Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please show your work, so I can understand. thank yoh. :) Use the following to answer questions 5-15 (Straight Line, Double declining balance

can you please show your work, so I can understand. thank yoh. :)

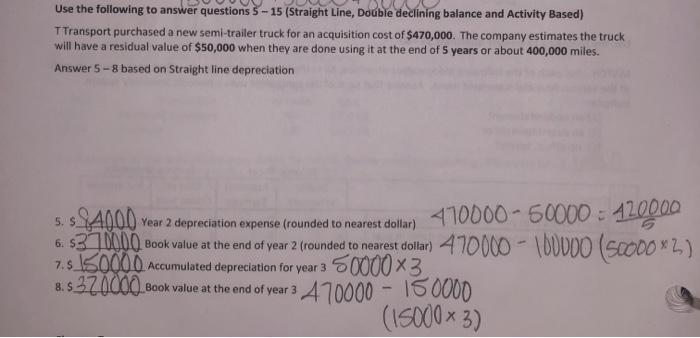

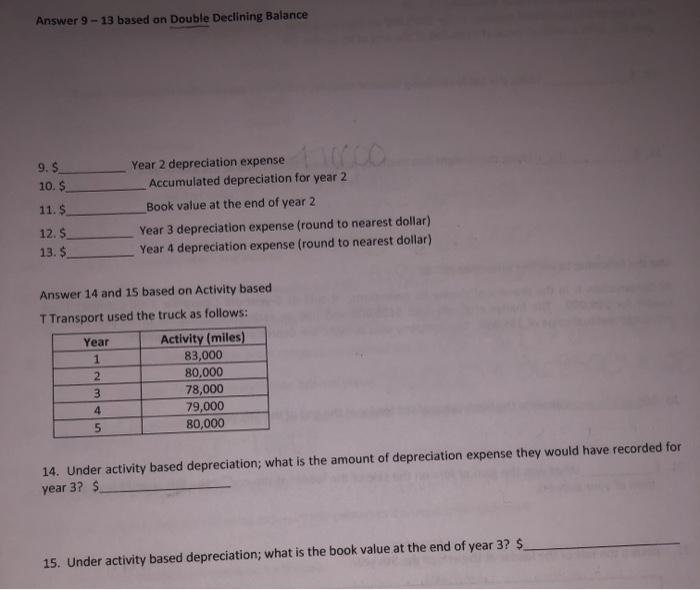

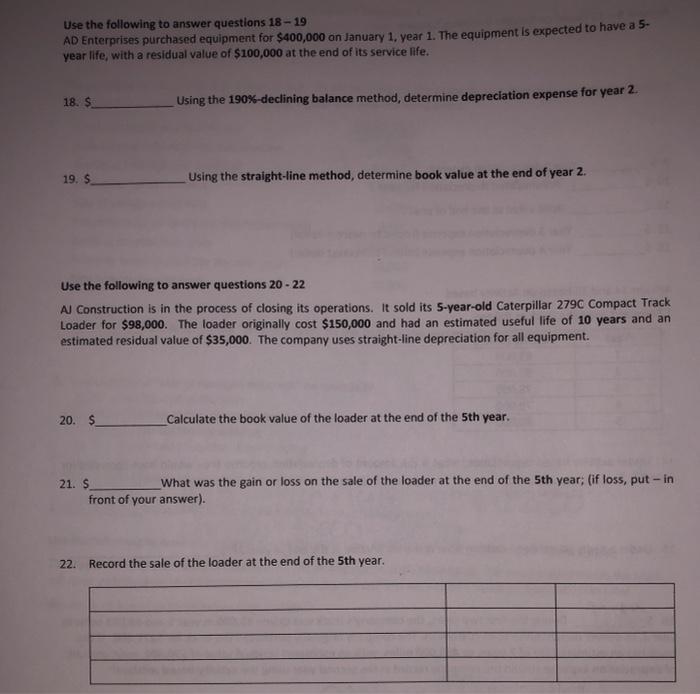

Use the following to answer questions 5-15 (Straight Line, Double declining balance and Activity Based) TTransport purchased a new semi-trailer truck for an acquisition cost of $470,000. The company estimates the truck will have a residual value of $50,000 when they are done using it at the end of 5 years or about 400,000 miles. Answer 5-8 based on Straight line depreciation 5. 84000 Year 2 depreciation expense (rounded to nearest dollar) 410000 - 50000 : 420000 6.537000 Book value at the end of year 2 (rounded to nearest dollari 470000 - 100000 (50000*2) 7.5 150000 Accumulated depreciation for year 3 500003 8.5 37.000 Book value at the end of year 3 470000 - 150000 (15000x3) Answer 9 - 13 based on Double Declining Balance 9. S 10. $ 11. $ 12. $ 13. $ Year 2 depreciation expense Accumulated depreciation for year 2 Book value at the end of year 2 Year 3 depreciation expense (round to nearest dollar) Year 4 depreciation expense (round to nearest dollar) Answer 14 and 15 based on Activity based T Transport used the truck as follows: Year Activity (miles) 1 83,000 2 80,000 3 78,000 4 79,000 5 80,000 14. Under activity based depreciation; what is the amount of depreciation expense they would have recorded for year 3? $ 15. Under activity based depreciation; what is the book value at the end of year 3? $ Use the following to answer questions 18 - 19 AD Enterprises purchased equipment for $400,000 on January 1. year 1. The equipment is expected to have a 5. year life, with a residual value of $100,000 at the end of its service life. 18. $. Using the 190%-declining balance method, determine depreciation expense for year 2 19. S Using the straight-line method, determine book value at the end of year 2. Use the following to answer questions 20-22 Al Construction is in the process of closing its operations. It sold its 5-year-old Caterpillar 2790 Compact Track Loader for $98,000. The loader originally cost $150,000 and had an estimated useful life of 10 years and an estimated residual value of $35,000. The company uses straight-line depreciation for all equipment. 20. $ Calculate the book value of the loader at the end of the 5th year. 21. S What was the gain or loss on the sale of the loader at the end of the 5th year; (if loss, put - in front of your answer). 22. Record the sale of the loader at the end of the 5th year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started