Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you help with the following questions 1 Using net income as a performance measurement in a performance evaluation system is most appropriate for which

can you help with the following questions

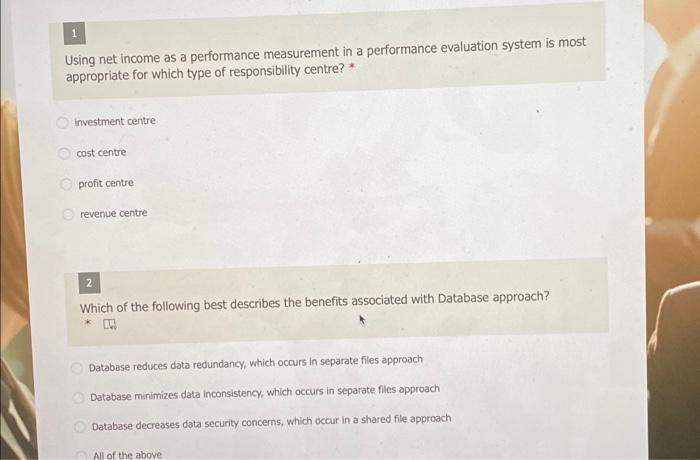

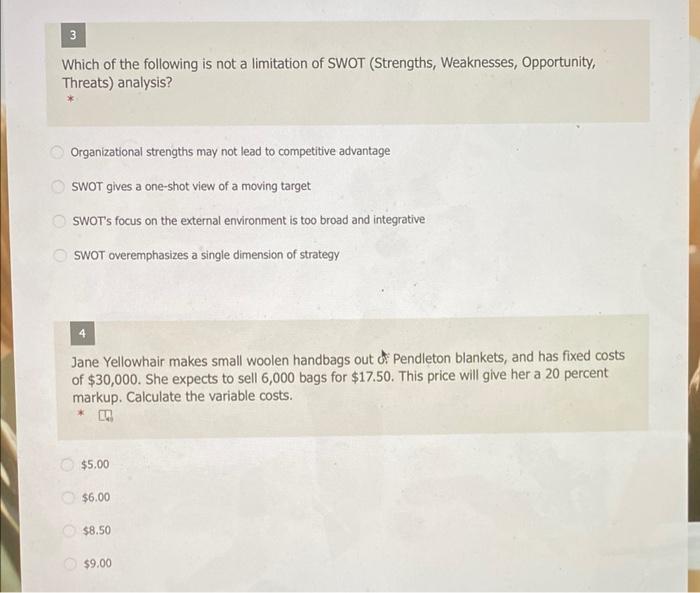

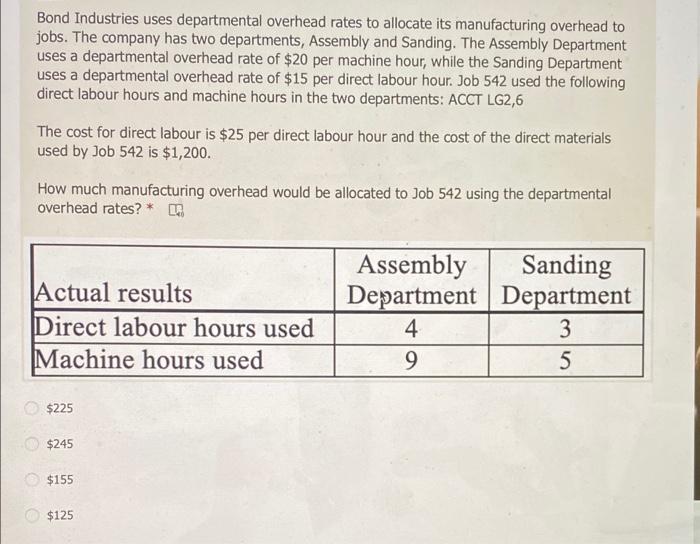

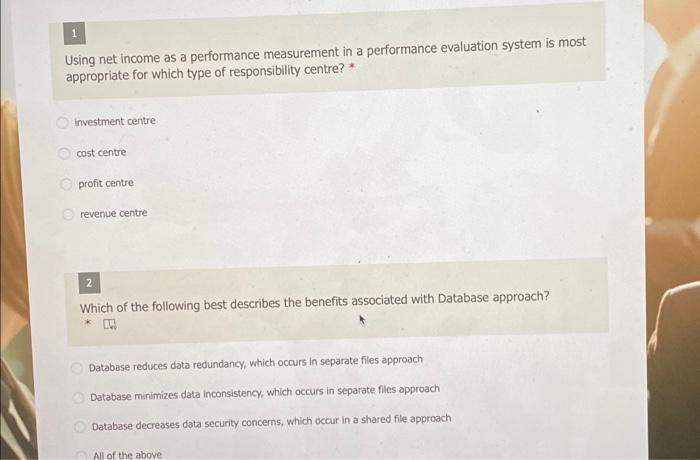

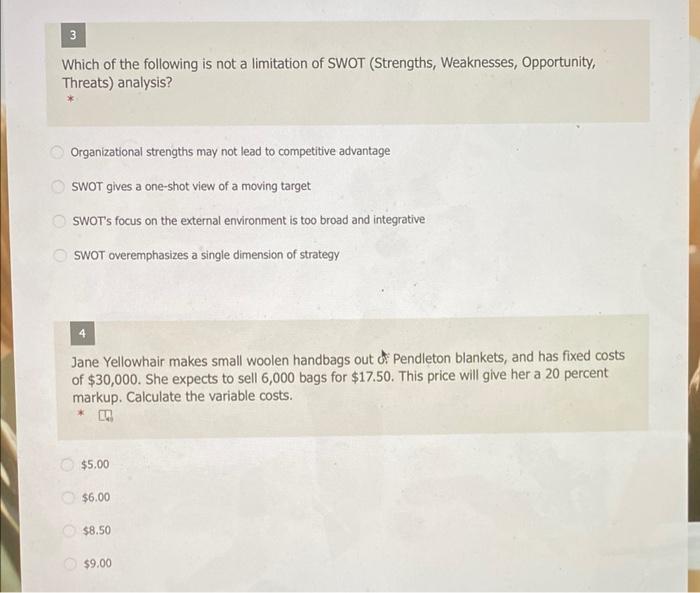

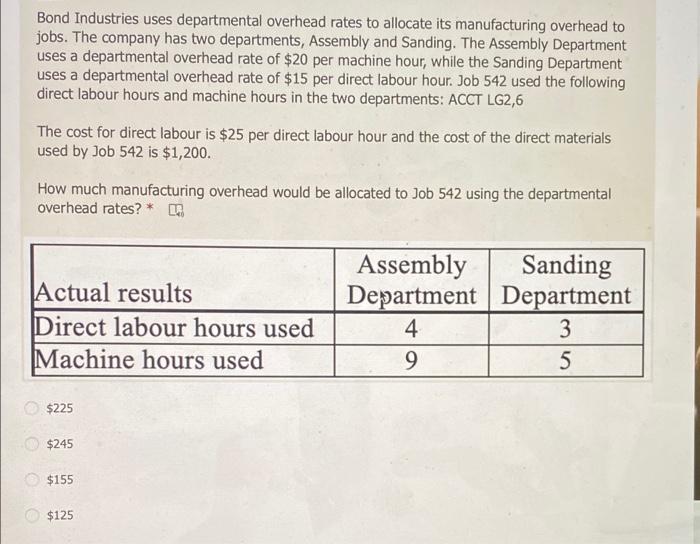

1 Using net income as a performance measurement in a performance evaluation system is most appropriate for which type of responsibility centre? investment centre cost centre profit centre revenue centre 2 Which of the following best describes the benefits associated with Database approach? Database reduces data redundancy, which occurs in separate files approach Database minimizes data inconsistency, which occurs in separate files approach Database decreases data security concerns, which occur in a shared file approach All of the above 3 Which of the following is not a limitation of SWOT (Strengths, Weaknesses, Opportunity, Threats) analysis? Organizational strengths may not lead to competitive advantage SWOT gives a one-shot view of a moving target SWOT's focus on the external environment is too broad and integrative SWOT overemphasizes a single dimension of strategy Jane Yellowhair makes small woolen handbags out of Pendleton blankets, and has fixed costs of $30,000. She expects to sell 6,000 bags for $17.50. This price will give her a 20 percent markup. Calculate the variable costs. $5.00 $6.00 $8.50 $9.00 Bond Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments, Assembly and Sanding. The Assembly Department uses a departmental overhead rate of $20 per machine hour, while the Sanding Department uses a departmental overhead rate of $15 per direct labour hour. Job 542 used the following direct labour hours and machine hours in the two departments: ACCT LG2,6 The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 542 is $1,200. How much manufacturing overhead would be allocated to Job 542 using the departmental overhead rates? * 1 Actual results Direct labour hours used Machine hours used Assembly Sanding Department Department 4 3 9 5 $225 $245 $155 $125

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started