Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CAN YOU PLEASE DO IT AND SHOW IT IN EXCEL? THANK YOU! The Lion s Firm is considering buying a vacant lot that is selling

CAN YOU PLEASE DO IT AND SHOW IT IN EXCEL? THANK YOU!

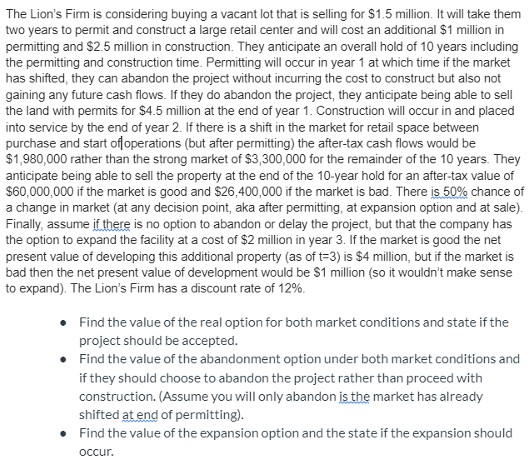

The Lions Firm is considering buying a vacant lot that is selling for $ million. It will take them two years to permit and construct a large retail center and will cost an additional $ million in permitting and $ million in construction. They anticipate an overall hold of years including the permitting and construction time. Permitting will occur in year at which time if the market has shifted, they can abandon the project without incurring the cost to construct but also not gaining any future cash flows. If they do abandon the project, they anticipate being able to sell the land with permits for $ million at the end of year Construction will occur in and placed into service by the end of year If there is a shift in the market for retail space between purchase and start of operations but after permitting the aftertax cash flows would be $ rather than the strong market of $ for the remainder of the years. They anticipate being able to sell the property at the end of the year hold for an aftertax value of $ if the market is good and $ if the market is bad. There is chance of a change in market at any decision point, aka after permitting, at expansion option and at sale Finally, assume if there is no option to abandon or delay the project, but that the company has the option to expand the facility at a cost of $ million in year If the market is good the net present value of developing this additional property as of t is $ million, but if the market is bad then the net present value of development would be $ million so it wouldnt make sense to expand The Lions Firm has a discount rate of

Find the value of the real option for both market conditions and state if the project should be accepted.

Find the value of the abandonment option under both market conditions and if they should choose to abandon the project rather than proceed with construction. Assume you will only abandon is the market has already shifted at end of permitting

Find the value of the expansion option and the state if the expansion should occur.

CAN YOU PLEASE DO IT AND SHOW IT IN EXCEL? THANK YOU!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started