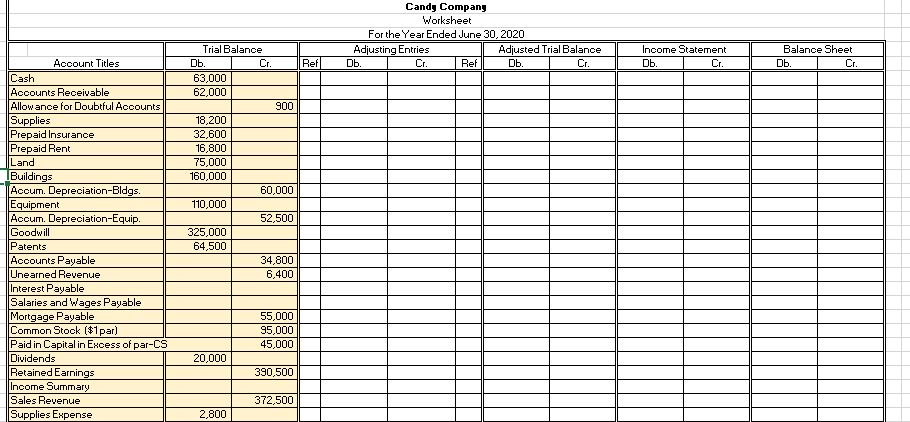

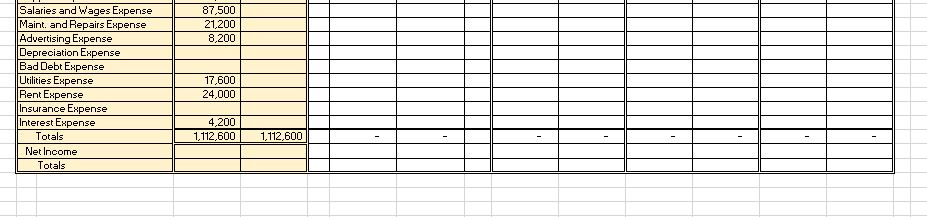

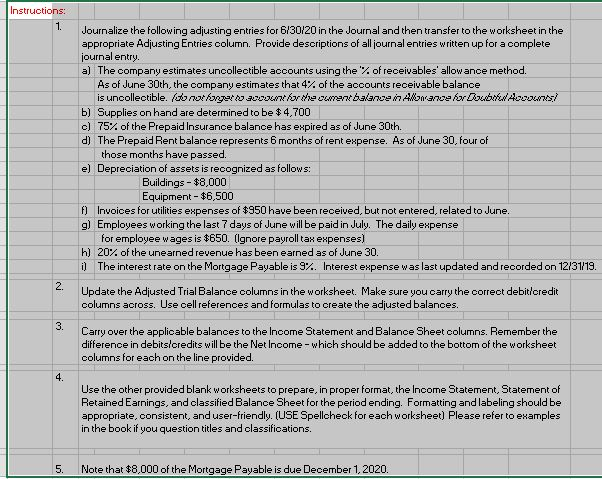

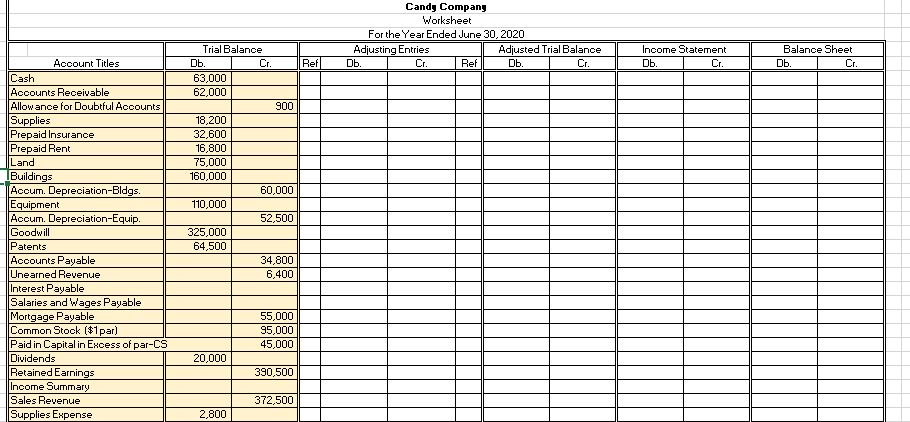

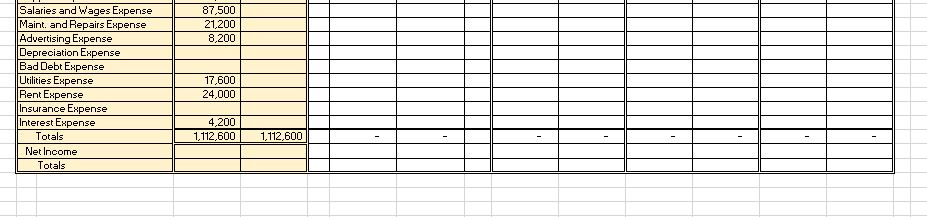

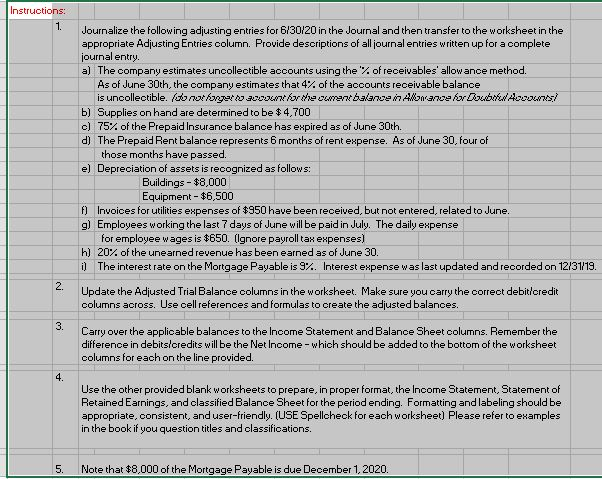

Candy Company Worksheet For the Year Ended June 30, 2020 Adjusting Entries Adjusted Trial Balance D. Cr. Ref D. Cr. Income Statement Db. Cr. Balance Sheet . Cr. Ref Account Titles Cash Accounts Receivable Allowance for Doubtful Accounts Supplies Prepaid Insurance Prepaid Rent Land Buildings Accum. Depreciation-Bldgs. Equipment Accum. Depreciation-Equip. Goodwill Patents Accounts Payable Unearned Revenue Interest Payable Salaries and Wages Payable Mortgage Payable Common Stock ($1par) Paid in Capital in Excess of par-CS Dividends Retained Earnings Income Summary Sales Revenue Supplies Expense Trial Balance D. Cr. 63,000 62,000 900 18,200 32,600 16,800 75,000 160,000 60,000 110,000 52,500 325,000 64,500 34,800 6,400 55,000 95,000 45,000 20,000 390,500 372,500 2,800 87,500 21,200 8,200 Salaries and Wages Expense Maint, and Repairs Expense Advertising Expense Depreciation Expense Bad Debt Expense Utilities Expense Rent Expense Insurance Expense Interest Expense Totals Net Income Totals 17,600 24,000 4,200 1,112,600 1,112,600 Instructions: 1 Journalize the following adjusting entries for 6/30/20 in the Journal and then transfer to the worksheet in the appropriate Adjusting Entries column. Provide descriptions of all journal entries written up for a complete journal entry. a) The company estimates uncollectible accounts using the '% of receivables' allowance method. As of June 30th, the company estimates that 4% of the accounts receivable balance is uncollectible. ( JANUARY (ree A Aalance in Mahree trement ANRAMANI b) Supplies on hand are determined to be $4,700 c) 75% of the Prepaid Insurance balance has expired as of June 30th. d) The Prepaid Rent balance represents 6 months of rent expense. As of June 30, four of those months have passed. e) Depreciation of assets is recognized as follows: Buildings - $8,000 Equipment - $6,500 A Invoices for utilities expenses of $950 have been received, but not entered related to June. 9) Employees working the last 7 days of June will be paid in July. The daily expense for employee wages is $650. (Ignore payroll tax expenses) h) 20% of the unearned revenue has been earned as of June 30. i) The interest rate on the Mortgage Payable is 9%. Interest expense was last updated and recorded on 12/31/19. 2. 3. Update the Adjusted Trial Balance columns in the worksheet. Make sure you carry the correct debit/credit columns across. Use cell references and formulas to create the adjusted balances. Carry over the applicable balances to the Income Statement and Balance Sheet columns. Remember the difference in debits/credits will be the Net Income - which should be added to the bottom of the worksheet columns for each on the line provided. 4. Use the other provided blank worksheets to prepare, in proper format the Income Statement, Statement of Retained Earnings, and classified Balance Sheet for the period ending. Formatting and labeling should be appropriate, consistent, and user-friendly. (USE Spellcheck for each worksheet) Please refer to examples in the book if you question titles and classifications. 5. Note that $8,000 of the Mortgage Payable is due December 1, 2020