Question

Can you please calculate the liquidity indicators for the Citigroup year 2022. Below is the list of liquidity indicators, I have provided the formulas and

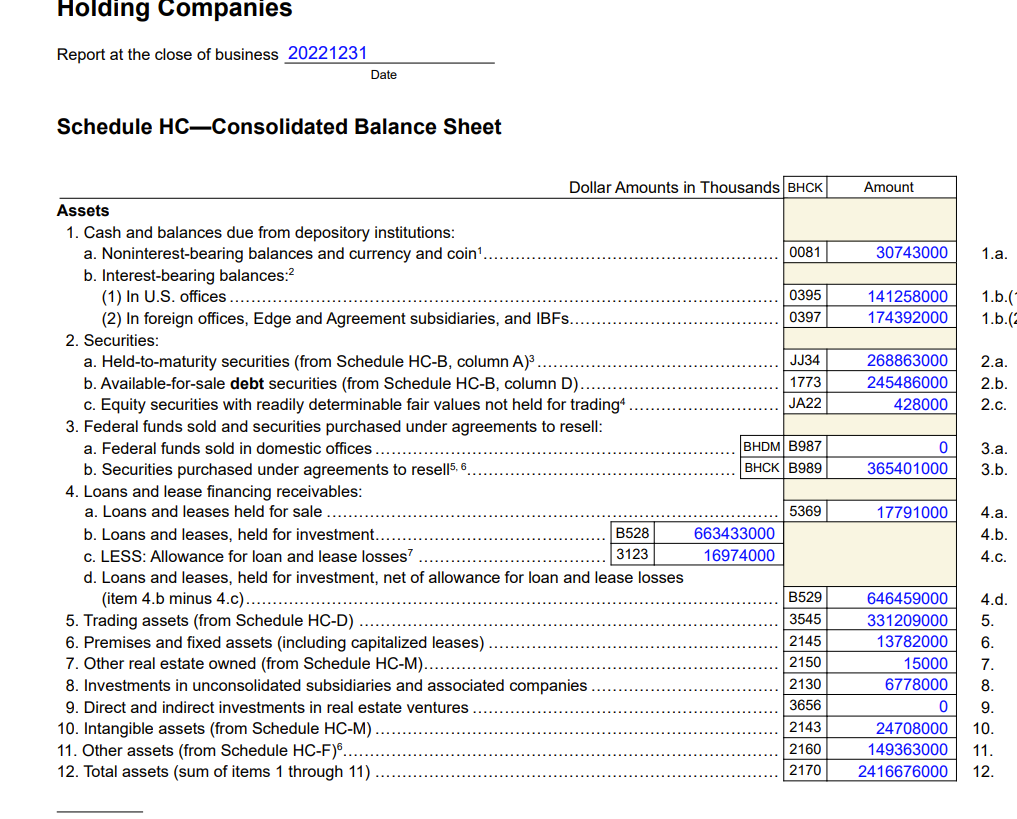

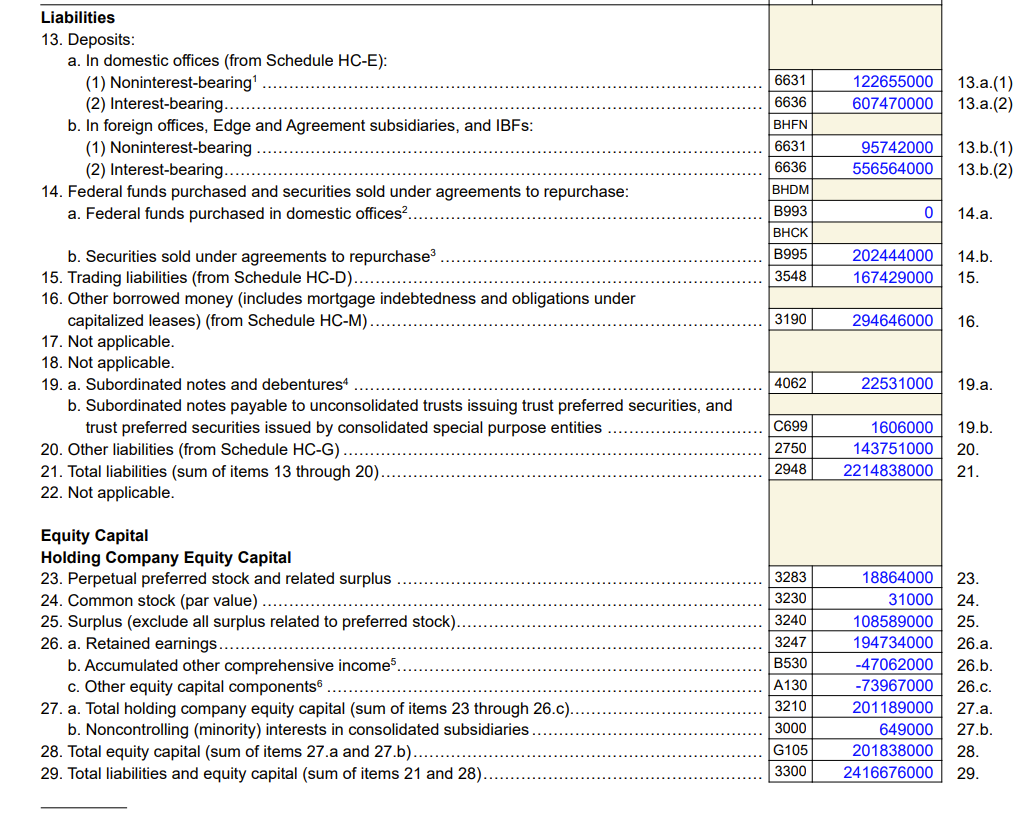

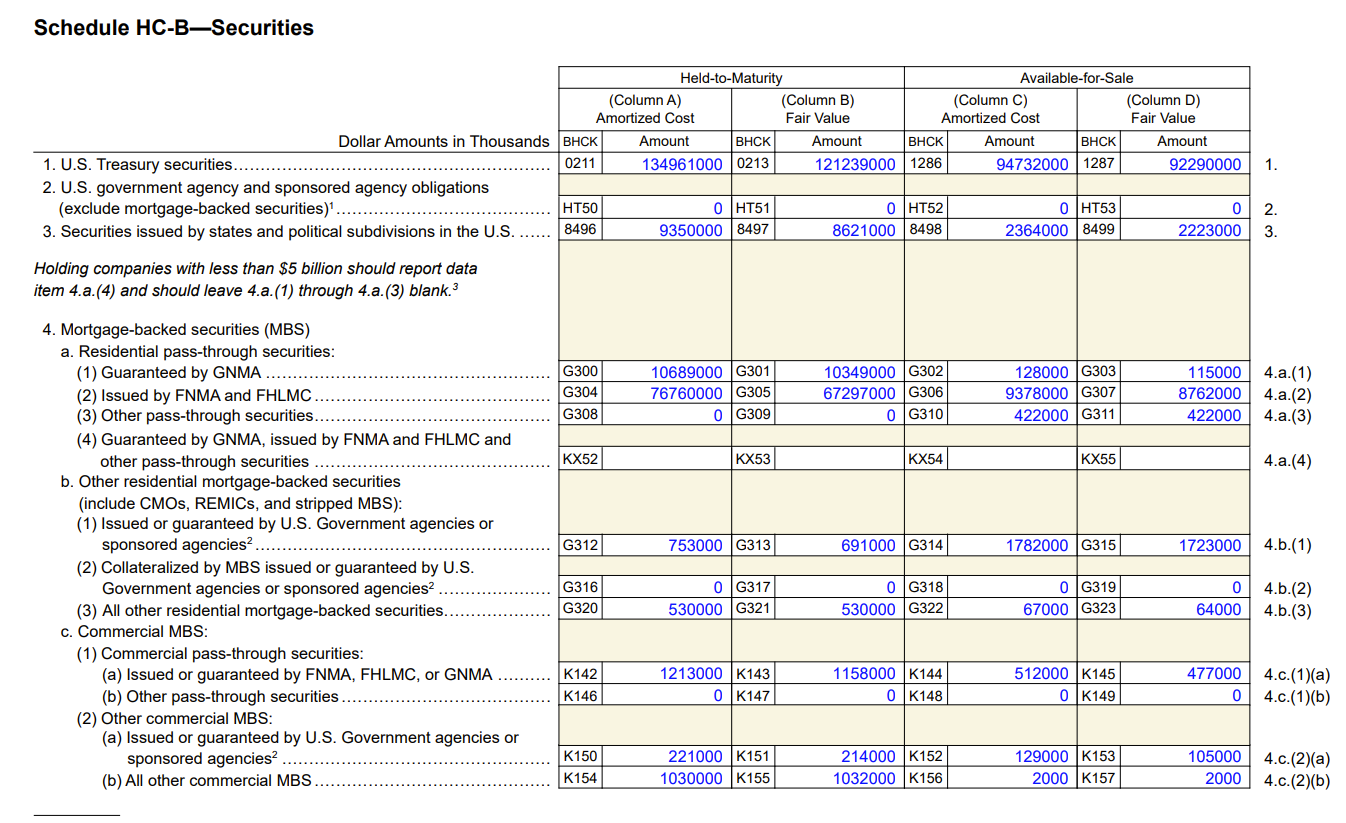

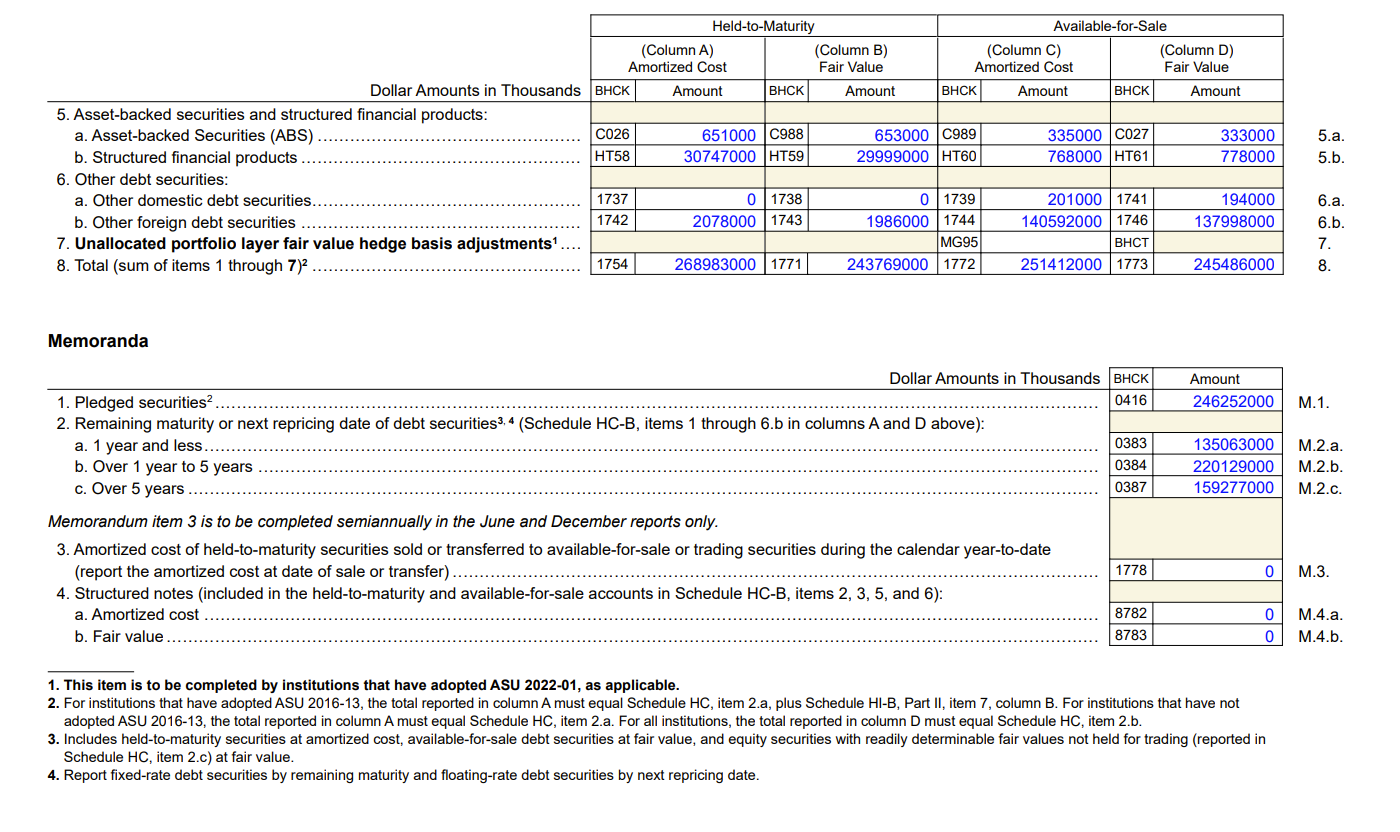

Can you please calculate the liquidity indicators for the Citigroup year 2022. Below is the list of liquidity indicators, I have provided the formulas and the screenshots of the financial statement to help the calculations. I am struggling to pull the appropriate values for these calculations, and I would appreciate if someone could please help me thanks.

Cash Position Indicator= Cash and deposits due from depository institution / Total assets

Liquid Securities Indicator= U.S Government securities / total assets

Net Fed Funds and Repurchase Agreement Indicator= (Fed funds sold and reverse repurchase agreements - Federal Funds purchased and repurchase agreements) / Total assets

Capacity Indicator= Net loans and leases / total assets

Pledged Securities Ratio= Pledged securities / Total security holdings

Hot Money Ratio= (cash and due from deposits held at other depository institutions + holdings of short-term securities + federal funds loans + reverse repurchase agreements) / (large CDS + eurocurrency deposits + federal funds borrowings + repurchase agreements)

Core Deposit Ratio= Core deposits / Total assets

Deposit Composition Ratio=Demand Deposits / time deposits

Loan Commitments Ratio= Unused loan commitments / total assets

| Cash Position Indicator |

| Liquid Securities Indicator |

| Net Fed Funds and Repurchase Agreements Indicator |

| Capacity Indicator |

| Pledged Securities Ratio |

| Hot Money Ratio |

| Core Deposit Ratio |

| Deposit Composition Ratio |

| Loan Commitments Ratio |

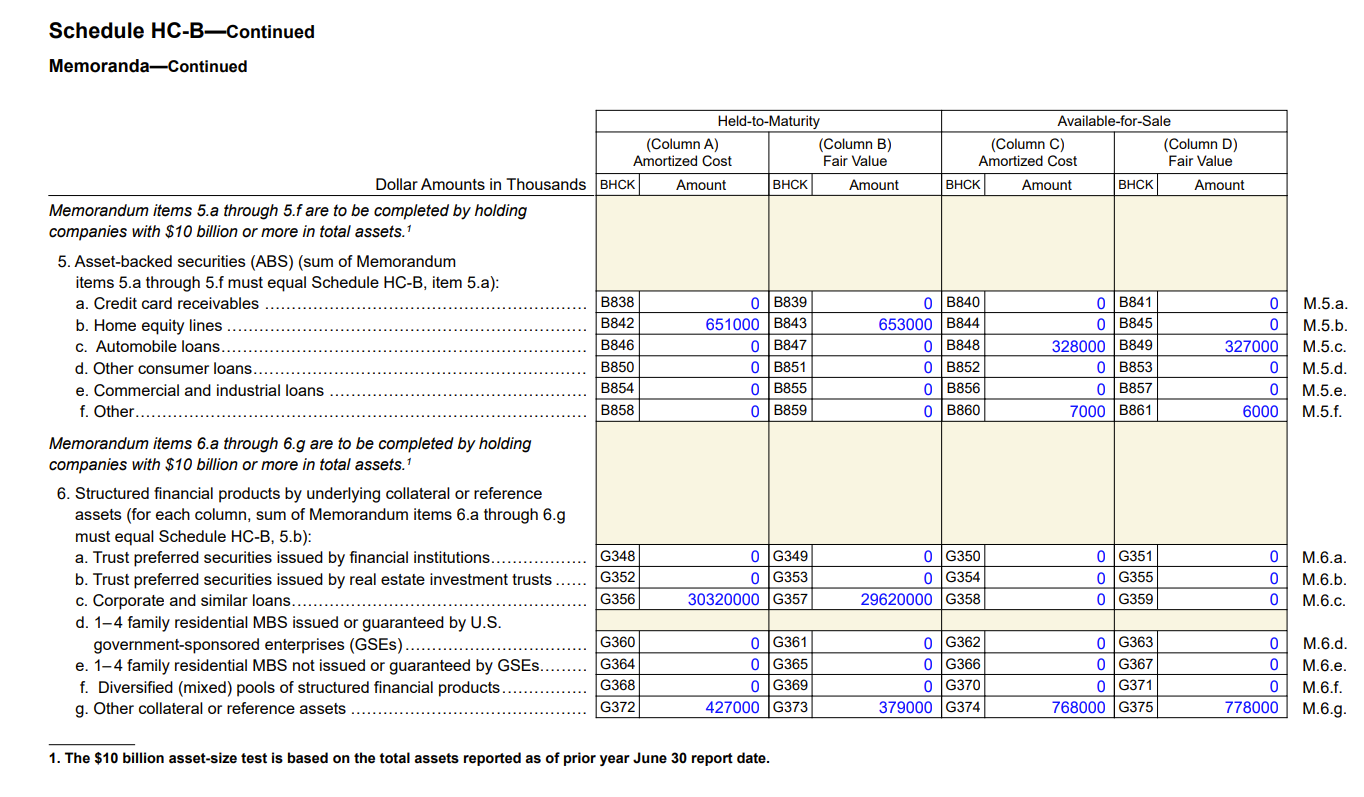

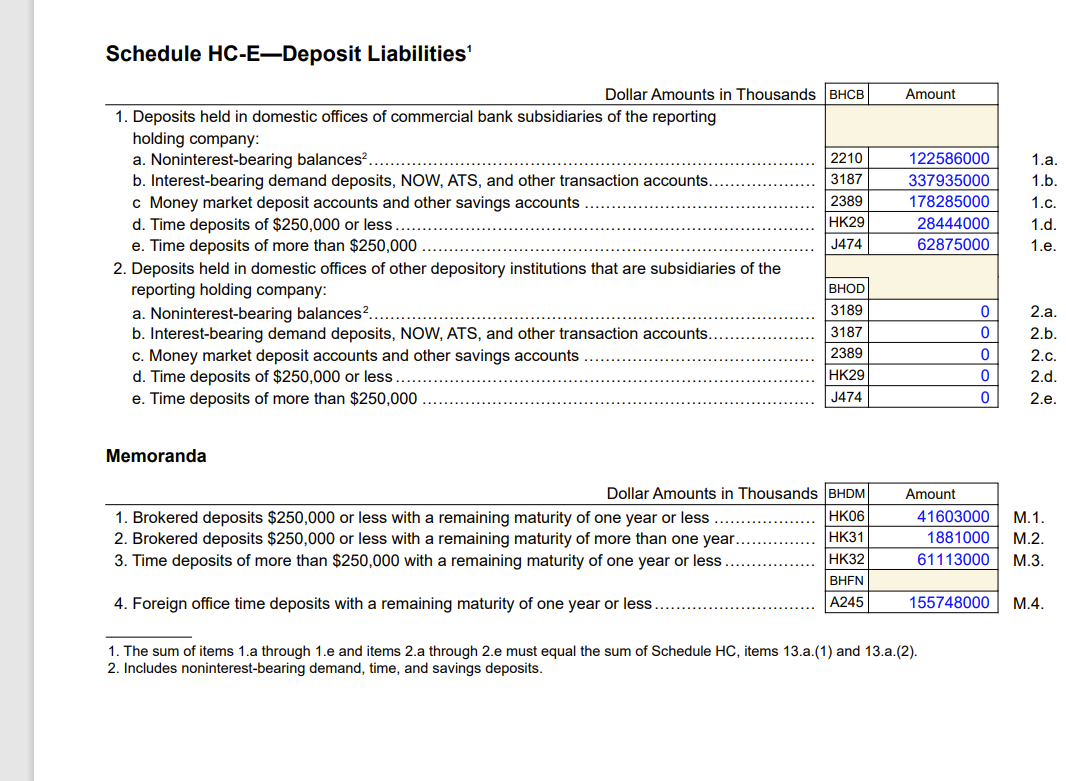

Holding Companies Report at the close of business Date Schedule HC-Consolidated Balance Sheet Liabilities 13. Deposits: a. In domestic offices (from Schedule HC-E): (1) Noninterest-bearing 1 (2) Interest-bearing..... b. In foreign offices, Edge and Agreement subsidiaries, and IBFs: (1) Noninterest-bearing (2) Interest-bearing. 14. Federal funds purchased and securities sold under agreements to repurchase: a. Federal funds purchased in domestic offices 2. 14.a. b. Securities sold under agreements to repurchase 3 14.b. 15. Trading liabilities (from Schedule HC-D). 15. 16. Other borrowed money (includes mortgage indebtedness and obligations under capitalized leases) (from Schedule HC-M) 16. 17. Not applicable. 18. Not applicable. 19. a. Subordinated notes and debentures 4 19.a. b. Subordinated notes payable to unconsolidated trusts issuing trust preferred securities, and trust preferred securities issued by consolidated special purpose entities 19.b. 20. Other liabilities (from Schedule HC-G) 20. 21. Total liabilities (sum of items 13 through 20) 21. 22. Not applicable. Equity Capital Holding Company Equity Capital 23. Perpetual preferred stock and related surplus 23. 24. Common stock (par value) 24. 25. Surplus (exclude all surplus related to preferred stock) 26. a. Retained earnings. 26.a. b. Accumulated other comprehensive income 5 26.b. c. Other equity capital components 6. 26.c. 27. a. Total holding company equity capital (sum of items 23 through 26.c). 27.a. b. Noncontrolling (minority) interests in consolidated subsidiaries 27.b. 28. Total equity capital (sum of items 27 .a and 27.b) 28. 29. Total liabilities and equity capital (sum of items 21 and 28). 29. Schedule HC-B-Securities 1. This item is to be completed by institutions that have adopted ASU 2022-01, as applicable. 2. For institutions that have adopted ASU 2016-13, the total reported in column A must equal Schedule HC, item 2.a, plus Schedule HI-B, Part II, item 7, column B. For institutions that have not adopted ASU 2016-13, the total reported in column A must equal Schedule HC, item 2.a. For all institutions, the total reported in column D must equal Schedule HC, item 2.b. 3. Includes held-to-maturity securities at amortized cost, available-for-sale debt securities at fair value, and equity securities with readily determinable fair values not held for trading (reported in Schedule HC, item 2.c) at fair value. 4. Report fixed-rate debt securities by remaining maturity and floating-rate debt securities by next repricing date. Schedule HC-B-Continued Memoranda-Continued 1. The $10 billion asset-size test is based on the total assets reported as of prior year June 30 report date. 1. The sum of items 1.a through 1.e and items 2.a through 2.e must equal the sum of Schedule HC, items 13.a.(1) and 13.a.(2). 2. Includes noninterest-bearing demand, time, and savings deposits. Holding Companies Report at the close of business Date Schedule HC-Consolidated Balance Sheet Liabilities 13. Deposits: a. In domestic offices (from Schedule HC-E): (1) Noninterest-bearing 1 (2) Interest-bearing..... b. In foreign offices, Edge and Agreement subsidiaries, and IBFs: (1) Noninterest-bearing (2) Interest-bearing. 14. Federal funds purchased and securities sold under agreements to repurchase: a. Federal funds purchased in domestic offices 2. 14.a. b. Securities sold under agreements to repurchase 3 14.b. 15. Trading liabilities (from Schedule HC-D). 15. 16. Other borrowed money (includes mortgage indebtedness and obligations under capitalized leases) (from Schedule HC-M) 16. 17. Not applicable. 18. Not applicable. 19. a. Subordinated notes and debentures 4 19.a. b. Subordinated notes payable to unconsolidated trusts issuing trust preferred securities, and trust preferred securities issued by consolidated special purpose entities 19.b. 20. Other liabilities (from Schedule HC-G) 20. 21. Total liabilities (sum of items 13 through 20) 21. 22. Not applicable. Equity Capital Holding Company Equity Capital 23. Perpetual preferred stock and related surplus 23. 24. Common stock (par value) 24. 25. Surplus (exclude all surplus related to preferred stock) 26. a. Retained earnings. 26.a. b. Accumulated other comprehensive income 5 26.b. c. Other equity capital components 6. 26.c. 27. a. Total holding company equity capital (sum of items 23 through 26.c). 27.a. b. Noncontrolling (minority) interests in consolidated subsidiaries 27.b. 28. Total equity capital (sum of items 27 .a and 27.b) 28. 29. Total liabilities and equity capital (sum of items 21 and 28). 29. Schedule HC-B-Securities 1. This item is to be completed by institutions that have adopted ASU 2022-01, as applicable. 2. For institutions that have adopted ASU 2016-13, the total reported in column A must equal Schedule HC, item 2.a, plus Schedule HI-B, Part II, item 7, column B. For institutions that have not adopted ASU 2016-13, the total reported in column A must equal Schedule HC, item 2.a. For all institutions, the total reported in column D must equal Schedule HC, item 2.b. 3. Includes held-to-maturity securities at amortized cost, available-for-sale debt securities at fair value, and equity securities with readily determinable fair values not held for trading (reported in Schedule HC, item 2.c) at fair value. 4. Report fixed-rate debt securities by remaining maturity and floating-rate debt securities by next repricing date. Schedule HC-B-Continued Memoranda-Continued 1. The $10 billion asset-size test is based on the total assets reported as of prior year June 30 report date. 1. The sum of items 1.a through 1.e and items 2.a through 2.e must equal the sum of Schedule HC, items 13.a.(1) and 13.a.(2). 2. Includes noninterest-bearing demand, time, and savings deposits

Holding Companies Report at the close of business Date Schedule HC-Consolidated Balance Sheet Liabilities 13. Deposits: a. In domestic offices (from Schedule HC-E): (1) Noninterest-bearing 1 (2) Interest-bearing..... b. In foreign offices, Edge and Agreement subsidiaries, and IBFs: (1) Noninterest-bearing (2) Interest-bearing. 14. Federal funds purchased and securities sold under agreements to repurchase: a. Federal funds purchased in domestic offices 2. 14.a. b. Securities sold under agreements to repurchase 3 14.b. 15. Trading liabilities (from Schedule HC-D). 15. 16. Other borrowed money (includes mortgage indebtedness and obligations under capitalized leases) (from Schedule HC-M) 16. 17. Not applicable. 18. Not applicable. 19. a. Subordinated notes and debentures 4 19.a. b. Subordinated notes payable to unconsolidated trusts issuing trust preferred securities, and trust preferred securities issued by consolidated special purpose entities 19.b. 20. Other liabilities (from Schedule HC-G) 20. 21. Total liabilities (sum of items 13 through 20) 21. 22. Not applicable. Equity Capital Holding Company Equity Capital 23. Perpetual preferred stock and related surplus 23. 24. Common stock (par value) 24. 25. Surplus (exclude all surplus related to preferred stock) 26. a. Retained earnings. 26.a. b. Accumulated other comprehensive income 5 26.b. c. Other equity capital components 6. 26.c. 27. a. Total holding company equity capital (sum of items 23 through 26.c). 27.a. b. Noncontrolling (minority) interests in consolidated subsidiaries 27.b. 28. Total equity capital (sum of items 27 .a and 27.b) 28. 29. Total liabilities and equity capital (sum of items 21 and 28). 29. Schedule HC-B-Securities 1. This item is to be completed by institutions that have adopted ASU 2022-01, as applicable. 2. For institutions that have adopted ASU 2016-13, the total reported in column A must equal Schedule HC, item 2.a, plus Schedule HI-B, Part II, item 7, column B. For institutions that have not adopted ASU 2016-13, the total reported in column A must equal Schedule HC, item 2.a. For all institutions, the total reported in column D must equal Schedule HC, item 2.b. 3. Includes held-to-maturity securities at amortized cost, available-for-sale debt securities at fair value, and equity securities with readily determinable fair values not held for trading (reported in Schedule HC, item 2.c) at fair value. 4. Report fixed-rate debt securities by remaining maturity and floating-rate debt securities by next repricing date. Schedule HC-B-Continued Memoranda-Continued 1. The $10 billion asset-size test is based on the total assets reported as of prior year June 30 report date. 1. The sum of items 1.a through 1.e and items 2.a through 2.e must equal the sum of Schedule HC, items 13.a.(1) and 13.a.(2). 2. Includes noninterest-bearing demand, time, and savings deposits. Holding Companies Report at the close of business Date Schedule HC-Consolidated Balance Sheet Liabilities 13. Deposits: a. In domestic offices (from Schedule HC-E): (1) Noninterest-bearing 1 (2) Interest-bearing..... b. In foreign offices, Edge and Agreement subsidiaries, and IBFs: (1) Noninterest-bearing (2) Interest-bearing. 14. Federal funds purchased and securities sold under agreements to repurchase: a. Federal funds purchased in domestic offices 2. 14.a. b. Securities sold under agreements to repurchase 3 14.b. 15. Trading liabilities (from Schedule HC-D). 15. 16. Other borrowed money (includes mortgage indebtedness and obligations under capitalized leases) (from Schedule HC-M) 16. 17. Not applicable. 18. Not applicable. 19. a. Subordinated notes and debentures 4 19.a. b. Subordinated notes payable to unconsolidated trusts issuing trust preferred securities, and trust preferred securities issued by consolidated special purpose entities 19.b. 20. Other liabilities (from Schedule HC-G) 20. 21. Total liabilities (sum of items 13 through 20) 21. 22. Not applicable. Equity Capital Holding Company Equity Capital 23. Perpetual preferred stock and related surplus 23. 24. Common stock (par value) 24. 25. Surplus (exclude all surplus related to preferred stock) 26. a. Retained earnings. 26.a. b. Accumulated other comprehensive income 5 26.b. c. Other equity capital components 6. 26.c. 27. a. Total holding company equity capital (sum of items 23 through 26.c). 27.a. b. Noncontrolling (minority) interests in consolidated subsidiaries 27.b. 28. Total equity capital (sum of items 27 .a and 27.b) 28. 29. Total liabilities and equity capital (sum of items 21 and 28). 29. Schedule HC-B-Securities 1. This item is to be completed by institutions that have adopted ASU 2022-01, as applicable. 2. For institutions that have adopted ASU 2016-13, the total reported in column A must equal Schedule HC, item 2.a, plus Schedule HI-B, Part II, item 7, column B. For institutions that have not adopted ASU 2016-13, the total reported in column A must equal Schedule HC, item 2.a. For all institutions, the total reported in column D must equal Schedule HC, item 2.b. 3. Includes held-to-maturity securities at amortized cost, available-for-sale debt securities at fair value, and equity securities with readily determinable fair values not held for trading (reported in Schedule HC, item 2.c) at fair value. 4. Report fixed-rate debt securities by remaining maturity and floating-rate debt securities by next repricing date. Schedule HC-B-Continued Memoranda-Continued 1. The $10 billion asset-size test is based on the total assets reported as of prior year June 30 report date. 1. The sum of items 1.a through 1.e and items 2.a through 2.e must equal the sum of Schedule HC, items 13.a.(1) and 13.a.(2). 2. Includes noninterest-bearing demand, time, and savings deposits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started