Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case 1 Ho Trading Company is a CCPC with a December 31 year end. On December 31, 2021, it had the following balances in

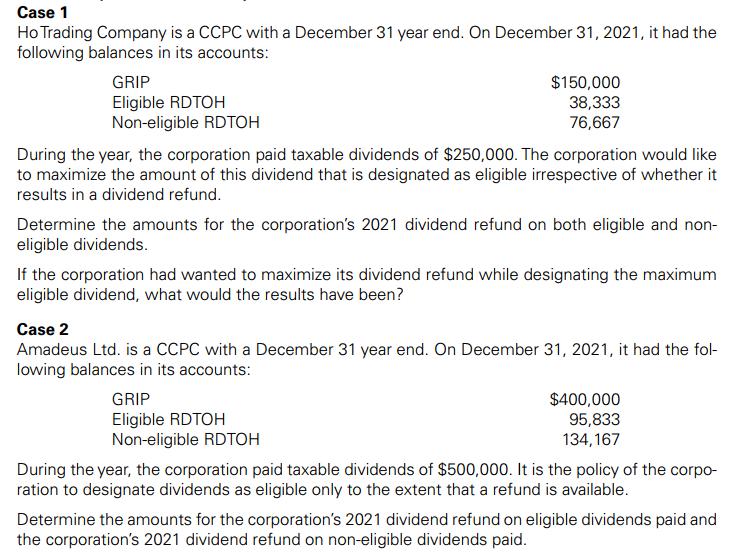

Case 1 Ho Trading Company is a CCPC with a December 31 year end. On December 31, 2021, it had the following balances in its accounts: GRIP Eligible RDTOH Non-eligible RDTOH $150,000 38,333 76,667 During the year, the corporation paid taxable dividends of $250,000. The corporation would like to maximize the amount of this dividend that is designated as eligible irrespective of whether it results in a dividend refund. Determine the amounts for the corporation's 2021 dividend refund on both eligible and non- eligible dividends. If the corporation had wanted to maximize its dividend refund while designating the maximum eligible dividend, what would the results have been? Case 2 Amadeus Ltd. is a CCPC with a December 31 year end. On December 31, 2021, it had the fol- lowing balances in its accounts: GRIP $400,000 95,833 Eligible RDTOH Non-eligible RDTOH 134,167 During the year, the corporation paid taxable dividends of $500,000. It is the policy of the corpo- ration to designate dividends as eligible only to the extent that a refund is available. Determine the amounts for the corporation's 2021 dividend refund on eligible dividends paid and the corporation's 2021 dividend refund on non-eligible dividends paid.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

CASE 1 D eter mine the amounts for the corporation s 2021 dividend refund on both eligible and non e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started