HCL in good form. (NOTE: not all of the listed accounts are needed). Assume HCL has a 25% income tax rate