Answered step by step

Verified Expert Solution

Question

1 Approved Answer

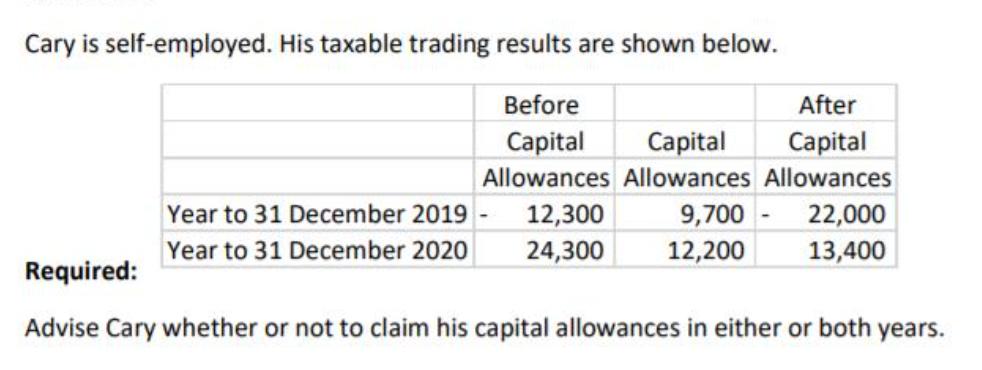

Cary is self-employed. His taxable trading results are shown below. Before After Capital Capital Capital Allowances Allowances Allowances 12,300 24,300 12,200 9,700 Year to

Cary is self-employed. His taxable trading results are shown below. Before After Capital Capital Capital Allowances Allowances Allowances 12,300 24,300 12,200 9,700 Year to 31 December 2019 - Year to 31 December 2020 22,000 13,400 Required: Advise Cary whether or not to claim his capital allowances in either or both years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided heres the advice for Cary regarding claiming capital allowances Year to 31 December 2019 Claim capital allowances In 2019 claiming capital allowances reduces his taxable profit by 2600 12300 9700 This is beneficial as it will lower his tax liability Year to 31 December 2020 Claim capital allowances Similarly in 2020 claiming capital allowances reduces his taxable profit by 11800 24300 12500 This is also beneficial and will lower his tax liability Overall Recommendation Cary should claim his capital allowances in both years 2019 and 2020 Doing so will reduce his taxable profit and lead to lower tax payments Note This advice is based on the assumption that claiming capital allowances is advantageous in both years However its important to consult with a tax professional for personalized advice considering Carys specific tax situation and potential implications in other areas such as future capital allowance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started