Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please write out the formulas and what to put into a finance calculator? Thanks Question P1 (8 Point) Hero and Zero are both

can you please write out the formulas and what to put into a finance calculator? Thanks

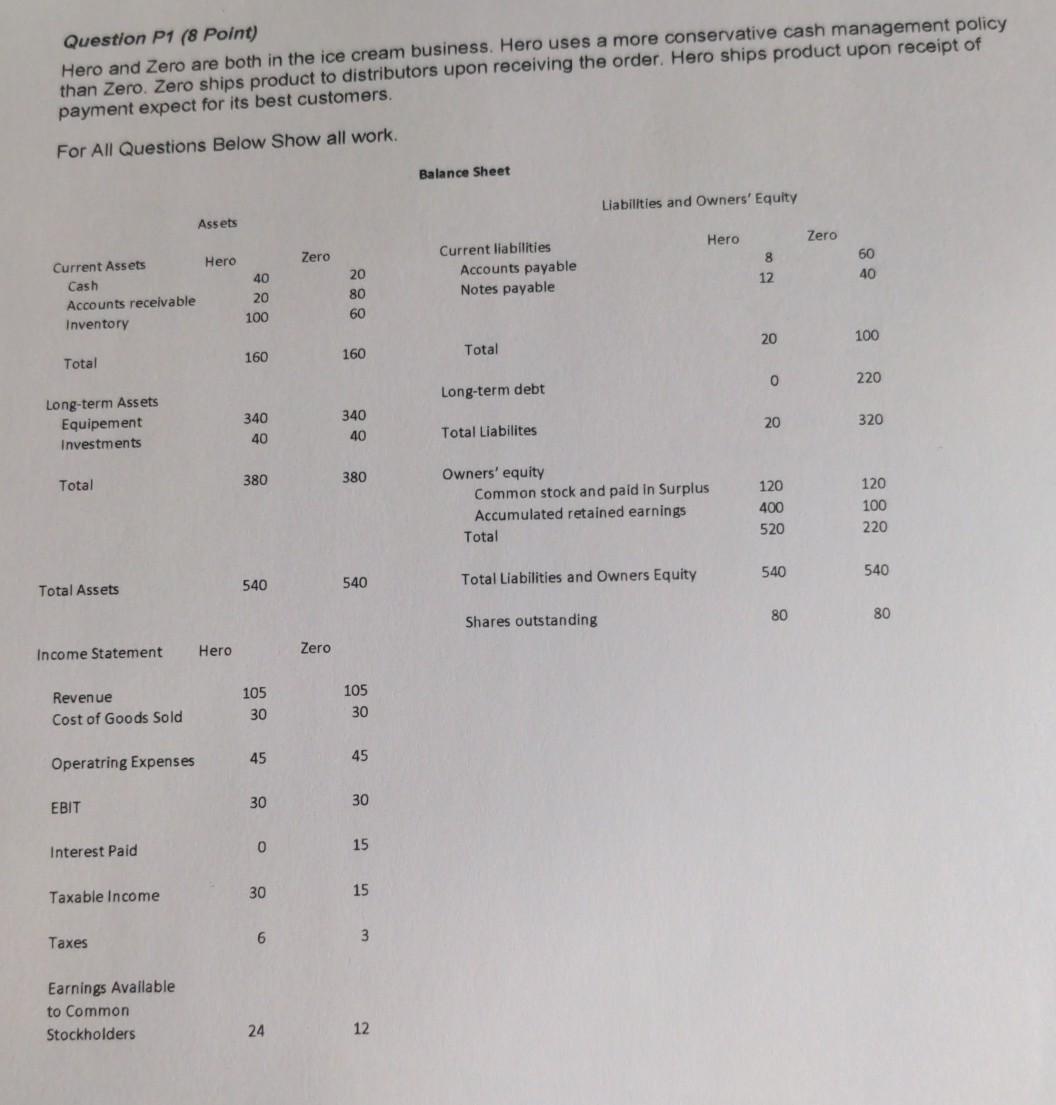

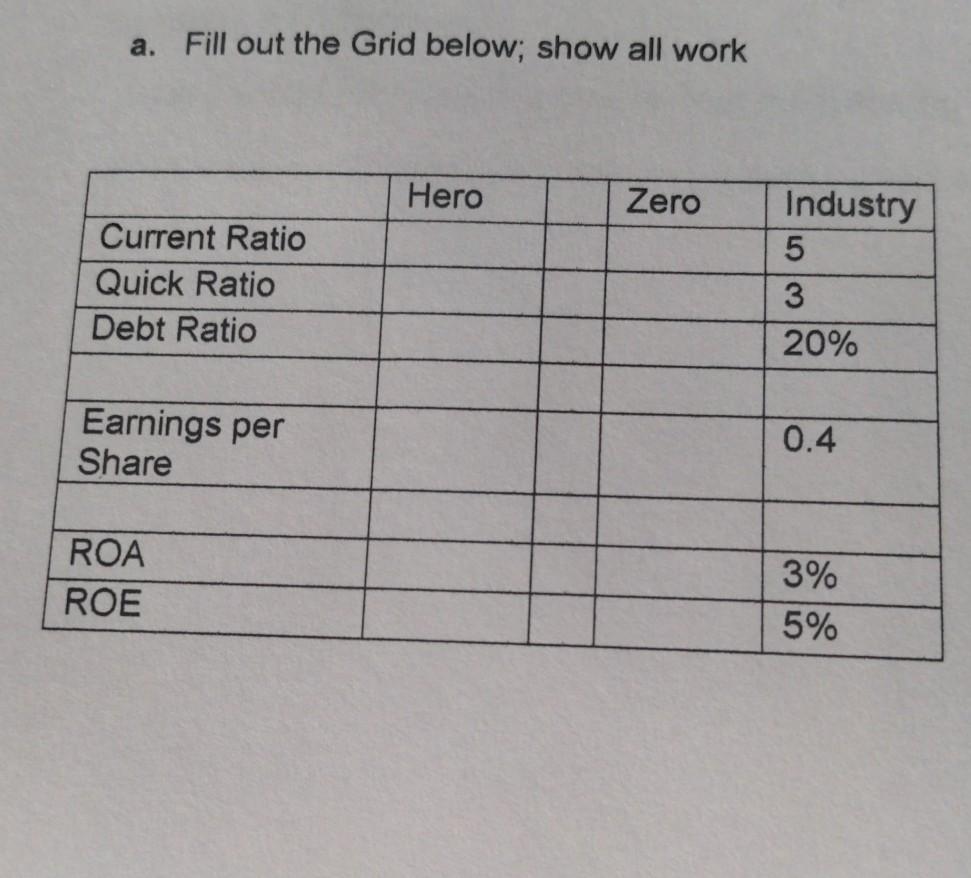

Question P1 (8 Point) Hero and Zero are both in the ice cream business. Hero uses a more conservative cash management policy than Zero Zero ships product to distributors upon receiving the order. Hero ships product upon receipt of payment expect for its best customers. For All Questions Below Show all work. Balance Sheet Liabilities and Owners' Equity Assets Hero Zero Hero Zero 8 12 Current liabilities Accounts payable Notes payable 60 40 Current Assets Cash Accounts receivable Inventory 40 20 80 60 20 100 20 100 160 160 Total Total 0 220 Long-term debt Long-term Assets Equipement Investments 340 40 340 40 20 320 Total Liabilites 380 380 Total Owners' equity Common stock and paid in Surplus Accumulated retained earnings Total 120 400 520 120 100 220 540 540 540 540 Total Assets Total Liabilities and Owners Equity 80 80 Shares outstanding Zero Income Statement Hero Revenue Cost of Goods Sold 105 30 105 30 45 45 Operating Expenses 30 30 EBIT 0 15 Interest Paid Taxable income 30 15 Taxes 6 3 Earnings Available to Common Stockholders 24 12 a. Fill out the Grid below; show all work Hero Zero Current Ratio Quick Ratio Debt Ratio Industry 5 3 20% Earnings per Share 0.4 ROA ROE 3% 5%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started