can you please fill in the excel?

can you please fill in the excel?

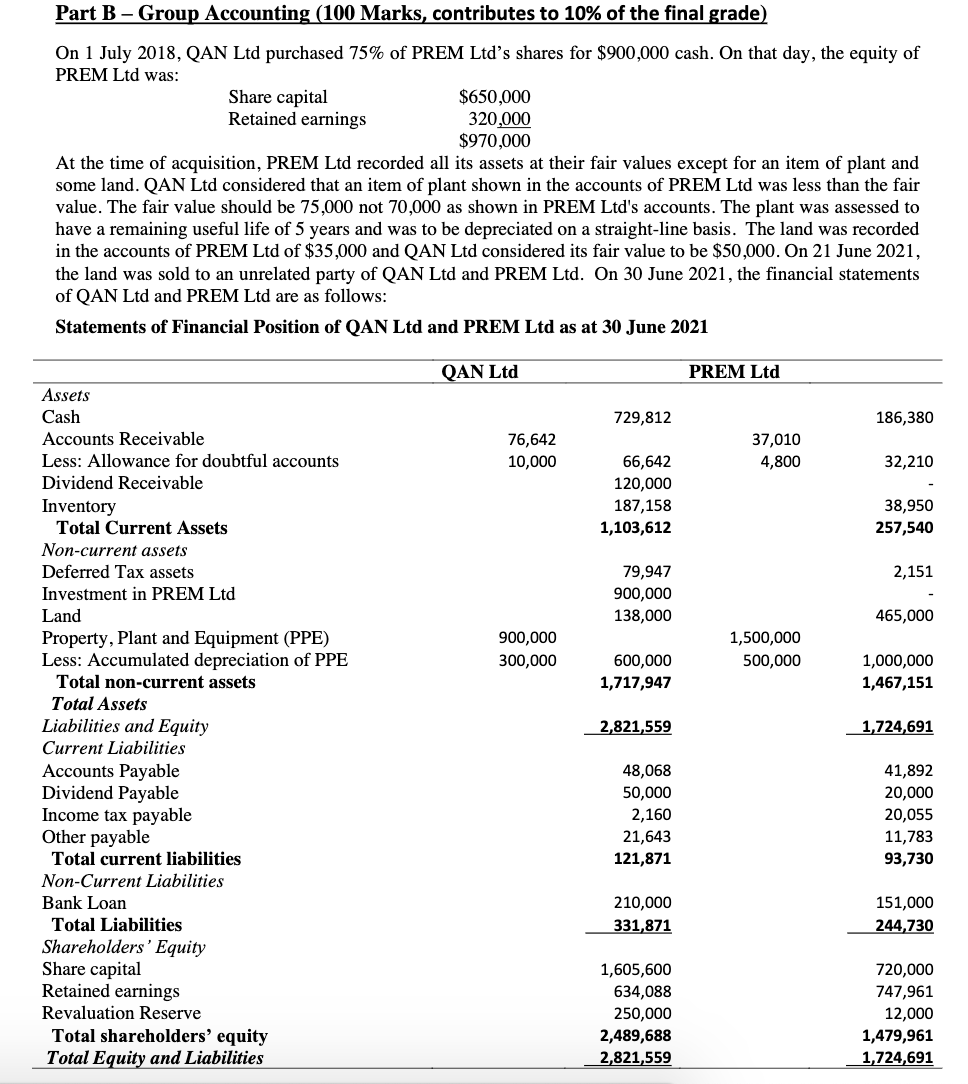

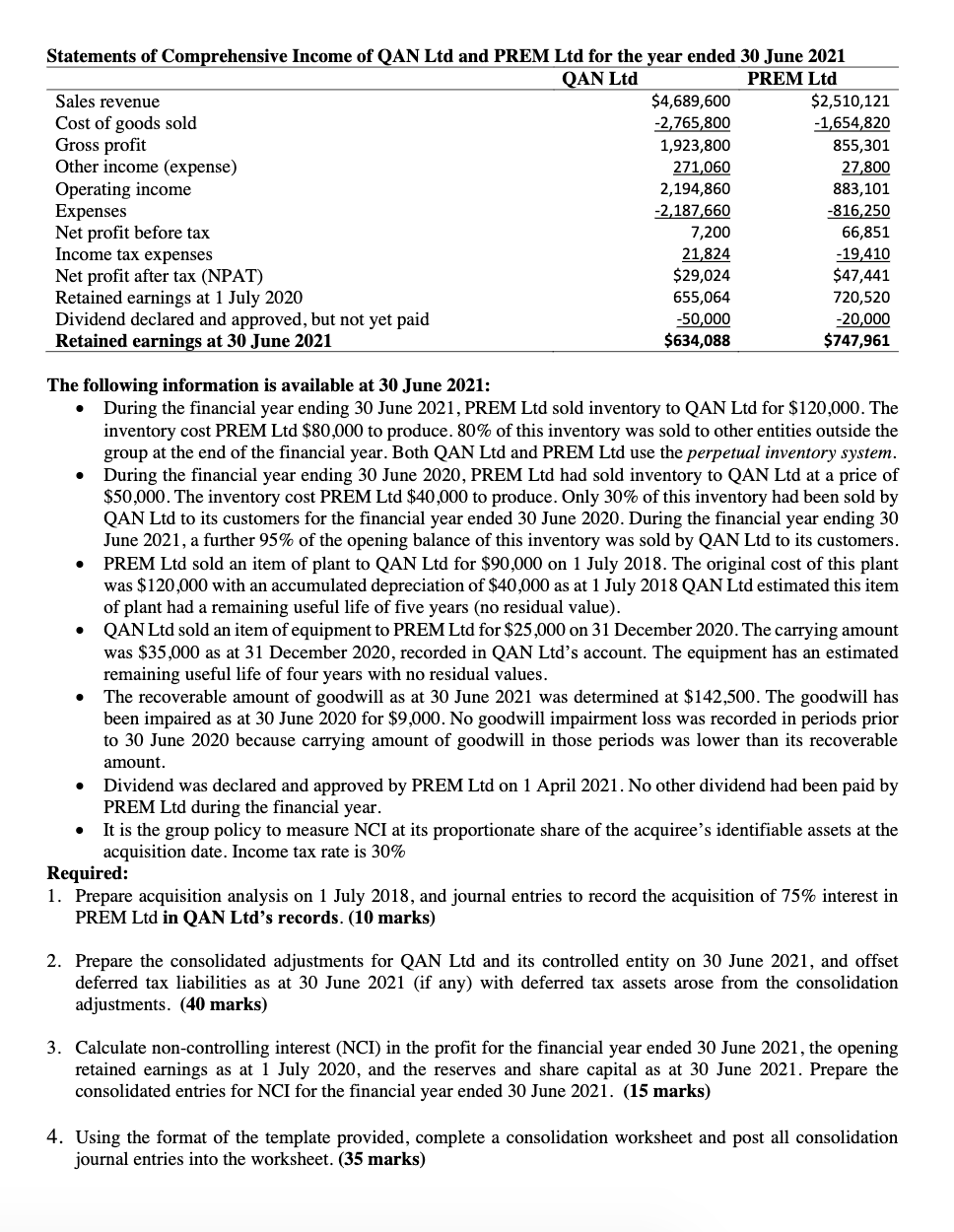

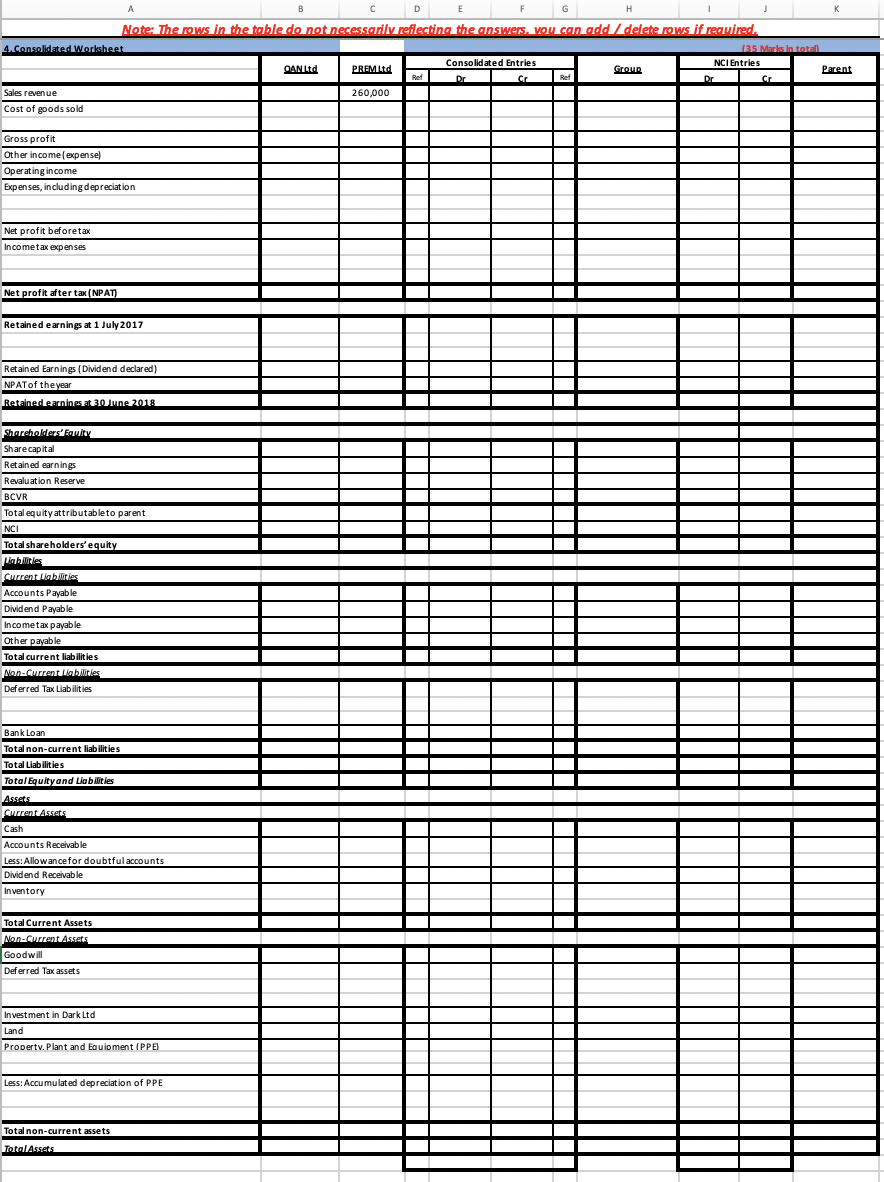

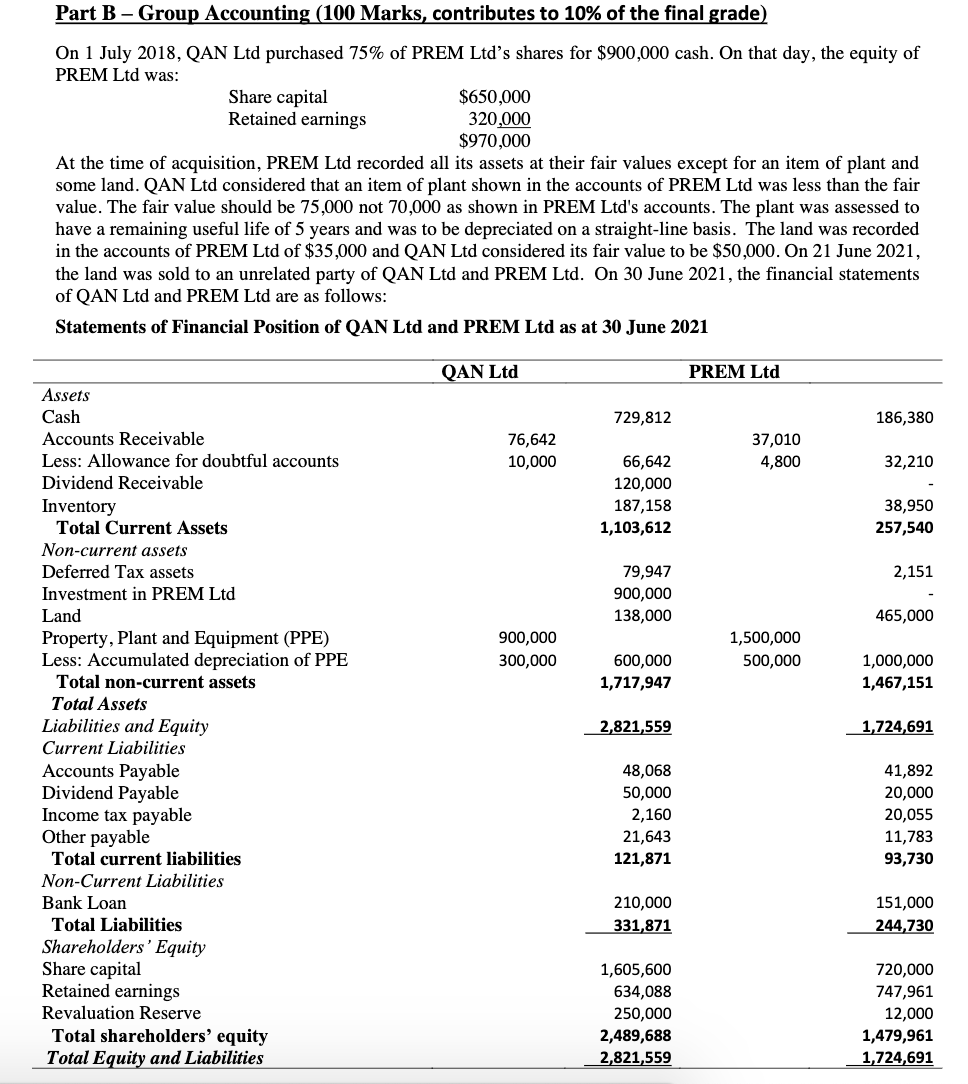

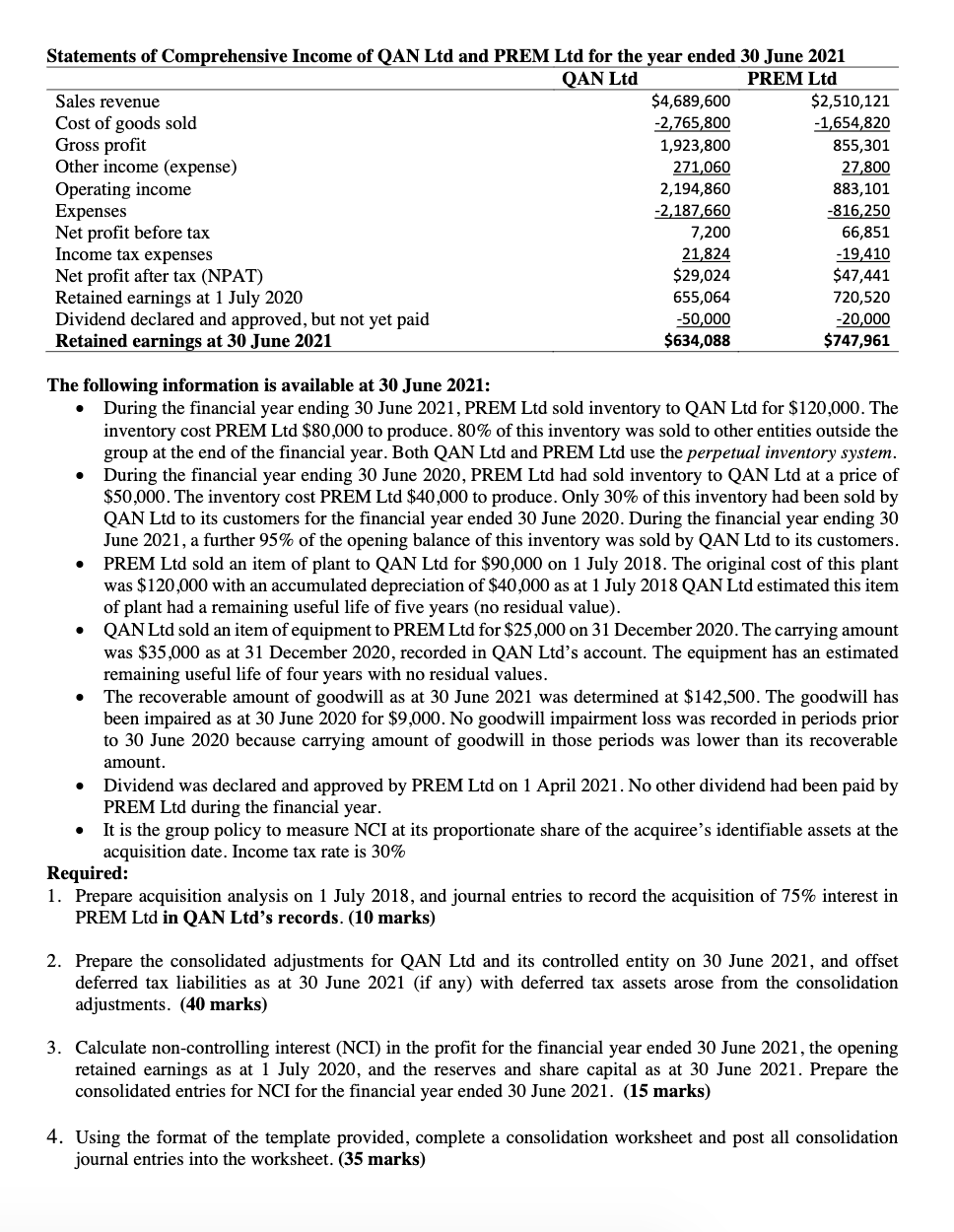

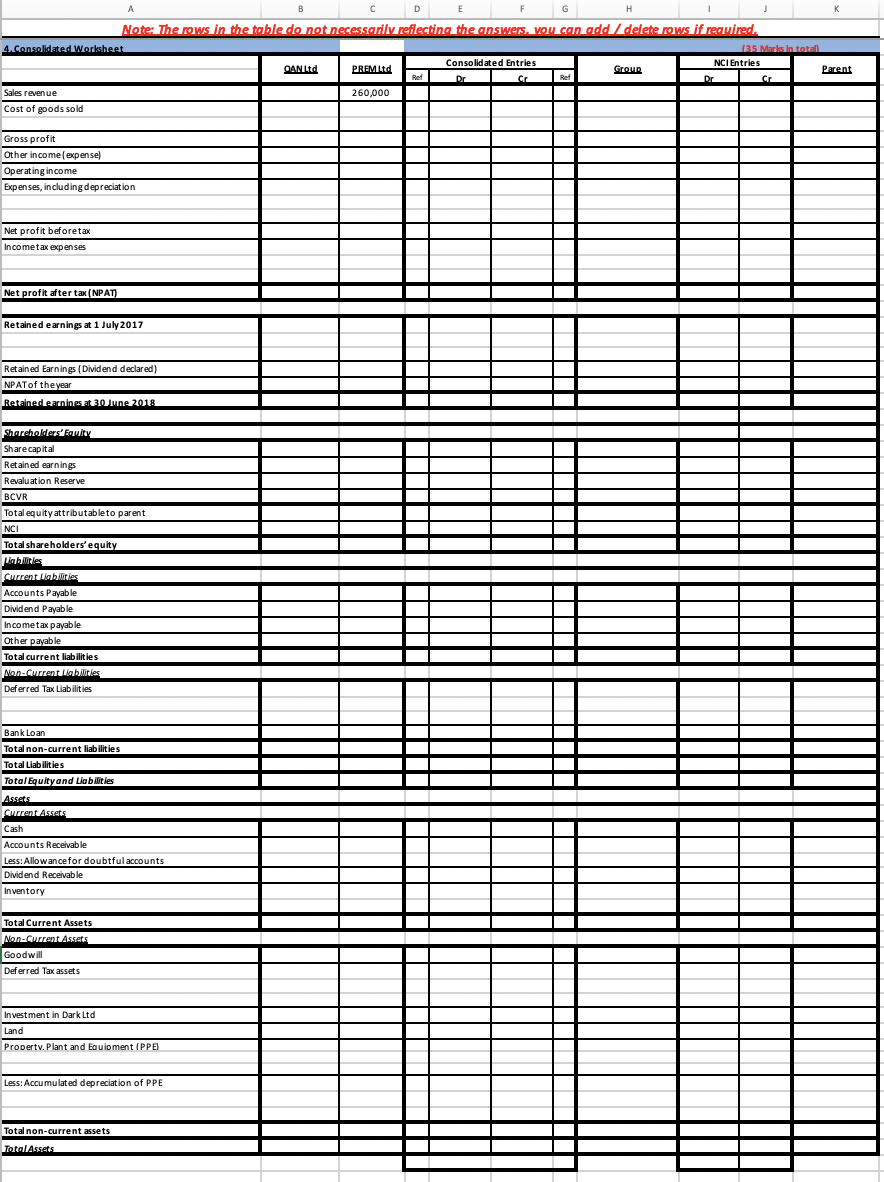

Part B - Group Accounting (100 Marks, contributes to 10% of the final grade) On 1 July 2018, QAN Ltd purchased 75% of PREM Ltd's shares for $900,000 cash. On that day, the equity of PREM Ltd was: Share capital $650,000 Retained earnings 320,000 $970,000 At the time of acquisition, PREM Ltd recorded all its assets at their fair values except for an item of plant and some land. QAN Ltd considered that an item of plant shown in the accounts of PREM Ltd was less than the fair value. The fair value should be 75,000 not 70,000 as shown in PREM Ltd's accounts. The plant was assessed to have a remaining useful life of 5 years and was to be depreciated on a straight-line basis. The land was recorded in the accounts of PREM Ltd of $35,000 and QAN Ltd considered its fair value to be $50,000. On 21 June 2021, the land was sold to an unrelated party of QAN Ltd and PREM Ltd. On 30 June 2021, the financial statements of QAN Ltd and PREM Ltd are as follows: Statements of Financial Position of QAN Ltd and PREM Ltd as at 30 June 2021 QAN Ltd PREM Ltd 729,812 186,380 37,010 76,642 10,000 32,210 66,642 120,000 187,158 1,103,612 38,950 257,540 2,151 79,947 900,000 138,000 465,000 900,000 300,000 1,500,000 500,000 600,000 1,717,947 1,000,000 1,467,151 Assets Cash Accounts Receivable Less: Allowance for doubtful accounts Dividend Receivable Inventory Total Current Assets Non-current assets Deferred Tax assets Investment in PREM Ltd Land Property, Plant and Equipment (PPE) Less: Accumulated depreciation of PPE Total non-current assets Total Assets Liabilities and Equity Current Liabilities Accounts Payable Dividend Payable Income tax payable Other payable Total current liabilities Non-Current Liabilities Bank Loan Total Liabilities Shareholders' Equity Share capital Retained earnings Revaluation Reserve Total shareholders' equity Total Equity and Liabilities 2,821,559 1,724,691 48,068 50,000 2,160 21,643 121,871 41,892 20,000 20,055 11,783 93,730 210,000 331,871 151,000 244,730 1,605,600 634,088 250,000 2,489,688 2,821,559 720,000 747,961 12,000 1,479,961 1,724,691 Statements of Comprehensive Income of QAN Ltd and PREM Ltd for the year ended 30 June 2021 QAN Ltd PREM Ltd Sales revenue $4,689,600 $2,510,121 Cost of goods sold -2,765,800 -1,654,820 Gross profit 1,923,800 855,301 Other income (expense) 271,060 27,800 Operating income 2,194,860 883,101 Expenses -2,187,660 -816,250 Net profit before tax 7,200 66,851 Income tax expenses 21,824 -19,410 Net profit after tax (NPAT) $29,024 $47,441 Retained earnings at 1 July 2020 655,064 720,520 Dividend declared and approved, but not yet paid -50,000 -20,000 Retained earnings at 30 June 2021 $634,088 $747,961 The following information is available at 30 June 2021: During the financial year ending 30 June 2021, PREM Ltd sold inventory to QAN Ltd for $120,000. The inventory cost PREM Ltd $80,000 to produce. 80% of this inventory was sold to other entities outside the group at the end of the financial year. Both QAN Ltd and PREM Ltd use the perpetual inventory system. During the financial year ending 30 June 2020, PREM Ltd had sold inventory to QAN Ltd at a price of $50,000. The inventory cost PREM Ltd $40,000 to produce. Only 30% of this inventory had been sold by QAN Ltd to its customers for the financial year ended 30 June 2020. During the financial year ending 30 June 2021, a further 95% of the opening balance of this inventory was sold by QAN Ltd to its customers. PREM Ltd sold an item of plant to QAN Ltd for $90,000 on 1 July 2018. The original cost of this plant was $120,000 with an accumulated depreciation of $40,000 as at 1 July 2018 QAN Ltd estimated this item of plant had a remaining useful life of five years (no residual value). QAN Ltd sold an item of equipment to PREM Ltd for $25,000 on 31 December 2020. The carrying amount was $35,000 as at 31 December 2020, recorded in QAN Ltd's account. The equipment has an estimated remaining useful life of four years with no residual values. The recoverable amount of goodwill as at 30 June 2021 was determined at $142,500. The goodwill has been impaired as at 30 June 2020 for $9,000. No goodwill impairment loss was recorded in periods prior to 30 June 2020 because carrying amount of goodwill in those periods was lower than its recoverable amount. Dividend was declared and approved by PREM Ltd on 1 April 2021. No other dividend had been paid by PREM Ltd during the financial year. It is the group policy to measure NCI at its proportionate share of the acquiree's identifiable assets at the acquisition date. Income tax rate is 30% Required: 1. Prepare acquisition analysis on 1 July 2018, and journal entries to record the acquisition of 75% interest in PREM Ltd in QAN Ltd's records. (10 marks) 2. Prepare the consolidated adjustments for QAN Ltd and its controlled entity on 30 June 2021, and offset deferred tax liabilities as at 30 June 2021 (if any) with deferred tax assets arose from the consolidation adjustments. (40 marks) 3. Calculate non-controlling interest (NCI) in the profit for the financial year ended 30 June 2021, the opening retained earnings as at 1 July 2020, and the reserves and share capital as at 30 June 2021. Prepare the consolidated entries for NCI for the financial year ended 30 June 2021. (15 marks) 4. Using the format of the template provided, complete a consolidation worksheet and post all consolidation journal entries into the worksheet. (35 marks) A D H K B E F Note: The rows in the table do not necessarily reflecting the answers, vou can add /delete rows if required. 4. Consolidated Worksheet 135 Marks in total Consolidated Entries QANLI PREMIE NCI Entries Grove Parent Ref Dr Ret Dr 260,000 Sales revenue Cost of goods sold Gross profit Other income expensel Operating income Expenses, including depreciation Net profit beforetax Income tax expenses Net profit after tax (NPAT) Retained earnings at 1 July 2017 Retained Earnings (Dividend declared) NPATof the year Retained earnings at 30 June 2018 Shareholders' Emily Share capital Retained earnings Revaluation Reserve BCVR - Total equity attributable to parent NCI Total Total shareholders' equity Lahtitles Current Liabilities Accounts Payable ma Dividend Payable Incometax payable Other payable Total current liabilities Non-Current Liabilities Deferred Tax Liabilities Bank Loan Total non-current liabilities Total Liabilities Total Equity and Liabilities Assets Current Assets Cash Accounts Receivable Less: Allowance for doubtful accounts Dividend Receivable Inventory Assets Total Current Assets Non-Current Assets Goodwill Deferred Tax assets Investment in Dark Ltd Land Property. Plant and Equipment (PPE) Less: Accumulated depreciation of PPE : Total non-current assets Total Assets Part B - Group Accounting (100 Marks, contributes to 10% of the final grade) On 1 July 2018, QAN Ltd purchased 75% of PREM Ltd's shares for $900,000 cash. On that day, the equity of PREM Ltd was: Share capital $650,000 Retained earnings 320,000 $970,000 At the time of acquisition, PREM Ltd recorded all its assets at their fair values except for an item of plant and some land. QAN Ltd considered that an item of plant shown in the accounts of PREM Ltd was less than the fair value. The fair value should be 75,000 not 70,000 as shown in PREM Ltd's accounts. The plant was assessed to have a remaining useful life of 5 years and was to be depreciated on a straight-line basis. The land was recorded in the accounts of PREM Ltd of $35,000 and QAN Ltd considered its fair value to be $50,000. On 21 June 2021, the land was sold to an unrelated party of QAN Ltd and PREM Ltd. On 30 June 2021, the financial statements of QAN Ltd and PREM Ltd are as follows: Statements of Financial Position of QAN Ltd and PREM Ltd as at 30 June 2021 QAN Ltd PREM Ltd 729,812 186,380 37,010 76,642 10,000 32,210 66,642 120,000 187,158 1,103,612 38,950 257,540 2,151 79,947 900,000 138,000 465,000 900,000 300,000 1,500,000 500,000 600,000 1,717,947 1,000,000 1,467,151 Assets Cash Accounts Receivable Less: Allowance for doubtful accounts Dividend Receivable Inventory Total Current Assets Non-current assets Deferred Tax assets Investment in PREM Ltd Land Property, Plant and Equipment (PPE) Less: Accumulated depreciation of PPE Total non-current assets Total Assets Liabilities and Equity Current Liabilities Accounts Payable Dividend Payable Income tax payable Other payable Total current liabilities Non-Current Liabilities Bank Loan Total Liabilities Shareholders' Equity Share capital Retained earnings Revaluation Reserve Total shareholders' equity Total Equity and Liabilities 2,821,559 1,724,691 48,068 50,000 2,160 21,643 121,871 41,892 20,000 20,055 11,783 93,730 210,000 331,871 151,000 244,730 1,605,600 634,088 250,000 2,489,688 2,821,559 720,000 747,961 12,000 1,479,961 1,724,691 Statements of Comprehensive Income of QAN Ltd and PREM Ltd for the year ended 30 June 2021 QAN Ltd PREM Ltd Sales revenue $4,689,600 $2,510,121 Cost of goods sold -2,765,800 -1,654,820 Gross profit 1,923,800 855,301 Other income (expense) 271,060 27,800 Operating income 2,194,860 883,101 Expenses -2,187,660 -816,250 Net profit before tax 7,200 66,851 Income tax expenses 21,824 -19,410 Net profit after tax (NPAT) $29,024 $47,441 Retained earnings at 1 July 2020 655,064 720,520 Dividend declared and approved, but not yet paid -50,000 -20,000 Retained earnings at 30 June 2021 $634,088 $747,961 The following information is available at 30 June 2021: During the financial year ending 30 June 2021, PREM Ltd sold inventory to QAN Ltd for $120,000. The inventory cost PREM Ltd $80,000 to produce. 80% of this inventory was sold to other entities outside the group at the end of the financial year. Both QAN Ltd and PREM Ltd use the perpetual inventory system. During the financial year ending 30 June 2020, PREM Ltd had sold inventory to QAN Ltd at a price of $50,000. The inventory cost PREM Ltd $40,000 to produce. Only 30% of this inventory had been sold by QAN Ltd to its customers for the financial year ended 30 June 2020. During the financial year ending 30 June 2021, a further 95% of the opening balance of this inventory was sold by QAN Ltd to its customers. PREM Ltd sold an item of plant to QAN Ltd for $90,000 on 1 July 2018. The original cost of this plant was $120,000 with an accumulated depreciation of $40,000 as at 1 July 2018 QAN Ltd estimated this item of plant had a remaining useful life of five years (no residual value). QAN Ltd sold an item of equipment to PREM Ltd for $25,000 on 31 December 2020. The carrying amount was $35,000 as at 31 December 2020, recorded in QAN Ltd's account. The equipment has an estimated remaining useful life of four years with no residual values. The recoverable amount of goodwill as at 30 June 2021 was determined at $142,500. The goodwill has been impaired as at 30 June 2020 for $9,000. No goodwill impairment loss was recorded in periods prior to 30 June 2020 because carrying amount of goodwill in those periods was lower than its recoverable amount. Dividend was declared and approved by PREM Ltd on 1 April 2021. No other dividend had been paid by PREM Ltd during the financial year. It is the group policy to measure NCI at its proportionate share of the acquiree's identifiable assets at the acquisition date. Income tax rate is 30% Required: 1. Prepare acquisition analysis on 1 July 2018, and journal entries to record the acquisition of 75% interest in PREM Ltd in QAN Ltd's records. (10 marks) 2. Prepare the consolidated adjustments for QAN Ltd and its controlled entity on 30 June 2021, and offset deferred tax liabilities as at 30 June 2021 (if any) with deferred tax assets arose from the consolidation adjustments. (40 marks) 3. Calculate non-controlling interest (NCI) in the profit for the financial year ended 30 June 2021, the opening retained earnings as at 1 July 2020, and the reserves and share capital as at 30 June 2021. Prepare the consolidated entries for NCI for the financial year ended 30 June 2021. (15 marks) 4. Using the format of the template provided, complete a consolidation worksheet and post all consolidation journal entries into the worksheet. (35 marks) A D H K B E F Note: The rows in the table do not necessarily reflecting the answers, vou can add /delete rows if required. 4. Consolidated Worksheet 135 Marks in total Consolidated Entries QANLI PREMIE NCI Entries Grove Parent Ref Dr Ret Dr 260,000 Sales revenue Cost of goods sold Gross profit Other income expensel Operating income Expenses, including depreciation Net profit beforetax Income tax expenses Net profit after tax (NPAT) Retained earnings at 1 July 2017 Retained Earnings (Dividend declared) NPATof the year Retained earnings at 30 June 2018 Shareholders' Emily Share capital Retained earnings Revaluation Reserve BCVR - Total equity attributable to parent NCI Total Total shareholders' equity Lahtitles Current Liabilities Accounts Payable ma Dividend Payable Incometax payable Other payable Total current liabilities Non-Current Liabilities Deferred Tax Liabilities Bank Loan Total non-current liabilities Total Liabilities Total Equity and Liabilities Assets Current Assets Cash Accounts Receivable Less: Allowance for doubtful accounts Dividend Receivable Inventory Assets Total Current Assets Non-Current Assets Goodwill Deferred Tax assets Investment in Dark Ltd Land Property. Plant and Equipment (PPE) Less: Accumulated depreciation of PPE : Total non-current assets Total Assets

can you please fill in the excel?

can you please fill in the excel?